Programmatic buying of display and video ads will expand rapidly for years to come, according to new findings from Magna Global.

Programmatic buying of display and video ads will expand rapidly for years to come, according to new findings from Magna Global.

In a forecast released Monday, the Interpublic Group media investment unit predicted the amount of global ad inventory bought and sold using programmatic methods in 2015 will rise 49% compared to last year – reaching $14.2 billion worldwide.

The report, covering 41 markets, was drawn from surveys of Magna Global’s external partners as well as third-party sources. It predicted that programmatic buying will grow at an average rate of 31% annually over the next four years, reaching $36.8 billion by 2019.

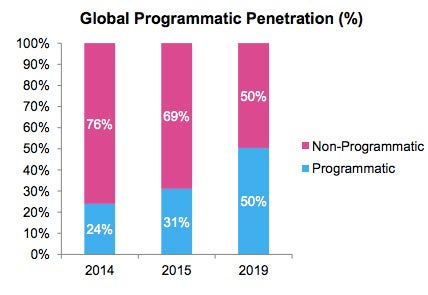

Worldwide programmatic spend is expected to grow this year to 31% of banner display and video share (compared to 24% in 2014), and will increase to 50% by 2019.

The findings suggest that despite persistent concerns about ad blockers, viewability and nonhuman traffic, programmatic growth remains strong.

“Growth hasn’t been slowed by the concerns you’ve heard this year around viewability and ad fraud and things of that nature,” said Luke Stillman, associate director of forecasting for Magna Global. “When we look at the spend numbers, it’s clear that the improvements in efficiency and the better targeting and better reporting just outweighs that.”

The data reflects the greater efficiencies and cost savings created by programmatic buying technology. According to Stillman, it illustrates how this technology is improving marketers’ ability to monetize digital impressions and use consumer data in their banner display and video ads.

“We’ve done this total global programmatic market size estimate for several years now, and every year when we look at the current year it’s a little higher than we previously estimated,” Stillman said. “It’s moving only up and to the right.”

Leading the way in this adoption of programmatic buying is the US, representing 54% of the global market in 2015 with $7.7 billion worth of transactions expected this year. The buying and selling of programmatic will constitute 43% of total U.S. display and video spending – and is expected to grow to 62% by 2019.

“There are some other markets that compete in sophistication with the UK,” added Stillman, pointing to the UK, the Netherlands and Australia. “These are advanced markets with similar penetration – but they just don’t have the raw size.”

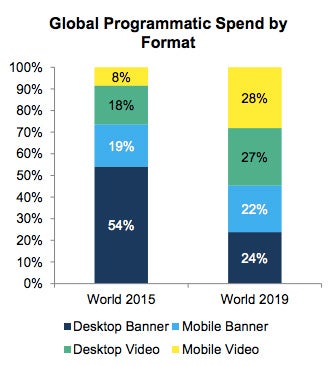

The study also looked at programmatic spend by device, finding that mobile spend will grow from 28% in 2015 to about 50% by 2019.