Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

When Even The Whales Are Small Fish

Microsoft has new job listings for software engineers to develop a line of “low-cost PCs powered through advertising and subscriptions,” reports Windows Latest. It’s one of many recent cases where Microsoft Advertising supports another business line, sometimes even foregoing ad revenue.

For example, Xbox console and cloud gaming accounts are part of the Microsoft Advertising identity graph (whereas LinkedIn is not), and console inventory is part of the exclusive supply.

But, when Microsoft began developing an in-game dynamic advertising product for Xbox in April, the ad business didn’t take a revenue cut, so third-party ad tech and developers earned more. Strengthening the third-party developer ecosystem is more pressing than ad revenue. Xbox itself is a larger business than Microsoft Advertising, so ad revenue is simply not the goal.

That frees advertising up, though, to be part of a broader value prop.

LinkedIn is another example, since certainly Google or Meta would consolidate LinkedIn within one walled garden and the central ID graph. No way would that juicy account data be left on an island. But LinkedIn, which has its own ad biz thank you very much, is bigger than Microsoft Advertising and makes no concessions to the ad platform.

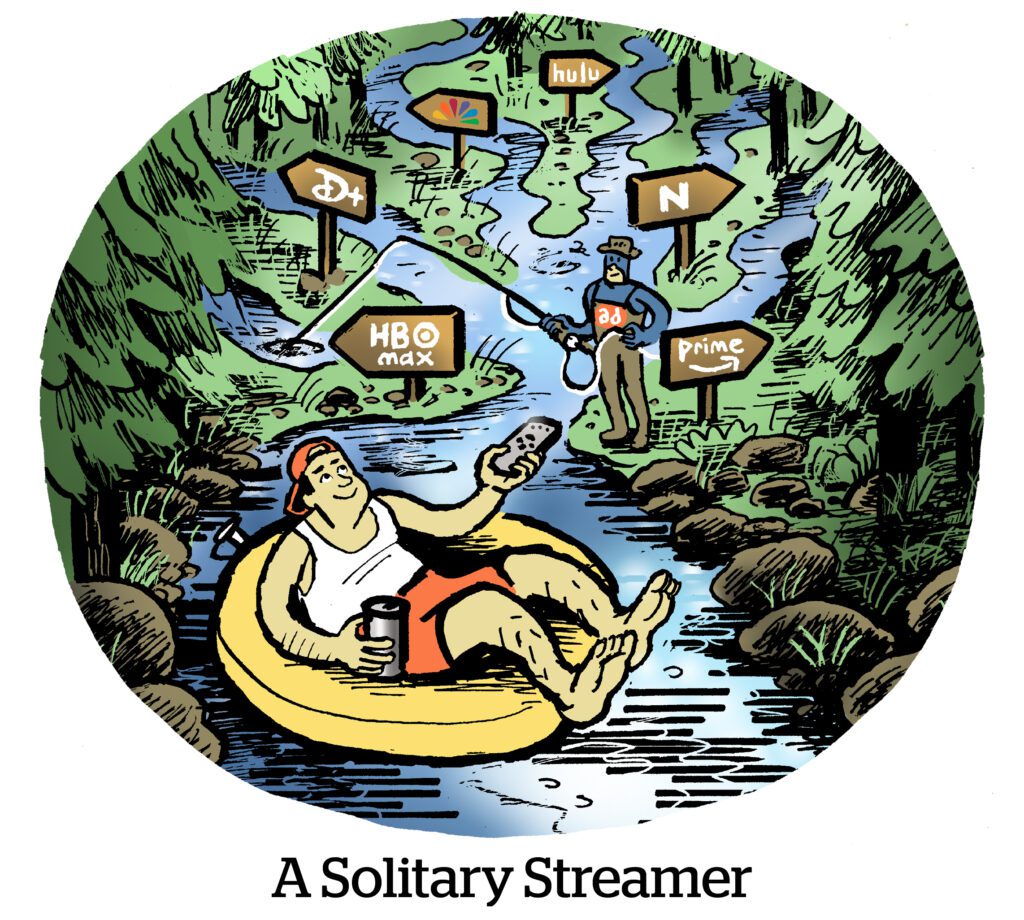

Your Stream Is Safe With Me

Connected TV advertising has 99 problems, and more than one of them is brand safety.

TV advertising was often tied to direct deals based on program guides, so brands could effectively ensure their ads ran in suitable media and with competitive separation.

But streaming did away with program guides and insights into competitive media adjacency. “Run of network” is the norm when you stream. As a result, brand safety is among the top reasons why buyers are demanding more show-level transparency into TV buys.

That need for transparency throughout a video stream is also why programmatic TV tech is being built differently.

To maintain control, CTV buyers prefer programmatic guaranteed deals and private marketplaces over open auction systems. Programmatic provides automation and real-time placements, says Deva Bronson, global head of brand assurance at Dentsu, at the Brand Safety Summit in New York City this week.

The new TV dichotomy is no longer broadcast versus digital, Bronson says. It’s direct versus programmatic buying.

Parting Clouds

Free ad-supported TV (FAST) is the next big thing in streaming.

That’s why CTV programmers (upstarts and traditional broadcasters alike) are scrambling for partner integrations to get a piece of the FAST ad spend.

But media companies must reorient their tech stacks to make it work. FAST channels are linear networks, but streamed via an internet connection, so it’s uncharted territory for both sides.

Music video network Vevo partnered with Amagi, a cloud-based ad monetization startup, to expand its FAST distribution (which is now up to 80 channels).

Amagi placed all its bets on streaming, but the reason why the startup became a unicorn so quickly (it raised $200 million this year in two different rounds) is because the cloud also helps broadcasters distribute their content through streaming channels, CEO Baskar Subramanian told AdExchanger earlier this year.

Programmers should seek partners that support “all demand sources, from programmatic to direct-sold, to maximize ad monetization,” Natalie Gabathuler-Scully, Vevo’s SVP of global revenue and distribution operations, tells AdExchanger.

But Wait, There’s More!

TAG introduces “Certified for Transparency” seal, with Ads.txt and App-Ads.txt compliance, among other measures. [release]

HUMAN acquires clean.io, a smaller malvertising and ecomm fraud prevention company. [release]

FedEx’s ShopRunner ecommerce service, part of its Dataworks data monetization business, launches a new mobile app. [Chain Store Age]

TikTok and DoubleVerify expand partnership to Brand Safety and Suitability measurement. [release]

Of course instant groceries don’t work. [The Atlantic]

You’re Hired!

Goodway Group hires John Davis as SVP, manager of the Brand Direct and Retail Media business. [release]