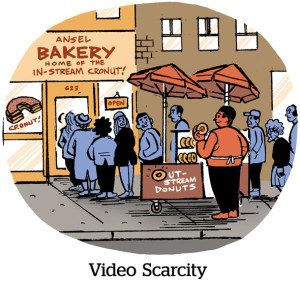

Premium video scarcity and the rise of in-feed mobile video have created the perfect storm for an explosion of outstream video – a format that, instead of running instream as pre-roll or mid-roll, is either embedded between article content or within a slideshow.

Premium video scarcity and the rise of in-feed mobile video have created the perfect storm for an explosion of outstream video – a format that, instead of running instream as pre-roll or mid-roll, is either embedded between article content or within a slideshow.

Thus, these formats don’t need to be attached to publisher’s video content to render. And those who sell them say there is better viewability because outstream video, when assimilated into the article text, doesn’t run below the fold or in the right rail.

“There are a lot of video dollars flowing online, and publishers want to be able to connect with that,” said Rob Leon, head of commercialization for AOL’s publisher products.

AOL launched two outstream video formats last week – one that only renders when the unit is 50% in view and minimizes upon completion, along with a second unit called SideView that allows existing video players to align with page content, making them less obtrusive. (Huffington Post, USA Today Sports and Complex magazine are all beta testers.)

“The whole idea is to give publishers access to great video content and to be able to monetize new video content,” Leon said.

Outstream Grows Legs – And Invites Questions

Outstream video is lucrative for publishers, as the format’s high viewability can command over $20 CPMs.

And market traction is heating up.

Teads, one of the largest suppliers of outstream video, reported $150 million in 2015 revenue, which represented 50% organic growth for the company. And Virool, which creates InLine video ad formats for publishers like Mashable, raised $12 million in Series A financing on Wednesday from Menlo Ventures and Thomvest Ventures.

But the jury is still out on whether consumers find outstream units less disruptive than other established formats. Christian Aichhorn, head of digital marketing and social media at Swiss global financial services firm UBS, sees the benefits.

“These ‘non-display’ formats do not appear as classical advertisements and therefore do not annoy users that much,” he said.

Alex Debelov, CEO of Virool, a company that makes outstream video ads, agrees.

“Consumers are tired of seeing ads before content, which is why you’re seeing them using ad blockers,” he said. “With outstream, we’ve tried to design something that looks nice where the user is in charge. When they actually want to engage with content, advertisers are seeing higher engagement.”

In some ways, Facebook has conditioned consumers to autoplay, in-stream video.

“I don’t think it’s unfamiliar for a user to see video within the context of a feed or article,” AOL’s Leon said, but added that maintaining a good user experience depends on the tech placing the video. “It’s about good quality of technology, so it’s a seamless experience. If it’s janky, consumers aren’t going to love it.”

Still, there’s a difference between social in-feed and outstream video that appears within an article.

Mark Book, VP of Digitas Studios, the agency’s content marketing division, also draws a sharp distinction between social in-feed and outstream video. “What I do not consider to be outstream are placements within a feed – so Facebook, Instagram and BuzzFeed. I would consider this to be pure native in-feed advertising.”

The difficulty is making the video units feel like they really belong on a page and that they fit the context of the surrounding content.

“The challenge thus far is truly making it feel like it belongs in a [publisher] environment,” said James O’Neill, VP of interactive marketing for MDC agency Assembly. “Native social video has an easier time with adoption because the channel has already been used for that type of content organically.”

“The challenge thus far is truly making it feel like it belongs in a [publisher] environment,” said James O’Neill, VP of interactive marketing for MDC agency Assembly. “Native social video has an easier time with adoption because the channel has already been used for that type of content organically.”

When purchasing outstream video from a smaller collection of publishers and sites, there tends to be more transparency and quality control, said Digitas’ Book, since many of those deals tend to be direct.

But once the format scales, he added, “you can run into ‘over-branded environments’ that turn consumers off to your content. This is not yet a widespread issue, but with its quick adoption, it could become one.”

But that’s an issue for the future, once outstream hits its stride. Right now, Aichhorn sees new branding opportunity beyond a tired banner ad.

“So far, there is not such high competition [in bidding] for these formats and consequently no ad overload for the user, which leads to better cost efficiency and a lower ad wear-out effect,” he said.

Adoption of outstream units in the exchange environment exploded in 2015.

Adoption of outstream units in the exchange environment exploded in 2015.

Rubicon Project partnered with Virool to boost its own video supply, AppNexus opened an outstream video marketplace with Teads and StickyAds and Unruly began to sell in-feed video formats programmatically to Videology’s clients.

But some suspect that by scaling these formats programmatically, buyers may end up paying for formats that are bundled up within standard banner or pre-roll buys.

“Every ad network is launching an outstream format, but it wasn’t a format that fits our vision at all, no matter how much money is to be made out there,” said Ari Lewine, co-founder of native ad platform TripleLift.

Right now, Lewine says outstream is in its heyday, but his hypothesis is that outstream may get lumped into reporting for existing pre-roll or digital formats that are more prevalently traded in the open exchanges.

“Once marketers demand a break-out, they will begin to value it differently than they would have otherwise,” he predicted.

Brands like UBS, however, seem to value the promise of outstream – or at least the perception of quality and added viewability. The bank uses Teads’ inRead format across business/luxury publishers, and its ads are guaranteed 100% viewable and independently verified by Moat.

For Aichhorn, the value is simple: “[We were looking for] videos to run in a premium environment with good visibility that were cost efficient.”