“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Chris O’Hara, vice president of strategic accounts at Krux.

Marketers are frustrated with spending as much as 60% of their working media dollars to fund intermediaries between themselves and their publishing partners. By the time marketer pay their agencies, trading desks, exchanges and third-party data providers and subsidize publishers’ ad-serving stacks, dollars turn into dimes. Marketers want less fraud, more people, less ad tech and more media dollars put to work to drive performance.

Quality publishers, who for so long sacrificed control for access to an always-on stream of programmatic cash, are now seeing balance return, as shady sources of inventory leave the ecosystem and start to create scarcity for premium supply. Publishers with desired audiences are starting to leverage hacks such as header bidding and private marketplaces to get more control and capture more revenue from transactions.

But they are also starting to look at data-only transactions among trusted demand-side partners. Now that marketers are catching up with data management platform (DMP) technology, securely sharing audiences becomes possible, opening up a new era where second-party data is poised to reign supreme.

A Primer

Before we talk about how that second-party data will become an emerging theme in 2016, let’s define some data terms.

First-party data is proprietary data that marketers and publishers have collected – with permission, of course – and, therefore, own. It can be cookies collected from a site visit, offline data onboarded into addressable IDs and even data from marketing campaigns.

Second-party data is simply someone else’s first-party data. Second-party data gets created any time two companies strike up a deal for data that is not publicly available. The most common use case is that of a marketer – say a big airline –getting access to data for a publisher’s frequent travelers.

Big Airline might say to Huge News Site with business travelers, “Let’s user match, so every time I see one of my frequent flyers on your site, I can serve him an ad.” Huge News Site may decide to allow Big Airline to target its users wherever they are found (a “bring your own data” deal) or make such a deal incumbent upon buying media. Either way, Big Airline now has tons of really valuable Huge News Site reader data available in its DMP for modeling, analysis and targeting.

Despite the much heralded death or merely diminution of third-party data, it is still a staple of addressable media buying. This is data that is syndicated and made available for anyone to buy. This data could describe user behavior (Polk “auto intenders” of various stripes) or bucket people into interesting addressable segments based on their life circumstances (Nieslen “Suburban Strivers”), describe a user’s income level (Acxiom or Experian) or tell you where a user likes to go via location data (PlaceIQ or Foursquare). Most demand-side platforms (DSPs) make a wide variety of this data available within their platforms for targeting, and DMPs enable users to leverage third-party data for segment creation – usually allowing free usage for analytics and modeling purposes and getting paid upon successful activation.

Data Quality And Scale

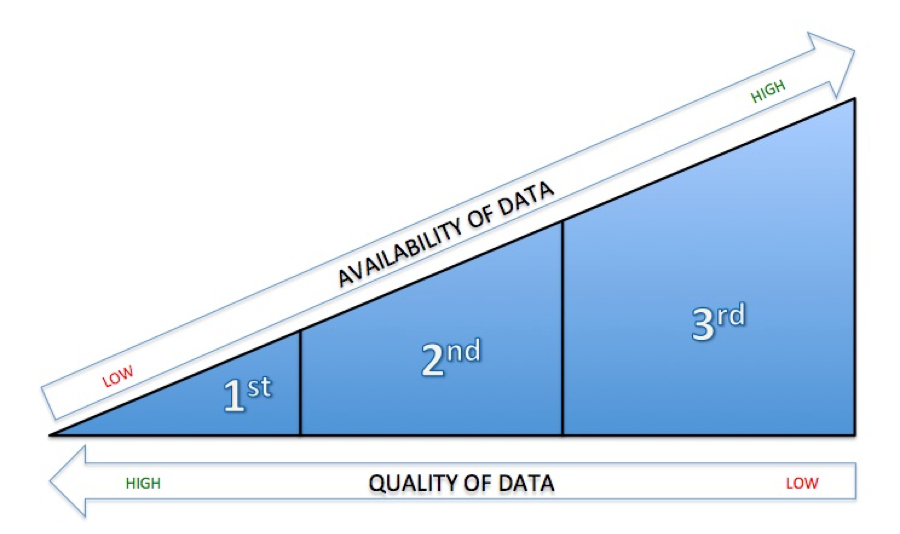

So, which kind of data is the best? When asked that question by a marketer, the right question is, inevitably, “all of it.” But, since that’s an annoying answer, let’s talk about the relative scale and value of each type of data. It’s easily visualized by this wonderfully oversimplified triangle:

First-party data is the most limited in scope, yet the most powerful. For marketers –especially big CPG marketers who don’t get a lot of site traffic – first-party data is incredibly sparse but is still the absolute most valuable signal to use for modeling. Marketers can analyze first-party data attributes to understand what traits and behaviors consumers have in common and expand their reach using second- or third-party data.

Retail and ecommerce players are more fortunate. A big-box store has first-party data out the wazoo: loyalty card data, point-of-sale system data, app data, website registration data, site visit data and maybe even credit card data if it owns and operates a finance arm. It can leverage a DMP to understand how media exposure drove a store visit, where customers were in the store (beacons!), what was purchased, how many coupons were remitted and whether or not they researched their purchase on the site. Talk about getting “closed-loop” sales attribution. The power of first-party data is truly amazing.

The biggest problem with third-party data is that all of my competitors have it. In programmatic marketing, that means both Ford and Chevy are likely bidding on the same “auto intender” and driving prices up. The other problem is that I don’t know how the data was created. What attributes went into deciding whether or not this “auto intender” is truly in-market for a car? There are no real rules about this stuff. A guy who read the word “car” in an article might be an “auto intender” just as someone who looked a four-door sedans three times in the last 30 days on reputable auto sites. Quality varies.

That being said, there is huge value in having third-party data at your disposal. Ginormous Music App, for example, has built a service that is essentially a DMP for music; it knows how to break down every song, assign very granular attributes to it and deliver highly customized listening experiences for free and paid users. Those users are highly engaged, have demonstrated a willingness to buy premium services and are, by virtue of their mobile device, easily found at precise geolocations.

Yet, for all of that, the value to a marketer of a Maroon Five segment is rather small. Everyone likes Maroon Five, from grandmothers to tweens to dads. A Maroon Five segment provides little value to an advertiser. Yet, if Ginormous Music App could push its app-based user data (IDFAs) into the cookie space and find a user match, it could effectively use third-party data to understand the income, behavior and general profile of many Maroon Five fans. And that’s what their advertisers like to buy. That’s pretty damn valuable.

So, how about “second-party” data? These are the “frequent business travelers” on Huge News Site and the “Mitsubishi intenders” on Large Auto Site. These are real users, with true demonstrated intent and behavior that has been validated on real properties. One of the most valuable things about audiences built on second-party data is that there is usually transparency regarding how those users found their way into a segment.

The ironic and kind of beautiful thing about the emergence of second-party data is that it is most often merely a connection to a premium publisher’s users. However, it can be uncoupled from a publisher’s media sales practice. Marketers, increasingly sick of all the fraud and junk in the programmatic ecosystem, are turning toward second-party data to access the same audiences they bought heavily in print 30 years ago. This time, however, they are starting to get both the quality – and the quantitative results – they were looking for.

On the flip side, quality publishers are starting to understand that, when offered in a strict, policy-controlled environment that protects their largest asset – audience data – they can make way more money with data deals than media deals.

Put simply, second-party data is heralding a return to the good old days when big marketers depended on relationships with big publishers as the stewards of audiences, and they created deep, direct relationships to ensure an ongoing value exchange. Today, that exchange increasingly happens through web-based software rather than martini lunches.

Follow Chris O’Hara (@chrisohara) and AdExchanger (@adexchanger) on Twitter.