“The Sell Sider” is a column written by the sell side of the digital media community.

“The Sell Sider” is a column written by the sell side of the digital media community.

Today’s column is written by Paul Cimino, global head of data strategy at Prohaska Consulting.

Not so long ago, publishers produced and distributed content to attract and monetize their audiences. Since content was relatively scarce, brands paid high CPMs directly to publishers to harness their content and access their target audiences.

The landscape has changed. Although premium content is still scarce, the overall volume of content has exploded. Sensing an opportunity, programmatic intermediaries moved in to handle the complicated process of aligning the supply, distribution and monetization of the increased inventory. And while revenue has grown, prices have dropped.

The vast amount of content on websites, blogs, social networks and apps has shifted power to advertisers. Exciting times for them – for publishers, not so much. But publishers can take back some of that power by focusing on one of their most valuable assets and putting data at the heart of their business models.

The intrusion of intermediaries in the landscape has meant that publishers have lost touch with their audiences and their power has been depleted by yield managers, ad networks, exchanges, supply-side platforms and demand-side platforms. Furthermore, fragmentation of audiences has eroded the size of publishers’ audiences.

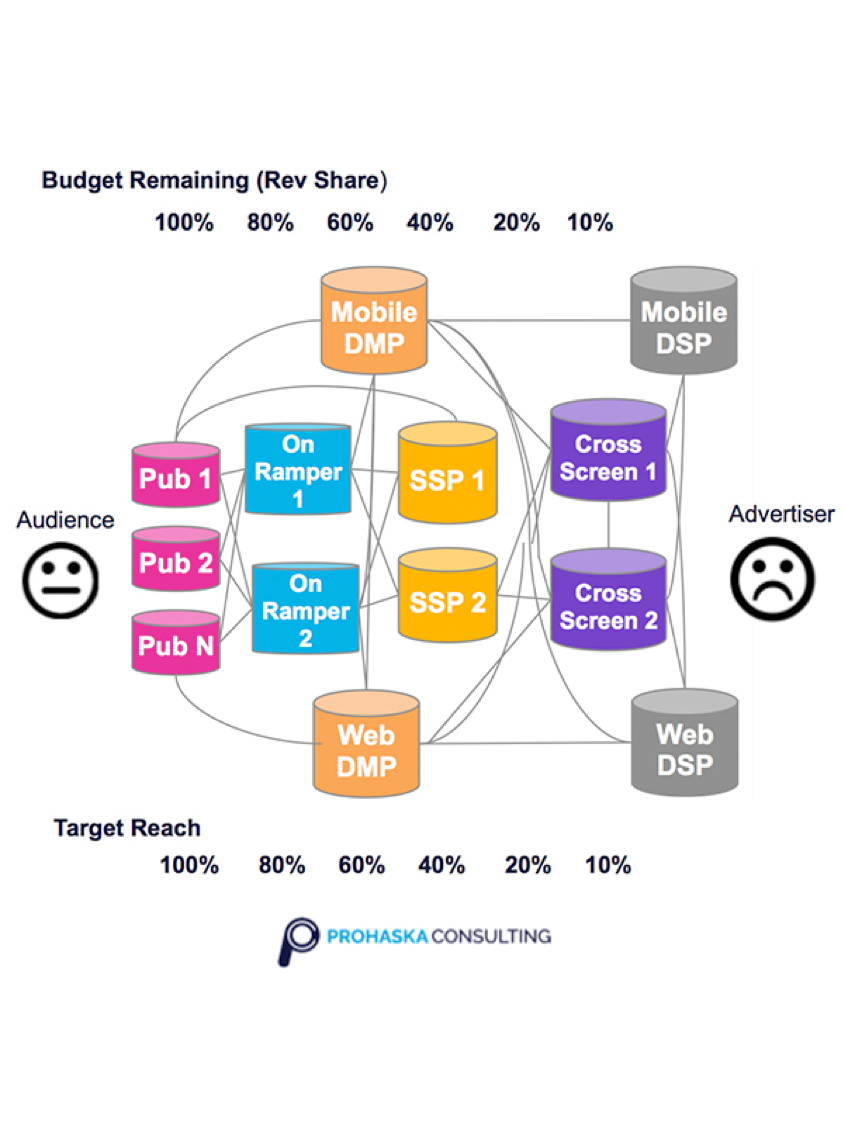

A chief issue facing publishers and advertisers is ad tech arbitrage-based fragmentation, where leveraging lists of anonymous identities serves as the basis of the business model. While good for the middleman, the arbitrage-based fragmentation of revenue and reach severely compromises audience targeting for the principals. The following infographic visualizes how intermediaries’ revenue share degrades targeting budgets, while multiple third-party integrations deplete reach.

At the same time, Google and Facebook have become audience powerhouses by developing systems where their audiences – fully opted in – drive higher in-flight reach and lower compounded revenue share. This leaves more budget for advertisers to focus on media that appeals to target consumers.

Audience Factories

It’s not all bad news for publishers. While ad blocking, viewability and fraud plague the ad world, conditions are ripe for increased demand for publishers’ offerings. But will publishers be able to take advantage of these changing conditions, and what will that evolution look like?

Publishers need to capitalize on the fact that they – and not ad tech companies – emotionally touch their audiences and have valuable first-party data as a result of their audience relationships. This could vastly improve their future.

The task of changing from media-centricity to audience-centricity will not be insignificant. Publishers will need to go way beyond their current third-party ad tech stack and create a brand-new business model. By aggregating the user profiles they gather through online via cookies and IDs, offline via direct mail and through other channels, such as point-of-sale and enterprise resource planning, they will create and build a deep, rich understanding of their audience.

If they can make that move, publishers have the potential to become “audience factories” – data-centric companies that understand that their segment data is a key asset to enable them to deliver, at scale, high-value audiences to key advertising partners.

Putting Large Publishers Back In The Pilot’s Seat

Large publishers need to start by investing in their own data production. This is a two-part issue. First, publishers need to leverage other peoples’ ID systems to build their own first-party identity footprint, such as a first-party data lake.

Second, publishers need to concentrate on predicting valuable behaviors for advertisers. While demography and intent segments are popular, they are also widely distributed and largely commoditized. Smaller but scalable pools of precise segments are very valuable.

Publishers can also partner with other publishers and data publishers. Using new data technology companies like OneSignal, Arbor Technologies, Screen6 and Pxcel, companies can help publishers more easily cooperate with other publishers and data companies to increase the scale and value of data by transparently sharing IDs and attributes.

Publishers should develop a walled-garden frenemy strategy by simultaneously selling to key audiences via Facebook and Google and also the open web and mobile. If possible, direct TV/cable spend and audience targeting to web and mobile. Consumers aren’t likely to learn about the existence of a new hot car like the BMW i8 on the web.

Finally, publishers need to focus on mobile and millennials. Big brands currently don’t have a way to get on the radar of millennials.

So, What If?

What if a large publisher became a data-first company, thought of its media and inventory as data and leveraged its multichannel position to corner the market on millennial mom data? This type of data-powered business would dwarf today’s traditional data businesses.

Already some companies are using data to radically transform their business model. Sojern, for example, started out by putting coupons on boarding passes, and over the past six years, it has turned into the pre-eminent data-driven ad platform in travel. It did this by focusing on data and predictions.

At some point, being able to predict audience behavior will enable publishers to move into multichannel media, attribution, apps and even helper bots. Who better to ask and answer than a trusted publisher? Google and Facebook are already there.

Follow Prohaska Consulting (@TeamProhaska) and AdExchanger (@adexchanger) on Twitter.