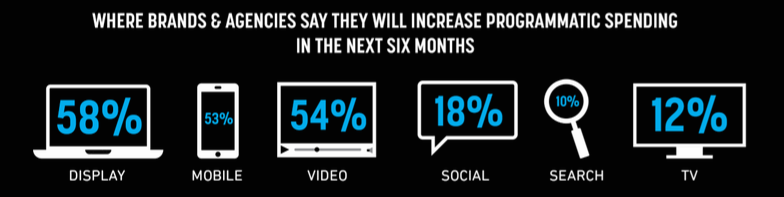

Eighty-seven percent of brands and agencies plan to spend at least 50% more on programmatic buys of desktop display, mobile and video advertising in the next six months, according to a survey conducted by AOL Platforms of executives at 25 advertisers, 96 agencies and 56 publishers.

Eighty-seven percent of brands and agencies plan to spend at least 50% more on programmatic buys of desktop display, mobile and video advertising in the next six months, according to a survey conducted by AOL Platforms of executives at 25 advertisers, 96 agencies and 56 publishers.

Display’s growth is driven by access to premium formats and reserved inventory, said AOL Platforms CMO Allie Kline.

“I hear people talk about display being less important, and that is a myth that this survey debunks,” she said. “Display is not only where the majority of money is spent, but also where the majority of increase will come from.”

Eighty-six percent of agency senior executives bought display programmatically, while 60% each bought mobile and video programmatically.

Mobile’s increase is driven by consumer consumption on handhelds and tablets, Kline said.

“We have so much data around how consumers are buying,” she said. “They are being exposed to display and video all day, and then at six o’clock at night, they go on their tablet to buy. We will see this category skyrocket.”

In the video category, Kline said she sees a need to create quality inventory to keep up with the increased spend. Brands and agencies plan to spend 8% more in programmatic television in the next six months, a small number that has a big impact because television budgets are so huge.

“We’re starting to see television play a material role,” Kline said. “To see that at 8% is pretty powerful for us.” It’s also an area where AOL has a lot of skin in the game, having acquired video platform Adap.tv and television audience-targeting company PrecisionDemand.

“The critical part is to not just go against digital budgets, which the space has been historically trying to do, but to bring them in, and let data decide what works best when and where. This is something we will be increasingly aggressive about through the end of year,” she said.Despite programmatic growth within the brand and agency community, publishers still lag in their understanding and adoption.

“We’re starting to see publishers ask for more education,” Kline said.

Publishers said their No. 2 challenge in the digital marketing ecosystem was education. Only half were confident in their understanding of programmatic.

“That signals market maturity,” Kline said. “The industry tends to focus on the money source first, and the supply source second.”

Seventy-six percent of brands and agencies consider economic efficiency a top benefit of programmatic.

“Brands are seeing the efficiency play, whereas publishers are thinking about the use of programmatic platforms to bring in data in an automated way to create a richer experience which has a higher CPM,” Kline said. In other words, publishers are most excited ways for programmatic to positively impact their bottom line.

“Publishers may not know what they’re losing out on. They don’t know that there might have been five times the budget available if the process was more efficient. They don’t know what they don’t see.”

While publishers were concerned with education, brands and agencies both had inventory quality and transparency on the top of their list of challenges.

For a brand marketer, the goal is “having full and real transparency about what’s working, what audience is important to them, and being able to action on that without being a direct marketing shop. We need to get there as an industry to unlock that group,” Kline said, driving further adoption of programmatic.