“The Sell Sider” is a column written for the sell side of the digital media community.

“The Sell Sider” is a column written for the sell side of the digital media community.

Today’s column is written by Paul Bannister, co-founder and executive vice president at CafeMedia.

There’s no question that programmatic buying, particularly real-time bidding, has created many efficiencies and been a force in shifting advertising budgets toward digital. Smart buyers find strong ROI in programmatic, while smart sellers find new ways to create value.

But programmatic buying has also created inefficiencies and challenges that continue to limit adoption. Many inefficiencies spring from the simple fact that programmatic buys require the use and understanding of a complex ecosystem. Some issues are well-documented, such as the ad tech tax and finding scalable, quality inventory pools, while others are murkier, though no less pernicious in their impact.

The digital advertising industry exists because advertisers have a need – reaching audiences with their message – that publishers can fill by aggregating large or targeted audiences that are receptive to marketing messages. All parties on the buy side would agree that maximizing advertiser return is the greatest goal, and those on the sell side would say maximizing publisher value is the greatest goal.

However, the increasing complexity of the digital media ecosystem is growing the gap between the two and making the industry less efficient.

The Core Models Of Digital Media Buying

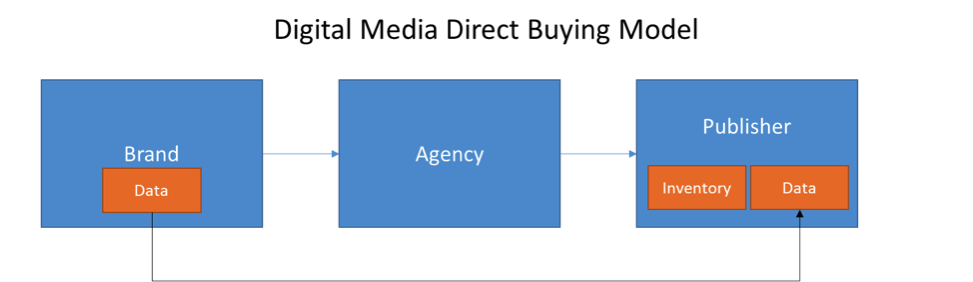

It’s worth clearly laying out the most standard models of buying digital media: a direct buy and a standard programmatic buy. While there’s no rocket science involved, it quickly becomes clear how even a simplified version of programmatic buying is much more complex than a direct buying model.

In a direct buy, there are usually three parties to the transaction: the brand, an agency and a publisher. It can even be argued that there are just two as the best agencies act as well-integrated extensions of the brand. There are also some other players in the mix, such as ad servers and verification services, but they have small and clear roles within the process.

Here the publisher is managing the inventory and data when executing the program. Each publisher is intimately versed in their own inventory setup and has significant experience optimizing it for campaigns.

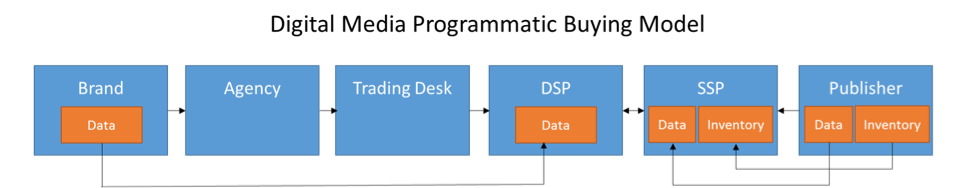

Let’s contrast this to the buying model for a programmatic deal. By adding a trading desk, demand-side platform (DSP) and supply-side platform (SSP) into the mix, the number of players with strategic roles in the process has doubled, which at least doubles the complexity and creates a number of points where the process can break down.

Not only has the actual inventory been moved into the SSP, but the controls for that inventory have moved into the DSP. In the direct-buying model, the actual hands on keyboards controlling the inventory were inside the publisher’s office. Now, they have moved somewhere across town or the country to a team that is far less knowledgeable about that inventory.

As a result, ad tech players need to create significant new technology to account for the buyer’s lack of knowledge about the underlying inventory.

Potential Solutions

It is clear that we need to move toward a world where buyers can get more control, publishers can add value and intermediaries perform necessary and clearly defined roles. No single solution is going to fit all needs – different advertisers and publishers will have different needs and there will be different scenarios. But perhaps there are a few models, many already being worked on, which can start to simplify the complexity we have created.

One macro change occurring at most major agencies is the collapsing of the separated agency trading desk back into the media agency teams. While this isn’t universally true, it’s a welcome change as it unifies the buying decision-making and removes a “hop” in the process from buyer to seller. As this becomes a more prevalent model it will improve value creation for everyone.

Beyond that, one simple model already exists: the private marketplace (PMP). Not just the technical concept of a deal ID-enabled PMP, but PMPs are being used as a way for buyers to retain significant control of buying decisions while letting publishers add value and set controls via their experience.

If a buyer wants a certain demographic, minimum viewability and brand safety controls, the publisher should enforce those rules. It’s cheaper for the buyer so more of their dollars flow to working media and PMPs allow for greater scale since there are fewer ad tech filters between the buyer and seller.

Some ad tech platforms are also moving in the direction of collapsing the DSP and SSP. When a buyer and seller are using a shared platform where they can collaborate, this can reduce complexity and let the publisher bring more of their value to the table. However, this isn’t without its own issues. There are potential conflicts in this scenario, not least of which is who the collapsed DSP/SSP is ultimately accountable to.

Much tighter coupling between the DSP and SSP could solve many issues. An updated OpenRTB spec that allowed for campaign and inventory metadata to be transferred could be a great solution. If a buyer could send the publisher information about each campaign strategy in real time with the bids, the publisher could much more effectively choose the best inventory pools.

On the flip side, if the publisher could send the advertiser information about its inventory and waterfall configuration, the advertiser could make much better decisions about exactly what to buy.

There are lots of potential solutions to the great separation of buyers’ intent and publishers’ inventory. Collectively working through this challenge will create value for everyone in the ecosystem and help realize the goal of driving the highest value for advertisers and publishers.

Follow Paul Bannister (@pbannist), CafeMedia (@CafeMedia) and AdExchanger (@adexchanger) on Twitter.