Video demand-side platform TubeMogul on Wednesday filed its S-1 registration document with the US Securities Exchange Commission, signaling its intention to raise $75 million in an initial public offering. Read the S-1.

Video demand-side platform TubeMogul on Wednesday filed its S-1 registration document with the US Securities Exchange Commission, signaling its intention to raise $75 million in an initial public offering. Read the S-1.

In the filing, TubeMogul stated, “For 2011, 2012 and 2013, our total revenue was $15.7 million, $34.2 million and $57.2 million, respectively, representing a compound annual growth rate, or CAGR, of 91%, and Total Spend through our platform was $17.8 million, $53.8 million, and $111.9 million, respectively, representing a CAGR of 151%.”

Its gross margins have grown similarly in each of the last three years. Those margins were 48% in 2011, 52% in 2012 and 66% in 2013. Net loss was $4.1 million, $3.6 million and $7.4 million, respectively.

TubeMogul offers both self-serve and managed services models, and in 2013 it supported campaigns for 2,000 individual brands – mostly through agencies but in a handful of cases directly with marketers.

The programmatic video company did not say how many shares of common stock it would sell nor at what price, so its approximately market valuation remains unknown.

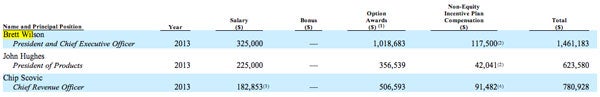

The S-1 disclosed compensation for TubeMogul’s C-suite executives:

A “Ctrl+F” suggests that TubeMogul is attempting to build a SaaS story with 626 mentions of the word “platform.” “Programmatic,” meanwhile, gets 20 mentions.

“Our Platform Direct offering allows advertisers to run self-serve campaigns eliminating the often complex and inefficient RFP process through which digital media is typically bought. Platform Direct customers enter into master service agreements with us that enable them to execute all of their campaigns under the agreement without the need for campaign-by-campaign insertion orders, or IOs. We generate Platform Direct revenue by charging our customers a utilization fee that is a percentage of media spend as well as fees for additional features offered through our platform. Because Platform Direct customers have control of the media purchasing decisions through our platform, our Platform Direct revenue is recognized on a net basis, meaning that it only includes our fees and not the cost of media purchased. The gross margin for our Platform Direct offering for 2013 was 95%.

Our Platform Services offering allows advertisers who continue to use a traditional RFP process to realize the benefits of our platform without needing to alter their purchasing process. Platform Services arrangements are generally in the form of discrete IOs which are negotiated on a campaign-by-campaign basis. We generate Platform Services revenue by delivering digital video advertisements based upon our customer’s campaign specifications. Our Platform Services revenue is recognized on a gross basis, meaning that it includes the cost of the media purchased. The gross margin for our Platform Services offering for 2013 was 51%.”

John Ebbert contributed.