“The Sell Sider” is a column written for the sell side of the digital media community.

“The Sell Sider” is a column written for the sell side of the digital media community.

Today’s column is written by Paul Bannister, co-founder and executive vice president at CafeMedia.

With all of the talk of header bidding and now header bidding wrappers, it’s clear that most publishers are moving forward in this space in a big way.

However, many buyers often have viewed these technologies as something they don’t need to think about, a publisher-facing technology that has no impact on their decision-making. That couldn’t be further from the truth.

Header bidding dramatically changes how publishers organize their waterfalls. The publisher’s ad waterfall is one of the most important things for a savvy buyer to understand. Where an advertiser’s media is prioritized in the waterfall – whether for a direct-sold deal or programmatically – has a big impact on their scale, access and performance, which are obviously critical issues for any advertiser.

How Publishers Organize Inventory

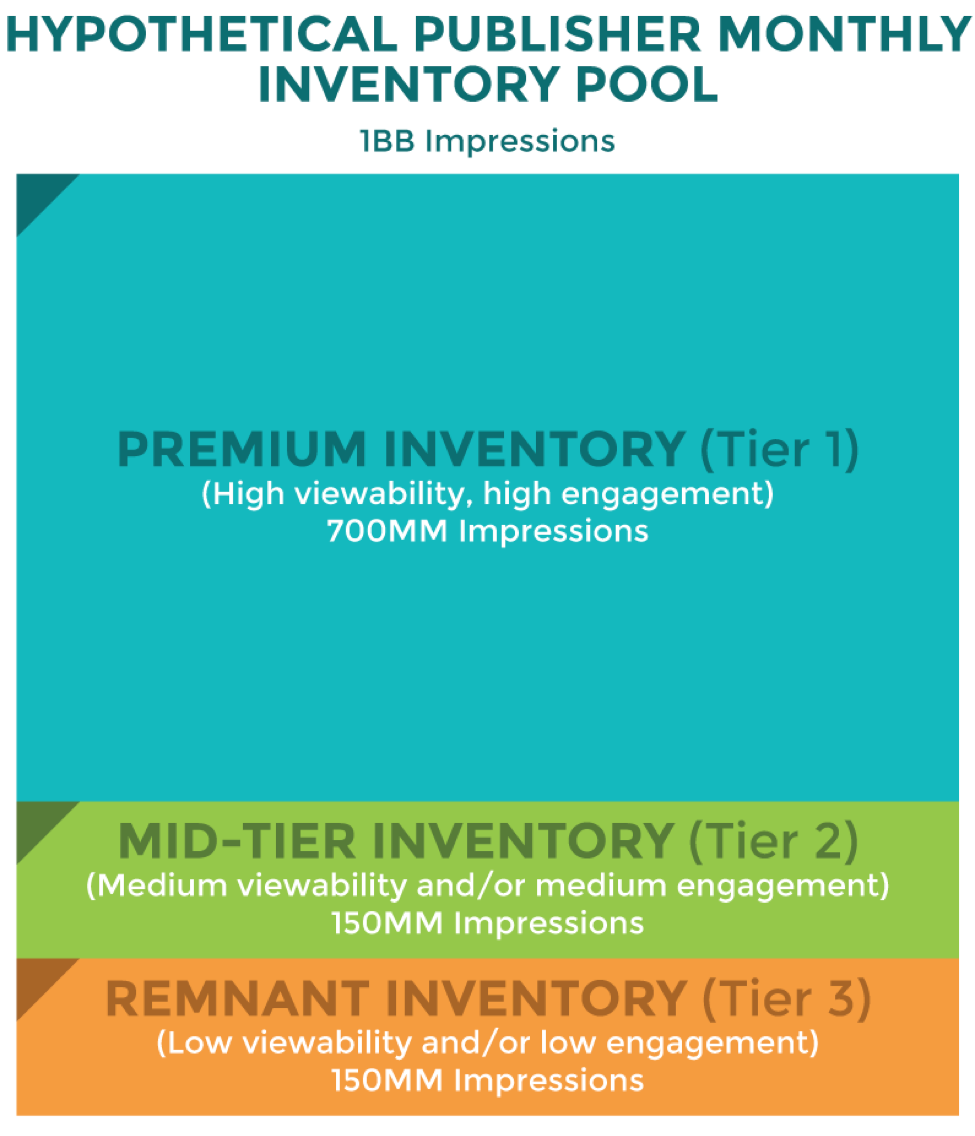

In terms of organization, you can think of a premium publisher’s inventory as a few stacked sets of boxes:

In terms of the waterfall itself, it’s a priority that is assigned to each campaign that lets the ad server decide what campaign to serve to a given impression. Broadly speaking, there are a few layers of priority. A takeover, for example, is prioritized at the top and delivers in all scenarios. In the middle, there are layers for prioritizing direct-sold deals depending on how difficult or important they are to deliver on. Below that, there is remnant priority for any impressions that have gone unsold to a direct advertiser.

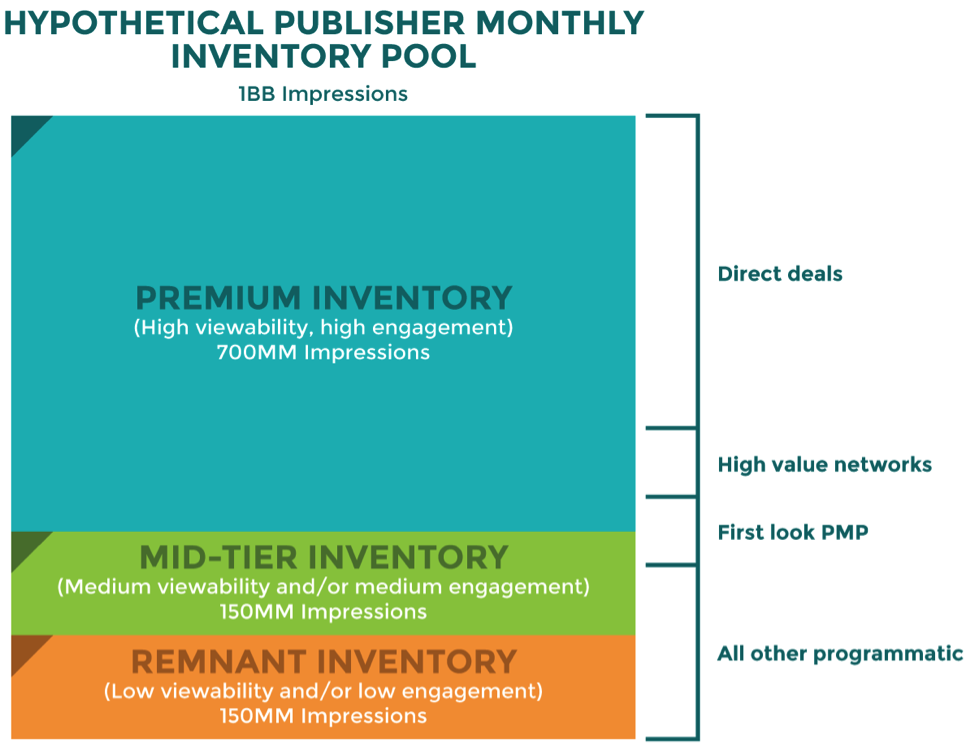

So the inventory pool and waterfall of a publisher a few years ago would look something like this:

Programmatic was prioritized at the bottom of the waterfall because even if a publisher had created some high-value private marketplaces (PMPs), it never knew which impression a PMP wanted and which impression would be monetized via RTB open market at a much lower rate. The eCPM of the impression once passed to an SSP was unknown – it could be high or it could be low, so the average was used to prioritize, which almost always put it at the bottom of the waterfall.

A “first-look” deal, in the old parlance of programmatic, meant that a deal was prioritized above all other programmatic, but still below everything else in the publisher’s waterfall. Those deals would usually get good performance, but their scale was massively reduced since they never would be able to get access or visibility into the full inventory pool, just a fraction of it.

Header bidding changed this by letting the publisher know in advance that a PMP wanted a particular impression at a premium price. This allows publishers to invert the waterfall:

Publishers still have to manage their inventory to ensure direct deals can deliver, and PMPs may be deprioritized in times of high demand, but generally this allows a smart programmatic buyer to not only get access to great inventory but to pick the impressions they want from the entire pool of inventory, not just the small pool they’re seeing in a normal programmatic configuration.

Programmatically buying from publishers that haven’t set up header bidding or haven’t modified their waterfalls is just buying from the bottom of the barrel. Equally as inefficient are buying through SSPs and exchanges that don’t have that sort of capability or are prioritized poorly. Working with publishers that have implemented header bidding and reorganized their inventory gives buyers a strategic advantage: significant access and priority to those audiences.

This affects buyers in two other ways. Firstly, “first look” (see what I did there?) is terminology that should be eliminated from their vocabulary. Now, buyers should be asking about their priority in the ad stack. Secondly, programmatic-first waterfalls truly change the value dynamic of programmatic from cheap, low-tier inventory to true premium, direct-quality inventory. Buyers need to keep in mind that this puts pricing on the same level as a direct-bought deal – and maybe even more expensive since now they can hand choose exactly what impressions they want.

For publishers, as more buyers begin to understand the benefits, we may be able to move to a world where open market programmatic becomes nonexistent or very small. By balancing guaranteed, direct-sold deals against header bidding PMPs, a publisher can fully yield optimize its inventory pool without having to open up to the open market at all – further increasing demand for its audience.

This also changes the dynamic of incremental traffic. In the old model, if a publisher had 100 million incremental impressions appear one month, this wasn’t of great value since they would be monetized as remnant. Now that it can put premium, nonguaranteed buyers at the top of its stack, a publisher can drive significantly more value from incremental traffic.

Header bidding is a win-win. Buyers get greater access and performance, and sellers get more visibility and control. Understanding and optimizing for the waterfall is the key to success for sellers and buyers.

Follow Paul Bannister (@pbannist), CafeMedia (@CafeMedia) and AdExchanger (@adexchanger) on Twitter.