OpenSlate – which helps brands find engaged YouTube audiences – also wants to make it easier for buyers to understand the value of YouTube inventory in TV terminology.

OpenSlate – which helps brands find engaged YouTube audiences – also wants to make it easier for buyers to understand the value of YouTube inventory in TV terminology.

In that spirit, OpenSlate on Thursday launched its YouTube GRP Planning Tool. A number of agencies and brands are already using it, including DigitasLBi.

The GRP Planning Tool is an enhancement to OpenSlate’s original offering, which helps advertisers find high-performing channels that meet brand requirements around demographics and brand safety. In total, OpenSlate says it analyzes a composite of 800,000 channels representing 35 billion monthly pre-rolls.

GRP Planning interprets the popularity of YouTube channels based on familiar TV buyer language: ratings.

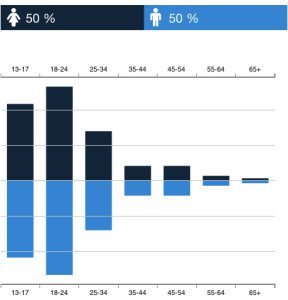

“It’s letting advertisers develop their own unwired TV network within YouTube and to see, for example, total audience overall for women ages 18-24,” said Mike Henry, CEO of OpenSlate. “They are able to see that for $25,000 spent, this is what you can expect in YouTube target rating points (TRP) and how many overall GRPs.”

A lightweight version of the GRP planner is complementary to agencies that want to build a basic media plan, but adding a paid tier boosts targeting variables for campaign specificities.

The product also provides more granularity into performance for agencies and marketers using premium YouTube ad programs like Google Preferred, which gives guarantees on inventory across top-performing YouTube channels.

“Google Preferred offers access to the top 5% of inventory, but how are they getting at that?” said Scott Marsden, SVP of media for DigitasLBi, one of the first agencies to use Google Preferred. “That figure is based on their algorithm and on their data that they’re not willing to open up, so I default to transparency and insight around how shows and programming are truly being identified.”

DigitasLBi is a veteran in trying to figure out the value of YouTube inventory.

The agency first partnered with OpenSlate in 2013, back when the vendor was called Outrigger Media, to build a YouTube tool called the Emerging Talent Tracker. That tracker ranked YouTube creators and channels across a broad set of metrics to determine audience engagement beyond proxies like subscriber and view counts.

The agency first partnered with OpenSlate in 2013, back when the vendor was called Outrigger Media, to build a YouTube tool called the Emerging Talent Tracker. That tracker ranked YouTube creators and channels across a broad set of metrics to determine audience engagement beyond proxies like subscriber and view counts.

But the problems evaluating inventory quality go beyond YouTube, and it’s becoming a bigger issue for buyers looking across numerous video supply sources including Twitter, Vine, Instagram and Facebook.

“The big problem we have in digital is oversaturation and over-frequency,” said Marsden. “It’s also difficult to measure because of the lack of cookies and inaccuracy in view counts or incomplete data. There’s market opportunity for better comparables and the need to create a single language media planners and buyers across TV and digital speak.”

There is progress. Facebook last fall began supporting TRP-based buys to unite planning metrics for TV and video buyers.

The challenge, however, is applying things like TRPs and gross rating points to sales and business outcomes because while a GRP accounts for campaign performance relative to a program or schedule, it lacks insight into audience attributes.

“At the end of the day, my belief is audience is going to continue to matter more than a GRP,” said Marsden, “but we do need to be able to understand different languages in order to create a full communications plan for clients.”