“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is by Ramsey McGrory, President & CEO of AddThis.

In the world of magic quadrant charts, I like this as a starting point for a discussion about data:

Starting with the Conclusion

Access to data is not a commodity, and it won’t be in 10 or 20 years. After all the regulatory and privacy questions are settled, advertising, publishing and e-commerce will be powered by a combination of offline, online, anonymous and personal data. The companies that emerge as long-term leaders will be the ones that provide infrastructure, distribution and services that power the smartest consumer engagement tools with the variety, velocity and volume of data available.

If you spend time considering the moves of consumer technology and diversified IT companies, you will realize how data is the thread that binds it together. To deliver on the vision of holistic consumer engagement, there are three critical layers: infrastructure, data, and services. While infrastructure commoditizes over time, the ability to leverage and understand data does not. So, staying in one quadrant is dangerous given the competitive landscape.

Setting the Table

The infrastructure for consumer engagement started consolidating in 2007 when Google, Yahoo, Microsoft, WPP, AOL and others acquired ad servers. That consolidation continues today among DSPs, DCOs, SSPs, DMPs, website analytics and most recently social CRM players. The strategy of many large companies in the digital B2B and B2C spaces is to consolidate the ‘paid, earned, owned’ infrastructure where a brand’s consumer engagement is managed centrally based on any and all touch points.

As the largest companies move from strategy to execution, data grows in importance. In its many forms, data is being infused into advertising, publishing and e-commerce, and fueling material improvements at each point in the value chains of advertising (research, planning, targeting, measuring) and publishing / e-commerce (attract audience, engage, monetize, measure).

The Evolving Data Landscape

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

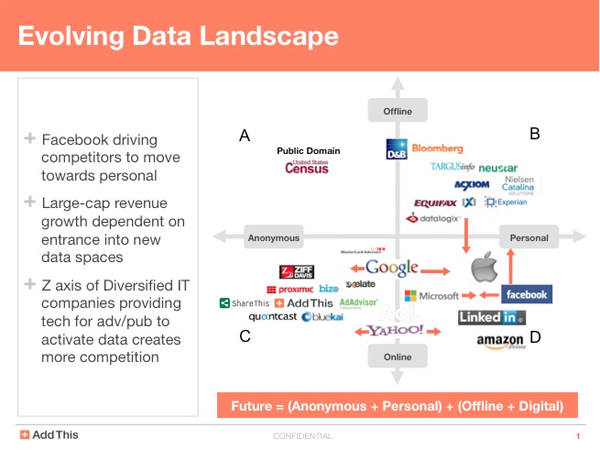

As the variety, velocity and volume of data increase, it’s worth looking at the different players. My intention is to create a framework and provide examples rather than be Terry Kawaja here.

On the X-axis, imagine two ends of a ‘visibility’ spectrum – Aggregated / Anonymous and Personal. On the Y-axis, imagine two ends of a ‘source’ spectrum – Offline and Online.

In the A quadrant, there are a number of examples of offline anonymous data such as census, crime statistics or government spending. In the B quadrant, examples of this data are voter file, criminal records, retail data co-ops, transactional data sets and measurement panels. Many companies aggregate, maintain, analyze and activate these data sets for outbound marketing, direct mail, CRM, POS and political campaigns. There are scale players such as Experian, Acxiom, Equifax and Nielsen and vertical players such as IXI (finance), Catalina (retail) and Polk (auto). These businesses have operated for decades.

In the last 7 years, the focus of this group has been to bring this offline data online. The first notable direct match product was Yahoo’s ConsumerDirect (~2005) which matched Yahoo’s registered user base with Nielsen’s Homescan panel. This allowed marketers to deliver ads on line, then measure the offline impact (products sold). Many have taken this concept or created derivatives of it. Most B quadrant players are investing in translating their offline data assets into online through direct matches with consumer technology companies or through on-boarding and anonymization.

The companies in the C quadrant are cookie-driven businesses that leverage intent, contextual, demographic, social or purchase data. Their business models range from licensing data to selling products that leverage the data such as audience targeted advertising or modeling services. Digital publishers are included here but ad networks are not. Companies in the C quadrant can move into D quadrant by, for example, becoming a consumer brand (bit.ly), providing consumer tools like email or social sign-in (AddThis), or providing DMP services to ingest a brand’s CRM (Turn, Bluekai).

The D quadrant is the most interesting. Facebook, LinkedIn, Amazon, Ebay, Yahoo and Apple are the anchors here. Facebook became a new sun in the digital social system where Google was once the center. This has caused a major shift in the market where many of the largest consumer technology brands are tacking harder right toward quadrant D. Google embraced the anonymous world represented by search and ad serving but that’s evolving with G+ and Motorola. Other examples: Microsoft consolidating Skype, Xbox and Windows ad infrastructure — or AOL with HuffPo. I am over-simplifying to make a point.

Facebook itself is evolving rapidly as well. Facebook is expanding into the B and C quadrants. The Facebook email match service and the measurement partnership with Datalogix are recent examples of Facebook expanding into the B quadrant. Facebook’s launch of FBX and limited authorization to allow third party ad serving are clear indications that Facebook believes aggregated and anonymous data has value.

The Z-Axis

In this piece, I did not call out a Z axis of diversified IT players such as IBM, Adobe, Salesforce, Oracle, SAP or even Amazon and Google (DSPs, ATDs, DMPs, Exchanges and the like fall somewhere on this Z axis as well). I believe they represent the sector focused on delivering some combination of infrastructure, data and services to companies that are consumer facing. These IT juggernauts are competitive with the largest consumer technology companies, and while they may not own data themselves, they must have data at scale integrated into their platform to provide valuable products and services.

Follow Ramsey McGrory (@nycmcg) and AdExchanger (@adexchanger) on Twitter.