Programmatic ad tech companies aren’t properly estimating their total addressable market, said BMO Capital Markets equity research analyst Dan Salmon.

Programmatic ad tech companies aren’t properly estimating their total addressable market, said BMO Capital Markets equity research analyst Dan Salmon.

Salmon presented a report Thursday at Programmatic I/O in San Francisco that pointed to two areas where these estimates tend to get thrown off. First, most ad tech vendors don’t factor in take rates – the percentage of a media buy that ad tech companies keep after a publisher or media company gets paid.

Applying take rates drives down programmatic total addressable market (TAM) estimates. This decrease is mitigated, Salmon points out, because of a second factor influencing incorrect TAM estimates: the tendency to account only for brand advertising and not direct marketing spend. Salmon estimates brand advertising TAM at $140 billion in the US and $420 billion globally.

But those numbers swell once one adds direct marketing: $320 billion in the US and $950 billion globally. Direct marketing spend tends to go ignored, Salmon speculated in his report, in part because direct response advertising tends to be a closed loop system – opaque to third parties estimating TAM.

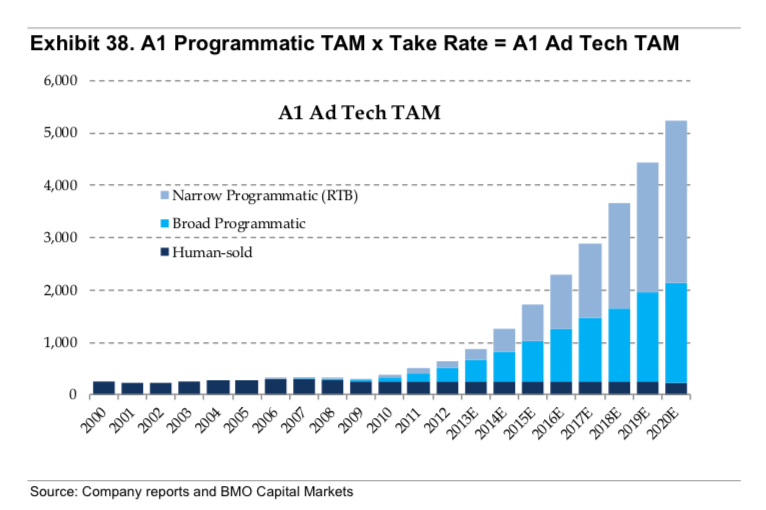

So without factoring in direct marketing, programmatic TAM estimates for 2015 are just south of $2 billion.

Factor in direct marketing, and programmatic TAM estimates for 2015 shoot up to about $7 billion.

Salmon breaks down programmatic into three categories: human-sold, narrow programmatic (which is real-time bidding) and broad programmatic (which includes self-serve digital ad buying platforms, programmatic direct/guaranteed and programmatic TV).

Salmon breaks down programmatic into three categories: human-sold, narrow programmatic (which is real-time bidding) and broad programmatic (which includes self-serve digital ad buying platforms, programmatic direct/guaranteed and programmatic TV).

These categories are important because take rates vary depending on how inventory is sold.

In his report, Salmon points out that even human-sold inventory is affected by take rates: “Even if one ignores media agency fees, there is some level of spending for trafficking software and ratings data; and while programmatic tools are largely replacing them, human-sold ad networks (whose revenue represented a material portion of these dollars up until the past 5 to 7 years) generate revenue by delivering targeted ad impressions that are acquired at lower prices, thus creating the ‘take.’”

Salmon suggested ad tech companies should size programmatic ad dollars by the manner in which they’re transacted.

Nevertheless, take rates aren’t going anywhere but up, in part because ad network arbitrage has fallen out of favor and it’s being replaced by managed service or self-serve models.

“Because there is more transparency being brought to the ecosystem, it’s harder for ad tech companies to keep the portion they were used to,” said Salmon.

Salmon said he foresees more power shifting to premium content owners, notable in the digital video space. As traditional ad networks struggle to automate their models, platforms with direct access to consumers – and content production – will be the beneficiaries of the economic shifts in programmatic.

“I believe video will continue to grow as total percentage of all ads, and we will see more [digital] companies share revenue with TV companies,” Salmon said. “The idea of TV vs. video is a false choice. This is more about the changing nature of branding and video advertising.”

Ryan Joe contributed