Digital ad revenues in the US hit an historic high in the first half of 2014, reaching $23.1 billion, according to the IAB’s Internet Advertising Revenue Report released Monday. Notably, the IAB reported that mobile jumped 76% YoY and overtook banner ads.

Digital ad revenues in the US hit an historic high in the first half of 2014, reaching $23.1 billion, according to the IAB’s Internet Advertising Revenue Report released Monday. Notably, the IAB reported that mobile jumped 76% YoY and overtook banner ads.

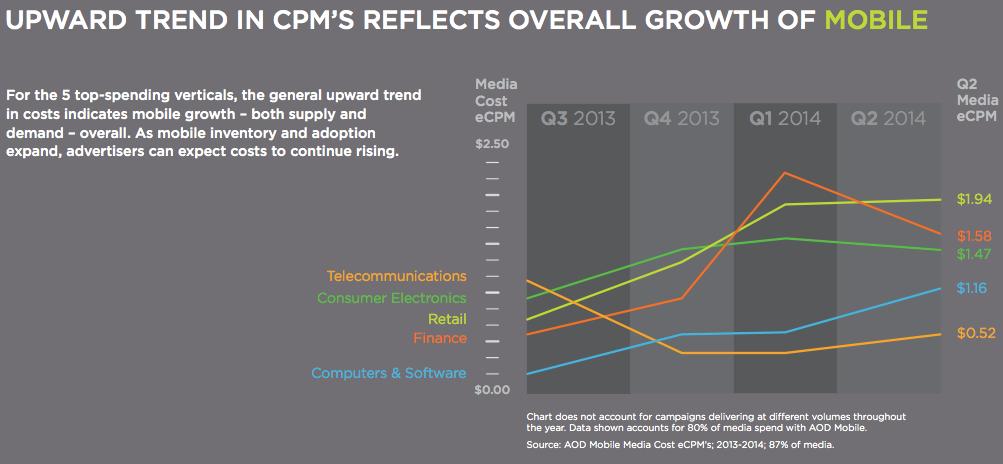

In another Monday release, the VivaKi AOD Benchmark Report saw CPMs increase across display, social, video and mobile channels. The AOD report notes that CPMs within mobile, which range from $0.52 to $1.94 in Q2 2014, are generally on the rise and that advertisers can expect this trend to continue.

“In general, we’ve seen CPMs go up over the last five quarters or so, across verticals,” VivaKi SVP of Analytics Shirley Xu-Weldon told AdExchanger. The reason is real-time bidding, which optimizes the value of each impression based on the number of bidders.

According to Xu-Weldon, targeting adds another dimension to rising CPMs. “If we know something concrete about a user,” she said, “if they fall into a particular cookie pool for example, that becomes even more expensive because the impression is already qualified in some way to potential buyers.”

VivaKi AOD’s report pooled data from the trading desk’s data warehouse SkySkraper and observed rising CPMs from Q3 2013 to Q2 2014. The report took social, mobile and video trends into account to build intelligence on top of aggregated, anonymous data points.

IAB, collaborating with PricewaterhouseCoopers, also saw tremendous growth rates in mobile, at 76% between Q2 2013 and Q2 2014. Mobile ad spend hit $5.3 billion, up from $3 billion in 2013.

The IAB report pinned total digital ad revenue at $23.1 billion for the first half of 2014. In contrast, banner ads in Q2 2014 dropped from 19% of total digital ad spend during the same period last year to 17%, totaling $3.9 billion.

“Consumers living online is no longer the exception – It is the rule,” Sherrill Mane, SVP of research, analytics and measurement at IAB, said in a press release. “Digital screens have become vital tools at every juncture of the day. It is no surprise that brand dollars have followed this growing movement at a steady clip.”

So what do rising CPMs mean for the industry as a whole moving forward?

“We’re going to continue to see more competition in market when it comes to grabbing for qualified impressions,” Xu-Weldon said. “This will continue to happen as we see more players get into programmatic, but also the way in which they get into programmatic.”

Xu-Weldon added that CPMs are not just based on behavioral targeting anymore. “It’s not just about conversions, it’s also about clients being able to have a conversation with the consumer in a much more valuable way that is going to expand the brand,” she concluded. “Players in this space will have to continue this conversation in mobile and in social.”