More earnings reports – ch-ching?

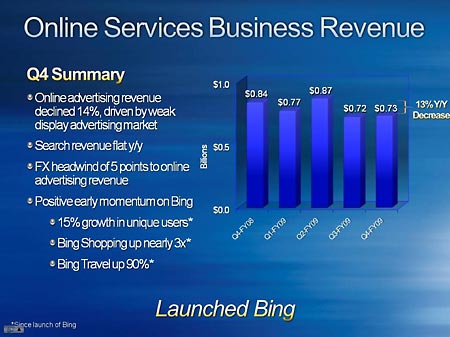

Microsoft’s Steve Ballmer stepped up to the Microsoft Fiscal 4Q 2009 earnings microphone (see the release) and although he didn’t have a lot to say about advertising on the call – they’ve got a lotta stuff going on over there at MSFT – a few nuggets did slip out in the form of Slide 14 in their Microsoft Office PowerPoint presentation (Download PPT).

On the call, Ballmer delivered the news on display and it wasn’t pretty. From Seeking Alpha:

“Moving on to the online services business, revenue declined 13%. Online advertising revenue was down 14%, mainly due to the significant decline in display advertising rates across the industry. Partially offsetting this was continued growth in page views.”

Well, maybe it will get better later in the year. Are things that bad, Steve?

“Online service business revenue excluding our [inaudible] business should mirror the online advertising market, which we expect to remain weak in the first quarter and potentially through the year. Display monetization rate should reflect the headwinds seen in broader industry trends but volumes from increased usage should be healthy.”

Erick Schonfled of TechCrunch notes the darkness online for MSFT saying, “The worst-performing business by far was the online business. It had the biggest operating loss of $732 million, which was $1 million more than its revenues of $731 million.”

Deal Already!

Still no word on a Microsoft-Yahoo search deal as rumors that Yahoo! would be given the reins on selling premium advertising for both companies continues to swirl according to eWeek.

Agency Holding Companies See Hope – Kind Of

Today’s Wall Street Journal covers optimism about ad industry prospects (“Ad CEOs Say Downturn’s Bottom Appears at Hand“) from the heads of Omnicom and Publicis according to the WSJ’s Suzanne Vranica and Ruth Bender. How about this for “positive” quotes?

- John Wren, CEO of Omnicom: “We don’t see a recovery, but we feel we’ve hit the troughs.”

- Publicis CEO Maurice Lévy: “We believe the worst is behind us.”

- AdExchanger.com: “Big changes coming in online display – are you ready to optimize!”

On the Omnicom Group earnings call, Omnicom CFO Randall Weisenburger discussed how digital is becoming harder to track (from Seeking Alpha):

“I think that’s certainly right, the digital space, the sector growth rates that probably occurred in 2007, 2008, digital was faster growth, emerging markets are faster growth. Digital overall is a harder and harder thing to capture. Our view is that digital effects all of our businesses and it’s really ingrained, Jason’s early point about some of these things is integrated marketing really has changed the way some of these numbers are being collected versus what they were a few years ago. But those digital trends are very positive for us and we think they will continue.”

Old Gray Lady Clicks Digital Heels

Old Gray Lady Clicks Digital Heels

Martin Nisenholtz, head of digital of the the New York Times, and Chief Ad Officer Denise Warren say those big, new OPA ads may be working out. From the earnings call transcript on Seeking Alpha:

“So in terms of pricing, we’ve, for the first half of the year, maintained and grown our pricing slightly on the online side. We did see a slight dip in Q2 on some of our premier units but again, that’s really a result of the robust comps that we were up against in the prior year. We have introduced several premium display units that are garnering significant premiums and rates in the marketplace so that is really helping our display position and will bode well for us in the coming year.”

Over at About.com, CPC text ads (we presume text) took over some of the heavy lifting of display. According to the as CEO Janet Robinson said, “Total revenues decreased 5% to $27.1 million as lower levels of display advertising were only partially offset by higher cost per click advertising.”

Later on the earnings call, Nisenholtz indicated things weren’t so bad at the old digital gray lady – especially compared to other ladies, “I mean Yahoo just announced a 14% decline in display. I think, while we’re not breaking out the numbers, I think our display performance overall at nytimes.com and across the News Media Groups was better than that.”

Mo’ Money, Mo’ Money

Kontera, the contextual/semantic ad network, dipped into the pockets of lead investor, Sequoia Capital, as well as Tenaya Capital and Carmel Ventures to the tune of $15.5 Million (see the release). Patrick Hoge of BizJournals.com covers the new funding announcement saying, “Kontera claims double-digit quarter-on-quarter revenue growth and that it reaches more than 100 million unique users per month on a network featuring 15,000-plus publishers.”

Kontera, the contextual/semantic ad network, dipped into the pockets of lead investor, Sequoia Capital, as well as Tenaya Capital and Carmel Ventures to the tune of $15.5 Million (see the release). Patrick Hoge of BizJournals.com covers the new funding announcement saying, “Kontera claims double-digit quarter-on-quarter revenue growth and that it reaches more than 100 million unique users per month on a network featuring 15,000-plus publishers.”

How Good – Or Bad – Is It?

Zach Rodgers of ClickZ tries to sort through indications of online advertising recovery in yesterday’s PubMatic report. There as skepticism on the agency side as Sarah Baehr, Razorfish’s VP Media told Rodgers, “I’m surprised to hear anything about prices trending up this year.” Later, Rajeev Goel explained that more premium inventory may be entering the market and encouraging buyers to bid higher, “Take Yahoo. What they’re not able to sell directly they now push into the Right Media exchange.” Read more.

Contentinople covers the PubMatic results and quotes a company rep saying that “ad networks driving innovation are Tribal Fusion, Collective Media, and interCLICK” and are responsible for price increases.

InterCLICKing

Things are so good at InterCLICK that they had to pre-announce their Q2 2009 earnings according to the release, which says InterCLICK “expects record revenue to exceed $10.5 million, an increase of at least 124% compared to the year-earlier period and 25% sequentially, raising guidance from its previous forecast for quarterly revenue to exceed $9.5 million.” With gross margins predicted to be around 47%, the ad network business obviously hasn’t idled for some.

Local Ad Schtick

Mass High Tech reports that PaperG, a “hyperlocal ad network,” has raised financing to support its ongoing build out. According to its website, PaperG’s core is a “Flyerboard is a virtual bulletin board that features ads from local businesses” that can integrate into publisher websites.