The retail industry, unlike verticals where data compliance is a major issue, appear more in the thought-leadership phase of advanced data analysis than actual execution, despite isolated gains by some their progressive counterparts in building their own marketing-tech stacks.

The retail industry, unlike verticals where data compliance is a major issue, appear more in the thought-leadership phase of advanced data analysis than actual execution, despite isolated gains by some their progressive counterparts in building their own marketing-tech stacks.

Eighty-three percent of retailers profiled in EKN Research’s “Big Data in Retail” study said they are either “at par” or “lagging behind” similar vertical competitors in their strategic use of analytics.

In a survey of 70-plus retail business and technology executives conducted between July and September of this year, 57% of which work for retail brands that bank more than $500 million a year in revenue, a mere 22% reported using analytics solutions to parse ever-growing mounds of unstructured data.

EKN analyst Giri Agarwal said the issue is less about data volume – which is increasingly accessible through traditional POS (point of sale) systems, mobile apps, websites, etc. – and more about the budgetary decisions and organizational challenges retailers face as a result of that volume growth.

“Retail leadership is intuitive – they’ve grown up making gut-based decisions in previous lives as merchants, buyers and marketers,” Agarwal said. “The transformation to a data-driven culture won’t come naturally to a lot of retailers.” Agarwal pointed out that retailers often spend 54% of their IT budget on maintaining existing IT operations. This leaves less than half for new development and capital investments, which would enable advanced data analytics investments at scale.

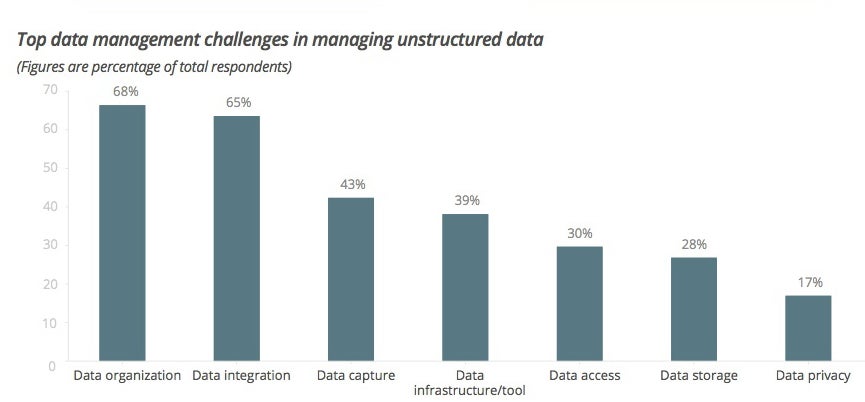

Overwhelmingly, 68% of retailers cited “data organization” as their top data-management challenge. Following that figure are the 65% that said they struggle with data integration while 43% ran into some roadblocks with data capturing. Data access and data storage, struggles for 30% and 28% of retailers, respectively, were lesser concerns. One of the greatest changes since 2012 was the fact that managing data volume, the top concern last year, is no longer at the top of the heap.

Retailers may, in fact, trail other industry verticals in terms of adoption of big data analysis tools and techniques because of the nature of their businesses. Agarwal noted that some industries, particularly financial services and pharmaceuticals, are in a seemingly better position to run advanced analysis of high-volume data than the retail industry.

Compliance and business risk within these heavily regulated industries, Agarwal said, necessitate substantial investment in big data analytics. For instance, these tools are used to “help banks identify and prevent fraudulent transactions, [which is] more directly tied to the brass tacks of their business model than to the idea that big data can help improve customer engagement in retail.”

While retailers may be comparatively slower to adopt analytical solutions, this vertical excels in developing analytics solutions themselves in-house either by building or acquiring. Major retailers like Target and Walmart are pouring what Agarwal described as “hundreds of millions of dollars” into big data “exploration.” Moreover, Staples acquired personalized offers startup Runa while Home Depot snapped up pricing engine BlackLocus.

Although large, progressive retailers are making the data investment, there is a “dual reality” that exists, where, on average, a $1 billion retailer invested less than $75,000 on big data experimentation this year, the bulk of which will go toward proof of concepts and ROI-mapping to determine future scale, EKN noted. This indicates the industry has much room for growth in reaching data maturity.