It’s easy to forget, but Yahoo was once the largest and most promising digital media company – its stock a bellwether for the internet sector as a whole. By Q1 2017, regulatory hurdles permitting, that stock will stop trading as the company’s people, its portfolio of brands and its technology assets are absorbed into Verizon.

To honor Yahoo’s important role in the industry, we present, in chronological order, AdExchanger’s comics on the company’s foibles during the reign of Marissa Mayer. Enjoy!

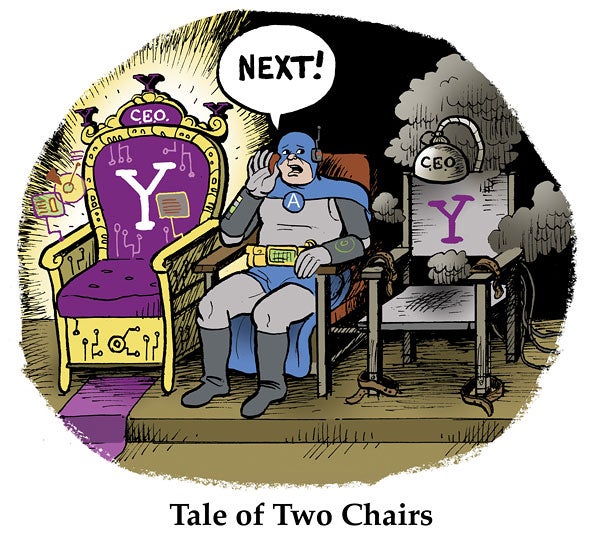

September 2011: Yahoo was struggling with talent attrition and loss of market share after a disastrous string of CEOs, including its bumbling founder Jerry Yang, the sailor-mouthed Carol Bartz and the resume-doctoring Scott Thompson.

July 2012: Finally, the company arrived at what seemed the perfect choice. Could Marissa Mayer avoid the fate of her predecessors?

July 2012: Finally, the company arrived at what seemed the perfect choice. Could Marissa Mayer avoid the fate of her predecessors?

October 2012: Former AdMeld CEO Michael Barrett left Yahoo, where he served as global CRO for a very short stint. It was just a hint, albeit a high-profile one, of the talent retention challenges Mayer would face in shoring up Yahoo’s ad biz.

May 2013: One of Yahoo’s biggest bets under Mayer was its $1.1 billion deal to acquire Tumblr. The site had very little advertising, but Mayer aimed to change that.

August 2013: Mayer went “glam” in a photo shoot for Vogue. So too did AdExchanger Man.

January 2014: Perhaps sensing that she had been neglecting the company’s ad platforms opportunity (while eventual acquirer AOL focused heavily on ad tech), Mayer reorged the company’s ad products into easy-to-understand new brands. Was it too little too late?

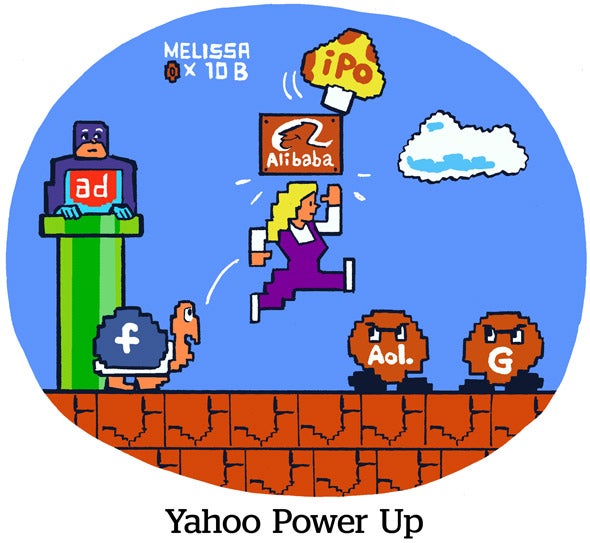

September 2014: Yahoo then appeared to gain a colossal windfall from Alibaba’s IPO. The value of Yahoo’s stake in the Chinese ecommerce giant was estimated at $10 billion at the time.

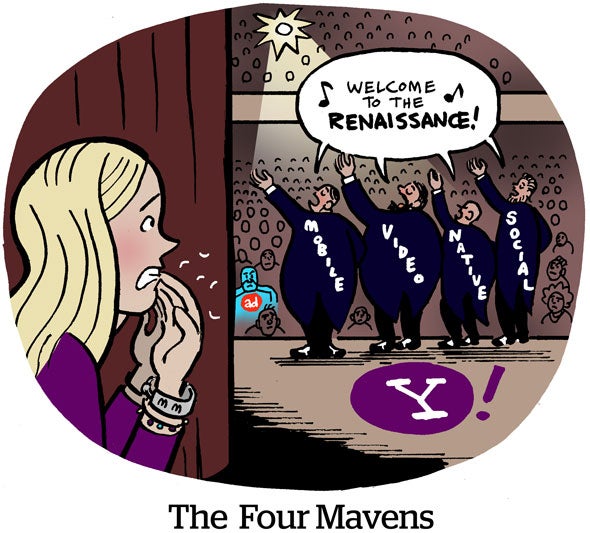

July 2015: Yahoo had begun to report its financials in a different way, breaking out its revenue from mobile, video, native and social as a way of highlighting its investment in these areas. Mayer used the somewhat forced acronym MaVeNS to describe this initiative. Would investors and advertisers bite?

February 2016: Mayer was out of time. Without clear demonstrable gains in mobile audience share in the face of incredible momentum for Facebook and Google, investors successfully forced Mayer’s hand by pressuring the company’s board to initiate a sale process. Verizon’s AOL, and in particular its CEO Tim Armstrong, was seen as the leading suitor. The rest is, as they say, history.