By Kelly Liyakasa and Alison Weissbrot

By Kelly Liyakasa and Alison Weissbrot

Snap Inc. brought in $404.5 million in revenue in 2016, six times the $58.7 million it made in 2015 and higher than some investors had estimated, the company disclosed Thursday in its long-anticipated S-1.

The popular photo, video and messaging app company aims to raise $3 billion in an IPO with a valuation of up to $25 billion, giving it considerable spending power as it seeks to scale further and give Facebook a run for its mobile money.

Snap’s global average revenue per user, or “ARPU,” was $1.05, according to the SEC filing. For the sake of comparison, Facebook’s average revenue per user is a staggering $20 per user, it revealed Wednesday in its Q4 earnings report.

Snap reported that on average, it has 158 million daily active users who create more than 2.5 billion snaps per day. And those users generate more than 10 billion daily video views on average.

“The volume of people creating and watching videos made it easy to understand what worked and what didn’t,” the company wrote in its SEC filing, referring to ad learnings and optimizations made possible by the sheer volume of activity on its platform.

The company’s momentum hasn’t squashed concerns that competitors like Instagram Stories are stealing share of attention from the messaging app, with TechCrunch sources reporting between 15-40% declines in views of Snapchat Stories since August when Insta debuted its Stories feature.

But Snap’s snapping back with claims that on average, more than 60% of its daily active users utilize its chat service to communicate with friends. On average, daily active users visit Snapchat more than 18 times each day. Clearly frequency and return visits are the name of the game.

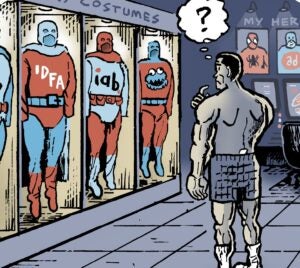

Snap monetizes primarily through advertising products like Snap Ads and sponsored creative tools such as Sponsored Lenses and Sponsored Geofilters. It has a programmatic offering [AdExchanger coverage], which was mentioned in the IPO filing with scant details offered.

Since the October launch of its ads API, which allows buyers to purchase Snap Ads programmatically on its platform, Snap has expanded its partnerships to offer the buying capabilities advertisers want and give them more control over their spend on the platform.

On Tuesday, Snap expanded its Ads API partnerships to include 15 vendors and launched a self-serve option for buyers.

The platform also added expanded partners for its Custom Audience Match API, which allows advertisers to upload and target against their CRM lists. It also launched a new API for creative development.

The update is a clear move to gain more digital advertising budgets, but Snap has a way to go before it can compete with the Facebook and Google behemoths, which command 80% of digital advertising dollars.

“While no single advertiser or content partner accounts for more than 10% of our revenue, many of our advertisers only recently started working with us and spend a relatively small portion of their overall advertising budget with us,” Snap wrote in its filing.