Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

NBCU Later

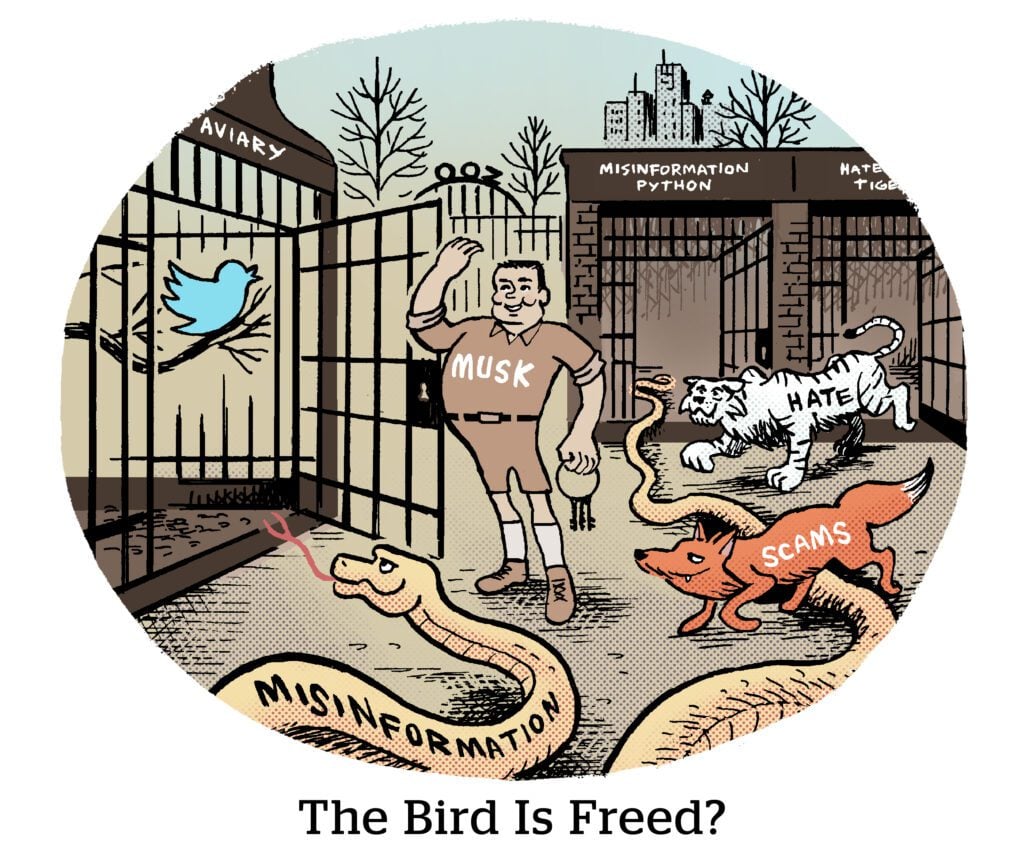

Linda Yaccarino, NBCU’s (now former) chair of global advertising, is leaving the broadcasting giant to become Twitter’s new CEO.

The news was confirmed in a tweet by Elon Musk, who will be stepping down as CEO within the next six weeks. He’ll continue on as executive chair and CTO, overseeing product design, software development and system operations.

Yaccarino has deep connections in the advertising industry and is a strong choice to revive Twitter’s flagging ad business – assuming Musk stays out of her way, says Lou Paskalis, chief strategy officer at Ad Fontes Media, in conversion with Vox.

Despite complaints from Musk’s fanboys about Yaccarino’s mainstream media bona fides and her involvement with the World Economic Forum, sources say she’s ideologically aligned with Musk’s conservative political slant. However, it’s doubtful that a longtime advertising executive will adhere to Musk’s “free speech absolutist” stance when it comes to brand safety.

On the policy front, it’s unclear how much power Yaccarino will have in her new role. Twitter is now a private company, and Musk will still likely exert a large degree of control over its direction.

Musk “is running product and technology for a 100% software company,” says Jason Goldman, Twitter’s former head of product. “What is the CEO in charge of: not paying the vendors?”

Cold Feet

Netflix has canceled its in-person upfront event.

Last week, the streamer told its clients that its upfront will be fully virtual, Ad Age reports.

Netflix is said to be concerned about its upfronts being disrupted by protests planned for next week in New York related to the ongoing Writers Guild of America strike. But the writers’ strike is entering its third week, and other programmers aren’t pulling the plug on their upfront shows.

Netflix’s reasoning aside, the last-minute switch-up before an upfront isn’t giving advertisers any more confidence about Netflix as a viable media partner.

The decision to scrap its live upfront is the latest “rookie move” from Netflix, a media buyer told Ad Age, noting the streamer’s lack of precise ad targeting capabilities that buyers can find on most other streaming services. Sure, Netflix is brand new to ads, but TV advertisers accustomed to digital-like targeting can only be patient for so long.

Plus, some buyers seem to think Netflix is intentionally keeping its new ad sales team behind closed doors.

It remains to be seen whether these concerns will have a real impact on how much ad buyers end up spending on Netflix this year.

Hey, Big Spenders

Usually, we talk about advertisers spending on social media platforms. But social platforms also have paid media plans to promote themselves.

Social media players devoted more dollars to digital media in 2022 than in 2021, but they deployed a variety of strategies for allocating their US ad spend, Adweek reports.

In 2022, YouTube and Snapchat actually increased spend on traditional advertising channels, including print and linear TV, according to data from Vivvix and Pathmatics. Pinterest was unusually enamored by the silver screen, with a third of its ad budget going to movie theaters.

Twitter increased its OOH spending from 7% of its digital ad budget in 2021 to 29% in 2022 as the pandemic eased and foot traffic in public areas recovered. TikTok shrank paid social from 74% of its budget in 2021 to a paltry 3% in 2022. And Snapchat ramped up its search spending from 7% in 2021 to 47% in 2022.

Overall, YouTube spent the most on ads in 2022, followed by LinkedIn, Facebook, TikTok and Pinterest. Pinterest was a new entry to the top five highest-spending social platforms, knocking out Snapchat, which ranked fifth in 2021.

But Wait, There’s More!

Publishers call on ad tech vendors to stop selling their contextual data without compensation. Whether it’ll happen is a different story. [Digiday]

Paramount-owned BET+ sets out to launch an ad-supported tier. [MediaPost]

Ben Affleck has a plan for a fairer streaming world. [Wired]

Twitter Blue has an unlikely beneficiary: sex workers. [The Verge]

You’re Hired!

Extreme Reach poaches its new CEO Louisa Wong from WPP-owned Wavemaker. [release]

IPG-owned UM restructures its c-suite with new hires Grant Ogburn, Myia Thompkins, Preston Larson and Brendon Volpe, in addition to promoting Erin Quintana and Jennifer Wadeyka. [Ad Age]