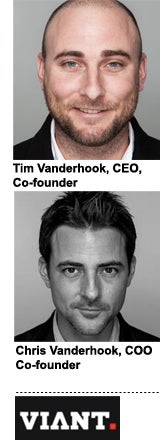

Interactive Media Holdings (IMH), the operating company behind ad network Specific Media, social network MySpace, video ad platform Vindico and smart TV system Xumo, rebranded Wednesday as Viant.

Interactive Media Holdings (IMH), the operating company behind ad network Specific Media, social network MySpace, video ad platform Vindico and smart TV system Xumo, rebranded Wednesday as Viant.

Along with the rebrand comes the release of a cloud-based platform called Advertising Cloud (yes, another cloud), which is a sum of three parts: a media execution platform, a data analytics platform and an Identity Management Platform that’s basically a determinisitic data-management platform claiming access to 1 billion consumer profiles. The number of active MySpace users was not shared.

The Advertising Cloud concept originated a year ago, said CEO Tim Vanderhook – one of the three brothers who founded the first iteration of the company formerly known as IMH back in 1999, Advertisement Banners – when it decided to take the tech behind its four owned-and-operated properties and translate it to customers in the cloud.

To borrow the phrase du jour, the Vanderhook brothers say Ad Cloud is “modular” and can be integrated with a client’s existing demand-side platform, etc.

The suite has been in beta for seven months and 10 customers run it end-to-end, said Vanderhook.

“We’ve seen, on average, 10x-20x increases in ROI when you activate first-party data, activate the entire sales channel and you’re able to link all the cross-device activity,” he added.

Tim and COO Chris Vanderhook spoke with AdExchanger.

AdExchanger: Why the rebrand?

TIM VANDERHOOK: It’s sometimes hard for people to grasp our organization as a whole, and we wanted to recreate the brand at the holding company level, so we created Viant. We had this vision we were chasing over the last 15 years of, “Can you solve the marketer’s dilemma in justifying advertiser spend?”

Given your network roots, how have you transitioned to programmatic?

TV: The biggest advantage is how much inventory is available connected now vs. a traditional network. There’s value in a traditional network model where the media buyer calls on the publisher. When you’re in the open exchange, it’s a little bit more risky on the inventory.

What were some challenges you faced in your transition?

TV: When we launched programmatic, the biggest pain points were the integrations with all the SSPs. It’s a slow process. There are standards but everyone is customizable. There are certainly cost synergies by sharing these programmatic pipes across the board, which really led us to create the Advertising Cloud.

What is the Advertising Cloud?

TV: There are lots of point solutions available but there is no end-to-end, fully integrated platform that does everything a marketer needs to do. They need to work with between five and 15 different companies to try and solve this digital advertising dilemma, so we’ve been at work for 15 years putting together a lot of these assets.

Is this a response to the emergence of numerous clouds and unified platforms in the market?

TV: We never do anything in response to competition. Linking digital ad exposure to in-store sales takes registration data. A big portion of the MySpace acquisition in 2011 was focused on that. Then you’ve got to build technology natively and integrate it, so it took many years to bring this to fruition. It’s hard to bucket a single competitor.

How is your cloud different?

TV: What’s missing today in the ad stack is the IMP, or identity-management platform. Data-management platforms exist today but a DMP is based on third-party anonymous cookies. The IMP is based on actual consumers and prospects based on who they are. The IMP does the following: First, onboarding, so a similar capability to LiveRamp, where we take an email or name in a database and turn it into an actionable device ID where you can message that consumer when you’re ready.

Second, all touch points flow into it. If you think of a website visit, an ad exposure, the use of a mobile app or past in-store purchases, all of that data exists and sits within that identity-management platform. Then you’ve got to be able to do lookalike modeling, actalike modeling or whatever the prerogative is for the campaign and maintain a flexible, open architecture. We’re partnered with 50-plus companies today, different DMPs and DSPs, because everyone’s using someone already.

Do you have access to first-party data?

CHRIS VANDERHOOK: We have our own first-party data through our acquisition of MySpace, so 1 billion registered user profiles, as well as a strong network of partnerships. The important part is real synthesis between real people’s names, real people and device IDs and no one’s been able to create that translation layer.

Are you still happy you bought MySpace?

CV AND TV: Yes.

CV: MySpace has a connotation right next to Facebook in terms of size and scale. We didn’t want to try and relaunch the social network aspect to go head-to-head with Facebook. That time had passed. We were really focusing around the music and entertainment side, a younger demo and the content.

TV: With the MySpace acquisition, we were privy to a lot of data that a lot of industry insiders would love to get at and when we look at how many videos were uploaded to MySpace even today, tens of thousands of pieces of video. Long form content 15 minutes and above are uploaded. There’s no doubt Facebook will be a huge player in user-generated video. It’s an easy place to upload, share and distribute as long as they get the tool set right, which I’m sure they will.

Is Advertising Cloud a suite sale or can clients license individual components?

TV: You can tap this end-to-end, but it’s all componentized. You can use the ones you want and forgo the ones you don’t want. You pay for it on a usage basis, and there’s no media sale. Of course, they can buy media through our media execution platform, but this is a technology sale.

What does your media execution platform look like?

TV: We can ship it to one of 50 companies we’re integrated with, or you can use the Viant Media Execution Platform (MEP). The MEP is multiformat and it runs display, video and audio; multidevice, across smartphones, tablets, desktop and connected TV, all third-party ad serving. Audience-based buying is only a percentage of the buy and it always will be. You are still going to have a buy with ESPN and CBS, so all that data needs to flow into an ad server to measure ROI across those partners.

The other part is the quality verification and viewability. We launched Adtricity under Vindico and we’re now making that technology in the cloud available for everyone to use, not just video. This is critical at the impression level because if an ad is not seen, it can’t have an impact online or in-store.

Do you have a DSP?

CV: There’s a brand-new DSP included in the MEP. Focusing a DSP on just a format or channel doesn’t solve any marketer’s problem. You can use it to activate and execute media buys, but you’re not getting that singular customer view every marketer wants. Because of cookie deletion, cookie-based platforms can’t find individuals [in CRM or first-party platform matches] with a high percentage. The decay rate of active cookies is so fast, we find oftentimes they come back and re-up within a week with another cookie dump.

TV: I don’t see a lot of value in purchasing raw impressions anymore. I see value in buying audiences and, specifically, focusing on past customers to drive repeat business and then acquiring new customers to drive new business.

Will the rebrand change the way Vindico, MySpace and Specific operate or are they autonomous?

TV: Vindico, MySpace and Specific continue to live on under their brand names. Those entities will use components of the Ad Cloud to help strengthen their offerings. Specific Media will be very strong in cross-device this year, and we’ve done a version of cross-device with householding, which has done well for us but we’re moving toward the logged-in, deterministic cross-device. They’re using the Viant IMP for that.

Will you buy a cross-device company to improve your mobile offerings?

TV: Most are probabilistic, which we feel are inaccurate methods of doing cross-device. Generally, logged-in, registered users is the most accurate way to do it. A lot of companies are fast and loose where it’s all about marketing, less about technology, so we’re always acquisitive but the strategy is usually long-term. We’re not looking to pick companies up just to compete in 2015.

Where’s Viant a year from now?

CV: This market turns away from proxies and it moves all into return on ad spend. That’s how it was in 1999 when we started. Everything you did was determined by what you gave back to the advertiser. We had this saying, “what have you done for me lately?” because that’s how clients treated you. The second you stopped delivering return, that’s the second they stopped buying from you.