“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Hannu Verkasalo, founder and CEO at Verto Analytics.

Over the past decade, one of the most important success metrics for brands and marketers has been the size of their audience and their total reach.

What is their market share? How many monthly users do they have? How many markets do they cover, and how many new users do they gain each day?

These are valid metrics and crucial for any organization that’s interested in becoming a successful player in today’s digital mobile world.

Recently, however, the metric has shifted to a new standard. Mobile-centric publishers are now optimizing for engagement. Engagement metrics include the total time spent per user per month, average session durations, interactions within an app, purchases completed per total sessions (conversion), the number of repeat daily visits and many indications of users’ loyal, repeated usage of that app or site.

In a world where mobile usage is rapidly overtaking PC usage, engagement metrics have become more important than the number of users or reach for many publishers. The reason is simple: Most of their interest in consumer data is related to retention, frequency and intensity of usage.

Why Engagement Matters

Advertising and in-app purchases, rather than subscriptions, for example, are key monetization methods for today’s mobile-centric publishers. As a result, it’s important for publishers to ensure a consumer stays within their app for a longer period of time, maximizing their total opportunity time with the consumer to deliver advertising or in-app purchases.

There’s also the conversion of app downloads to active usage. Consumers are often sporadic and their attention spans are short, so they will quickly drop an app if they find it boring. People explore hundreds of apps per year and won’t tolerate bad user experiences.

Getting the engagement right positively drives long-term retention for the app, and it boosts the app’s active user base. The switching costs are getting lower, too. Increasingly, it’s about the total end-to-end user experience and how companies make sure they get the majority of people who try their service to stay for a longer time and remain active within their content or app. The massive availability of content and apps, combined with consumers’ appetites and penchant for trying new content and apps, means brands and publishers must ensure they get the consumer engaged immediately from the first interaction onward in order to be successful.

The Facebook Factor

Some players, like Facebook, have made fairly interesting moves in their app strategy. One of the things Facebook has done is split selected features into separate apps. For example, Facebook Messenger was launched as a separate app to complement the original Facebook flagship app. While it certainly doesn’t drive reach, as Facebook’s core app also reaches most of the Facebook universe, the move has radically increased Facebook’s total engagement with consumers.

I recently studied this type of app portfolio management strategy to demonstrate how it benefits Facebook.

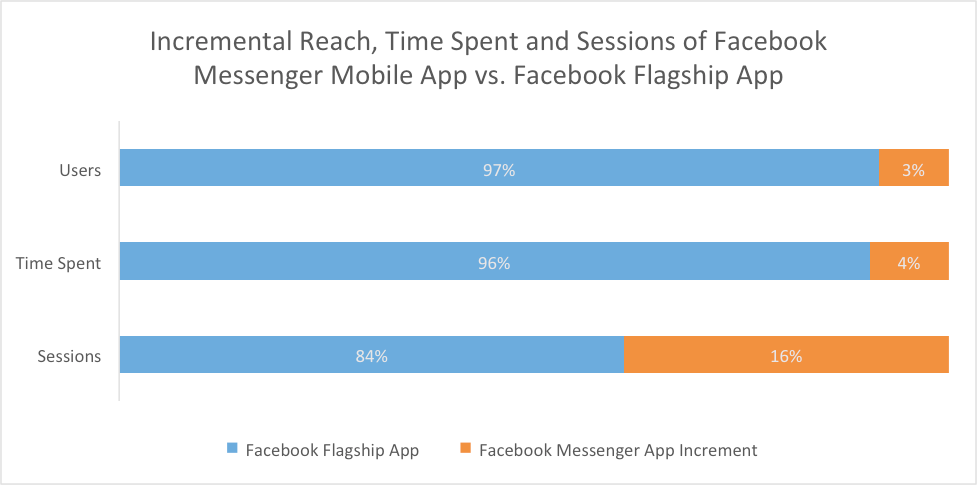

Source: Hannu Verkasalo, Verto Analytics

Facebook did not really gain any new users from splitting out Facebook Messenger, according to my research. Only 3% of the total Facebook mobile app audience solely uses Facebook Messenger and not the flagship Facebook app. However, in terms of time spent, the role of Facebook Messenger is a bit more significant: 4% of total time spent with Facebook’s apps is coming from Facebook Messenger.

What’s most interesting, I believe – at least from an advertising perspective – are the number of transactions and frequency of usage within the messaging app ecosystem: Facebook Messenger already represents 16% of the total number of sessions with Facebook apps. So, while Facebook Messenger did not really help Facebook’s reach, what it did do was to help Facebook drive engagement and frequency for its mobile app properties. (To keep it simple for this analysis, the other Facebook apps are omitted.)

And, this is just the beginning of this trend; the same is happening with other Facebook apps, such as Instagram and WhatsApp.

Saturation Point

All of the internet giants – including Facebook, Google, Twitter and Yahoo – know that their audience growth is facing saturation in developed markets. That’s why they’ve pursued other product models, such as launching content or software for other apps and sites to use. Yahoo, for example, has widgets for news feeds, while Google and Facebook created audience networks for advertising. It’s another way these companies can capture a little more time from consumers, and also continue to monetize them.

Saturation is another important reason why engagement is rapidly becoming the new reach for companies. In terms of mobile reach in developed markets, where a bulk of advertising dollars is also spent, there is simply not that much growth to be expected.

This highlights the need to rethink the strategy for developed markets specifically as smartphones are already facing saturation. If a given product is of interest only to a maximum of 13% of the total mobile population, and the total mobile population does not grow any more, then there are ultimately fewer opportunities to drive reach.

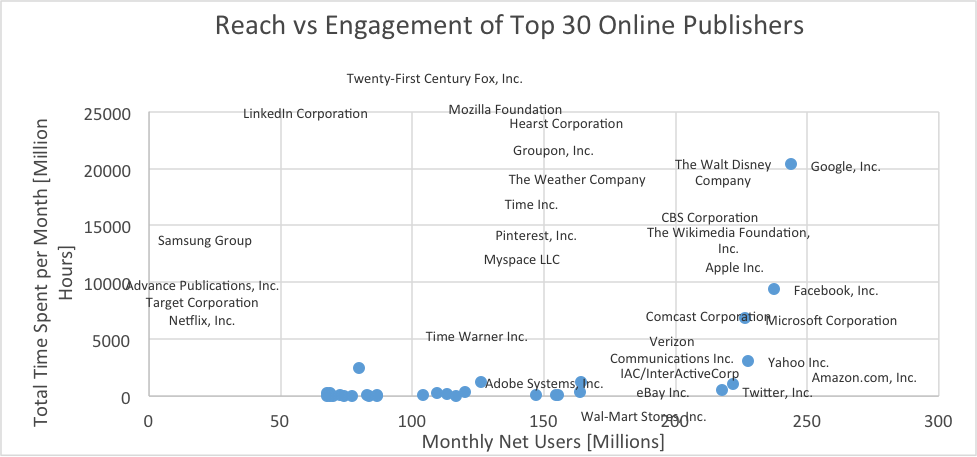

The chart below takes a look at reach vs. engagement data of the top 30 online digital publishers in the US. It’s clearly evident that the digital publishers with the highest time spent are Facebook and Google. What do both have in common? Their dominance in mobile.

Strong Mobile App Portfolios

Facebook and Google control a bulk of the top apps in the US: Facebook is the top app and Google controls the Android ecosystem. In June, 10 of the top 20 mobile apps, in terms of unique users in the US, belonged to either Google or Facebook. Many other publishers are close to Google and Facebook in terms of net reach, but the reason that Google and Facebook dominate the rankings with total time spent is because of their strong mobile app portfolios. As a result, this drives their dominance in mobile advertising.

Source: Hannu Verkasalo, Verto Analytics

The metrics in today’s digital world have shifted. What publishers do and what will drive their market value is how frequently, how much and how profitably they can engage with consumers. I believe this is the way forward for most companies – across operating systems, advertising, streaming, newspapers, music and games – to be able to grow by finding ways to keep consumers using their service, app or site.

Engagement is the new reach – and it’s a metric that is here to stay.

Follow Hannu Verkasalo (@hverkasalo), Verto Analytics (@VertoAnalytics) and AdExchanger (@adexchanger) on Twitter.