Google’s recent push to prioritize mobile-friendly sites in organic search results is straining the advertising ecosystem, according to Adobe Digital Index’s Q2 2015 Digital Advertising and Social Intelligence report, released Wednesday.

Google’s recent push to prioritize mobile-friendly sites in organic search results is straining the advertising ecosystem, according to Adobe Digital Index’s Q2 2015 Digital Advertising and Social Intelligence report, released Wednesday.

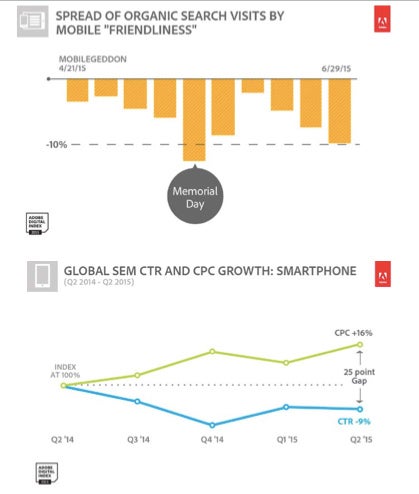

The Adobe Digital Index for Q2 2015 noted a 10% decrease in organic traffic on Google among sites that weren’t optimized for mobile.

The results are based on data from Adobe Media Optimizer, Adobe Social and Adobe Analytics (cumulatively representing 890 billion digital ad impressions and 21 billion referred social visits to all major social platforms).

Although marketers are bidding up in paid search to temporarily recover lost traffic, Tamara Gaffney, principal analyst at Adobe Digital Index, said that’s not a sustainable strategy.

“We saw cost per click rise 16%, but click through rates are down 9%,” she said. “Google is doing better in that they’re making more money off of the mobile click, but not really delivering a great result for marketers.”

As a result, Adobe predicted a widening gap between the price marketers will pay for mobile clicks, and the traffic they will receive in return. Further exacerbating this disparity: the fact that mobile revenue per visit (RPV) still largely lags behind desktop.

“Google’s hope is that marketers will value the mobile click more and improve their web results, but we can see from our data that even the best mobile [optimization] performs at half [the rate of] desktop in RPV right now,” Gaffney said. “You can’t incrementally do responsive design as a marketer, and expect the same results as desktop.”

In order to combat click inflation – when CPCs require more investment to break even – marketers may be finding more ways to diversify their spend. Marketer spend on Bing/Yahoo was up 24% year over year in the second quarter, surpassing Google by seven percentage points.

“We believe, based on this data, search marketers have reached a point of inflection where they believe the best place to spend their search dollar might not be Google anymore,” Gaffney said.

Facebook’s Growing Dominance

Facebook’s aggressive mobile moves have begun to seriously encroach Google’s, Adobe’s findings indicate.

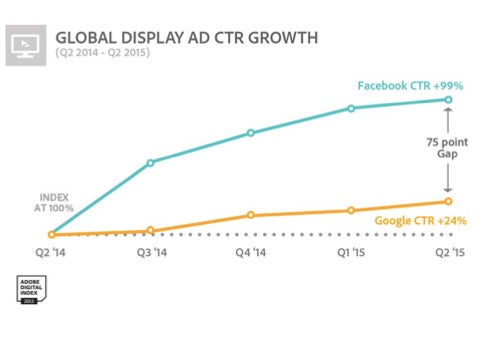

Despite the social network’s nearly 50% reduction in impressions (it reduced the overall frequency of display ads from four to two per page, but subsequently targeted more mobile ads in the newsfeed), it doubled its click-through rate year over year.

Gaffney noted 51% of consumers in the US believe Facebook served ads consumers were interested in. By contrast, 17% of consumers said the same of YouTube, according to a separate Adobe study surveying 400 US consumers.

“The gap between Facebook and Google is huge,” Gaffney said. “We haven’t seen as much radical change on Google’s side. While they reduced the number of ads in their owned and network areas (impressions were down 22%), the click-through rate was only up 24%.”

While Google’s results were still positive, – CTRs increased despite an overall reduction in impressions – “it wasn’t nearly what Facebook saw in terms of click through.”

While Google’s results were still positive, – CTRs increased despite an overall reduction in impressions – “it wasn’t nearly what Facebook saw in terms of click through.”

It’s important to note that Adobe Media Optimizer, with a heritage in paid search, had only recently pushed into programmatic display. Gaffney noted however that for the first time, it was able to plug Google Display into its programmatic system.

“This is part of the problem why I think Google hasn’t kept up with Facebook – they weren’t embedded into [third party] ad technology as quickly,” she said. “As Google invests in more optimization, it helps marketers spend more money in digital and that’s the rising tide that lifts all the boats.”