Judging from last week’s news, it’s tempting to say GroupM has got the programmatic religion. But that might be selling the holding company short.

Judging from last week’s news, it’s tempting to say GroupM has got the programmatic religion. But that might be selling the holding company short.

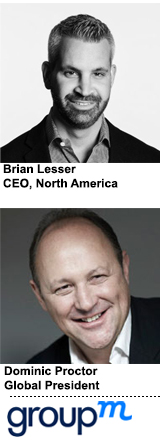

WPP Group’s media-buying arm, which controls $106 billion in global ad spending, last week promoted Xaxis CEO Brian Lesser to a big new job running its North America business. His elevation came just two days after GroupM said it would acquire Essence, a digital media agency known for its programmatic chops.

What’s going on?

The elevation of a trading desk CEO to a major cross-agency role is a first among agency holding companies. At rival agency groups, most such roles are still filled by executives whose careers dev

eloped in the last decades of the 20th Century, when print, radio and television dominated.

But then given WPP’s history investing in technology and data, the company was perhaps bound to be among the first to bring digital and programmatic natives up into the management ranks.

Speaking with AdExchanger, Lesser noted the rise of data-driven media buying at WPP dates back eight years, to when CEO Sir Martin Sorrell made a major move into ad tech with the acqu

isition of 24/7 Media.

“In 2007, Sir Martin signaled to the market that agencies need to be experts in developing technology and data,” he said. “There’s a tremendous opportunity in the technology being developed to extend programmatic and measurement into other channels. … And I would expect to see more of that aggressive acquisition strategy.”

But Lesser and other WPP executives say recent developments don’t indicate a strategic shift at GroupM so much as a strategic acceleration, driven in part by long-term tech bets but also by the day-to-day demands for talent and resources.

On top of that, WPP is simply an acquisitive company. Essence and the company’s other “programmatic” investments are a relative drop in the bucket of its total M&A activity.

Consider that even before the purchase of Essence, WPP purchased at least 12 agencies in the past quarter – with the two next-most acquisitive holding groups (Publicis and Dentsu), combining for eight deals. Those purchases included many “non-programmatic” companies, such as Brazilian PR firm Ideal Group, Indian experiential agency Geometry Global and British sports marketing firm Chime Communications.

“That strategy is going to stay as it is, or increase even as it evolves,” said Dominic Proctor, GroupM’s global president.

Proctor also said WPP would also continue to scour the market for investment stakes that provide technology and data. The most notable examples are its financial backing of comScore/Rentrak and AppNexus.

“The train is moving faster and faster,” he said. “The direction of change in our business has been relatively clear. What this represents is the pace of change.”

Lesser’s ascension meanwhile could be just a case of a talented executive being recognized and rewarded. In the near term, he said his plate will be full readjusting to an Americas-focused role (following a global remit at Xaxis) and learning the ins-and-outs at GroupM.

Future Of Xaxis

GroupM encapsulates Xaxis, which acts as the programmatic buying arm for the four principle WPP-owned media agency networks: Mindshare, MEC, MediaCom and Maxus. (Seventy-five percent of its revenue comes from GroupM clients.)

from GroupM clients.)

Lesser’s rise within GroupM, which is the world’s largest ad-buyer, speaks to the growing value of programmatic knowledge, and also to WPP’s strategy of aligning different businesses within holding companies, so that can scale can be tapped along with niche expertise – a practice that has been both successful and controversial. Successful because it has created margin opportunities during a period of compression for agency profits. Controversial because Xaxis, along with trading desks at some other holding companies, does not disclose its margins in many cases.

As new Xaxis CEO Gleason puts it, “We take upfront bets, significant investments in media, which we can’t disclose the pricing for.” The company has always been straightforward that it leverages its data, technology and media buys to generate margins, and for many that’s good enough.

“At the GroupM and WPP level, we’re in the business of offering clients a broad series of choices,” said Proctor. “We’re offering more horizontal positions, more parts of the group working together.”

Lesser echoes this sentiment around client choice in the programmatic buy.

“In some cases, we think we need to take a position on digital inventory so we can get better pricing and quality for our clients,” said Lesser. “It’s not something all GroupM clients buy into. It’s one solution in a spectrum of solutions GroupM offers.”

Lesser said he’s been involved in programmatic developments across the company, and as this promotion has been six months in the making, it should come as no surprise that he’s been privy to the broader growth strategy. He is also, for instance, a board member at AppNexus.

“To the extent that I’m involved in AppNexus, I think it’s consistent with the notion GroupM has signaled long before my appointment that the media agency business is going to become highly reliant on technology expertise,” said Lesser.

It’s important to note how exceptional WPP is in this regard.

“Agencies for the most part have not been able to invest in technology,” said Gleason, who said that under Lesser (and with WPP’s resources) Xaxis was able to build out a $25 million audience engine, which it calls Turbine, as well as other purchases like ActionX and BannerConnect.

Since picking up ActionX earlier this year, Gleason said the company’s mobile business has nearly tripled. “When you look at what mobile meant to our clients, and we hadn’t figured it out, being able to invest for advantage – people or technology – was everything,” he said.

Lesser said he’ll take the same approach, one he directly attributes to Martin Sorrell’s leadership, in his new role at GroupM. “I do think it’s a sign of what will come, which is that we will continue to be very aggressive in influencing those technology platforms to our clients’ advantage.”

Zach Rodgers contributed.