Hi, readers!

This is James Hercher with your weekly Commerce Media dispatch. Today, we’ll take a look at the recent IPO of a company that straddles the line between a tech business and a consumer brand.

Call it an Oddity.

New kid on the stock

The aptly named Oddity Tech, an Israeli DTC brand operator, doesn’t fit neatly in one category.

On one side, it’s a makeup and skincare product manufacturer. Oddity owns two brands – Il Makiage and SpoiledChild – and its entire revenue comes from the online sales of those products.

But being a straight-up DTC ecommerce company is no longer shiny enough to convince investors that a new brand can replace old-school incumbents.

“We are a consumer tech platform,” is the opening line of Oddity’s pre-IPO SEC filing from June.

And Oddity – Oddity Tech, that is – emphasizes throughout that it isn’t a skincare brand, but rather a tech and data company that, at the moment, operates a couple of cosmetics lines.

According to the filing, 40% of Oddity’s workforce are “technologists.”

What do they do?

“We deploy algorithms and machine learning models leveraging user data seeking to deliver a precise product match and seamless shopping experience,” write the founders.

Oddity does have actual scientists, since it acquired the biotech company Revela for $100 million. But that’s a lab for skincare and wellness product development, which is typical for a cosmetics manufacturer and alien for a tech company.

What’s the problem?

Being data-driven is good. But there are serious costs when DTC and emerging companies position themselves as tech and data companies when they are not.

There are costs in terms of the misrepresentation of the business. Not to compare Oddity’s legitimately durable and growing consumer business too closely to the WeWork fiasco, but WeWork was among the first and most notable data-driven newbie types to represent itself as a tech and data company and, thus, deserving of some kind of multiplier on its value similar to other SaaS and data companies.

But WeWork was and is an office booking and management company, and the effort to present itself as a tech company using a convincing façade cost it hundreds of millions of dollars. WeWork spent more than $100 million on Conductor, a digital mar tech and SEO startup that was resold at a loss less than two years later, and beefed up on engineers and data scientists who were mostly laid off even before the pandemic.

Again, Oddity is not an analog for WeWork – except for the fact that they both IPO’d as ostensible tech platform businesses.

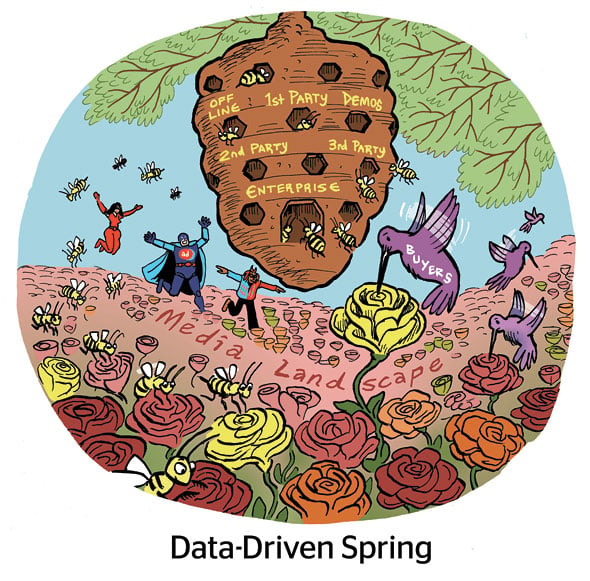

Oddity frames its tech-first approach as the antithesis of the industry standard model. Where others rely on offline and wholesale businesses, Oddity is digital and DTC. Competitors rely on outsourced tech and are “efficiency-centric,” according to a visual in the company’s SEC filing, while Oddity builds its own stack and is “data-centric.”

But DTC businesses that emerge with a strong differentiating edge – tech and data chops, for example, as well as sustainability or seemingly irreplicable marketing (Hello, Liquid Death, which is preparing a potential IPO) – often end up regretting not taking an efficiency-first approach.

The paths not taken

The paths not taken

Consider Allbirds, which IPO’d in 2021 and is another DTC star that has struggled lately.

Allbirds didn’t represent itself as a tech or data company. But its differentiator was sustainability, which also is primarily marketing, just like the framing of Oddity as a tech company.

And those types of marketing stances are costly.

Allbirds shoes are 50% to 60% more expensive than similar running shoes that aren’t made with the same commitments to sustainability. Shoes also simply don’t last as long when they’re made from merino wool or eucalyptus tree fiber, rather than synthetic materials built to last for pro runners.

Yes, the Allbirds eco commitment sets it apart from brands like Nike and Adidas. But Nike and Adidas are profitable companies.

The brands that Allbirds competes with can also easily use sustainability as a marketing tactic themselves. When they close shops in malls, for example, they’re able to tout their energy savings. They can buy carbon credits and pitch themselves as carbon neutral. And all the while their shoes will be cheaper, last longer and work better.

Oddity, likewise, may remain committed to the DTC model and the data-driven acquisition of online customers that it pitched in its IPO prospectus. But it also has a tech company’s disregard of old-school approaches, like wholesaling, retail store distribution and offline marketing.

And when the tech and data shine wear off, wholesaling and retail sales are going to look pretty cool.