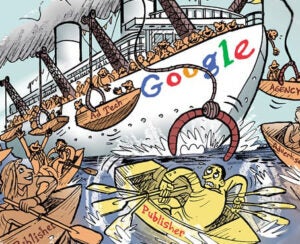

A long-simmering antitrust battle concerning Google’s ad tech business has reached a decisive turning point.

On April 17, 2025, US District Judge Leonie Brinkema ruled that Google violated sections one and two of the Sherman Act. She found that Google monopolized the open-web display publisher ad server market (via DFP) and the ad exchange market (via AdX), and had unlawfully tied these two products together under Google Ad Manager (GAM).

This landmark decision could trigger the forced divestiture of some of Google’s most powerful ad tech assets and fundamentally reshape the economics of digital media.

What happens if Google spins off AdX or DFP?

If the court ultimately orders Google to spin off AdX or DFP, the result would be a fundamental rebalancing of power across the digital advertising supply chain. Publishers have long been locked into using DFP to access Google’s exclusive demand via AdX – a dynamic that gave Google over 90% market share in the publisher ad server category and allowed it to manipulate auctions in its favor.

Severing this tie would enable publishers to choose their tech stack more freely and potentially unlock higher yields by routing inventory across multiple SSPs, rather than being funneled through a single, self-preferencing system.

For marketers, the implications are just as significant. Google’s walled-off infrastructure has long restricted AdWords advertisers – especially small and midsize businesses – to the inventory available only through AdX.

A divested ecosystem would open up broader reach, lower the supracompetitive take rates Google was able to charge and reduce the overtaxation that has characterized the opaque programmatic supply chain. Marketers would finally be able to allocate more of their budgets to working media rather than intermediaries.

The transition won’t be seamless. Google’s ad tech stack is deeply embedded across the industry. Unwinding it – even partially – will introduce friction in the short term. But if executed carefully, a spin-off would force each component to compete on its own merits, restoring incentives for product innovation and reducing the risk of another vertically integrated behemoth reemerging in its place. This could reset the digital marketplace in ways that benefit publishers, advertisers and the open web alike.

Where the legal process stands now

With the ad tech verdict delivered, attention turns to remedies. The court will schedule hearings in the coming months to determine the appropriate structural and behavioral interventions. Meanwhile, Google has already announced plans to appeal.

In parallel, the search antitrust trial decided last year is entering its own remedies phase this week, where the DOJ has proposed another dramatic fix: the divestiture of Google’s Chrome browser.

The search case still holds major implications for the broader ecosystem. If Google is forced to spin off Chrome and lose its ability to pay for default placement across competing browsers, its exclusive access to browser-level data would be lost.

The revenue-sharing deals with Apple, Mozilla and others – worth tens of billions – would collapse. Anonymized query data could be made available to competitors, allowing marketers and data platforms to reactivate high-value intent signals across the open web.

Privacy as a weaponized moat

Google and Apple have increasingly deployed privacy rhetoric not as a consumer safeguard but as a competitive lever. Apple’s rollout of AppTrackingTransparency (ATT) and the deprecation of IDFA were framed as pro-user reforms.

Both initiatives shut out third-party data access while preserving privileged integrations, most notably Apple’s $20 billion-per-year default search deal with Google. Google’s Privacy Sandbox has followed a similar script, restricting data flows to the broader ecosystem while continuing to feed signals into its own ad tech stack.

By invoking privacy to justify exclusive data access and lock out rivals, these platforms turned a public good into a private moat. But now, legal scrutiny is forcing a reckoning. If courts succeed in banning exclusive payments and mandating more equitable access to signals, privacy can be restored to its original purpose: user protection applied evenly, not selectively weaponized in defense of dominance.

The stakes for marketers

Marketers stand to gain the most from the structural reforms now in motion. By separating critical infrastructure, regulators are removing the hidden fees, biased auctions and supply-chain opacity that have inflated costs and eroded value. What replaces them will depend on how marketers adapt.

For the first time in a generation, digital advertising is being structurally reset. The outcome of the remedy phase will set the terms for how digital ads are bought, sold and measured in the years to come. The monopoly era is ending. What comes next is up for grabs.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Follow Adstra and AdExchanger on LinkedIn.

For more articles featuring Jason Bier, click here.