Oh THAT’S where some of the agency margins are!

Oh THAT’S where some of the agency margins are!

Google has made another step toward a more transparent future as the company looks to beat competitive, privacy-related and anti-trust threats. Will it be enough?

Today, on the Google AdSense blog, Big G’s VP of Product Management revealed its overall revenue share with publishers for Google AdSense – 68% of ad revenues go to content network pubs (content = display whether its video, graphical or text) and 51% of ad revs goes to those publishers that integrate Google search. Of course, what happens publisher by publisher may be a different story depending on the size of the publisher, the site’s content, etc. But, transparency is on the way for individual publishers writes Mohan: “Over the next few months we’ll begin showing the revenue shares for AdSense for content and AdSense for search right in the AdSense interface.” Read more on the AdSense blog.

(What do you think margins for Google’s paid search ads are – and I mean the ads that run around the Google search engine result pages? Must be around 90-95%!)

It will be interesting to see if this rev share is broken out by individual URLs so that publishers can start understanding where there’s money to be made. For example, better margins for “allergy” content versus “orthopedic” content might be another byte of data which tells the health info publisher about supply imbalance at Google and an opportunity for additional scale in their own content strategies.

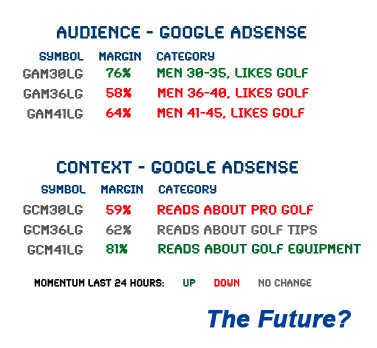

Or, how about offering margins by audience? Enter the Google margin ticker for audience! -and the Google margin ticker for content/context!

Barry Shwartz argues on Search Engine Land that this margin transparency move will put pressure on Google to reveal even more. Makes sense. But, let’s say transparency and openness IS the plan. And, transparency would put pressure on anyone in the ecosystem that isn’t supplying similar transparency – especially those involved in arbitrage. Google could grab that “arb” margin.

Given Google’s superior position in the funnel with search and the imminent roll-out (6 months? A year?) of search retargeting which will allow targeting of bottom-of-the-funnel intent throughout the display advertising ecosystem (especially if they own a DSP which targets all exchanges, all supply sources), Google transparency could show improved performance and superior insights than alternatives.

This scenario echoes the “agency/procurement officer” story where the procurement officer whoops the agency into submission and demands to know where every marketer dollar is spent and the assigned markup. In the future, Google may be like the procurement officer in that Google’s transparent strategy could lead to the demise of intermediaries that do not submit to providing transparent, quantifiable value.

Way Down The Road And Direct Sales

Thinking way down the road, how about the impact on direct sales by Google opening the kimono on its margins to its ad network? If an advertiser can buy and understand all of the pieces of the value chain, it would follow that a better understanding of what the direct buy offers will become increasingly important. Direct sales could lose their fat margins as ad dollars travel to more transparent supply sources. The big outlier here is the value of “brand”. That’s where the margin is for media companies and publishers.

Is there an ad tech company out there that can value brand data?

By John Ebbert