Amazon continues to be a risk for brick-and-mortar retailers, especially when it comes to consumers showrooming, or visiting a store to try on or see in person a product before then buying it online.

Amazon continues to be a risk for brick-and-mortar retailers, especially when it comes to consumers showrooming, or visiting a store to try on or see in person a product before then buying it online.

The “Aisle to Amazon: How Amazon is Impacting Brick-and-Mortar Retailers” report from Placed calculated the risk level for major retailers from Amazon, which has benefited from the showrooming trend. As consumers visit stores to check out products, they turn to Amazon to see if they can get a better price or free and expedited shipping.

“Amazon was the clear winner in e-commerce 1.0, and unless brick-and-mortar retailers shift from reactive to proactive, Amazon will win e-commerce 2.0 on the backs of offline retailers,” said David Shim, founder and CEO of Placed, in a press release about the study, which was released today.

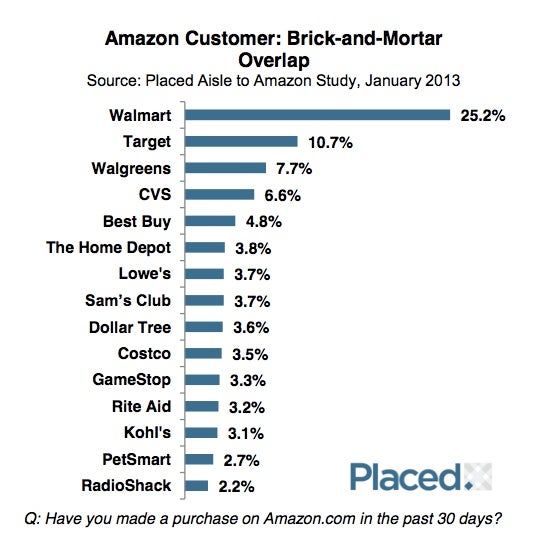

Placed, which analyzes in-store visits of consumers who have opted-in to a mobile location measuring app, found that, of Amazon customers, 25.2% also visited a Walmart store during the month of January, 10.7% visited Target, 7.7% Walgreen’s, 6.6% CVS, and 4.8% Best Buy.

While the Placed data has implications for retailers, it also shows marketers overall just how often consumers are turning to mobile for brand information—and that they are open to opting in to certain location-based targeting and advertising.

According to research company L2, 80% of smartphone owners use their phones to shop and 20% engage in showrooming. However, only one-third of those showrooming consumers actually act on it and purchase items online.

And just because Amazon customers are visiting a certain retail store doesn’t mean that store is at a great risk for showrooming. Bed, Bath and Beyond, PetSmart, and Toys ‘R’ Us were the retailers with the most risk, according to Placed. People who identified as showroomers were more likely to visit these stores during the month of January, while more retailers like Walgreens and CVS, where users go for specific items like prescriptions, don’t show up in the top ten.

What exactly makes Amazon such a risk for many brick-and-mortar stores? In addition to the wide variety of products on the site, Amazon offers free and expedited shipping for Amazon Prime members, and has a Price Check mobile app that easily allows users to compare prices while in a store.

Many brands are working to fight showrooming by offering price matching programs, or providing free shipping on larger items. Another way brands can try to keep customers buying in store or on their own websites, is by offering robust mobile offerings, including applications, mobile-optimized websites, and plenty of information and reviews via mobile for customers to turn to, rather than Amazon. Advertisements via mobile, especially with offers and discounts for buying in-store, can also be a tactic.

“By putting a number to showrooming, retailers can start to better understand the impact,” Shim said, “and take action based on data versus anecdotes and assumptions.”