While Google claimed advertisers are returning to YouTube, new data from Standard Media Index reveals advertisers really did tighten their purse strings after the video platform’s brand safety scare.

YouTube ad spend declined about 26% YoY in Q2, while ad spend spread across digital video platforms such as Hulu or network-owned video services, in comparison, increased by about 18% YoY in Q2.

(SMI’s data comes directly from media bookings and represents about 70% of all US ad agency spend. SMI mostly tracks inventory booked directly by agencies, so it doesn’t capture all pockets of YouTube inventory sold programmatically.)

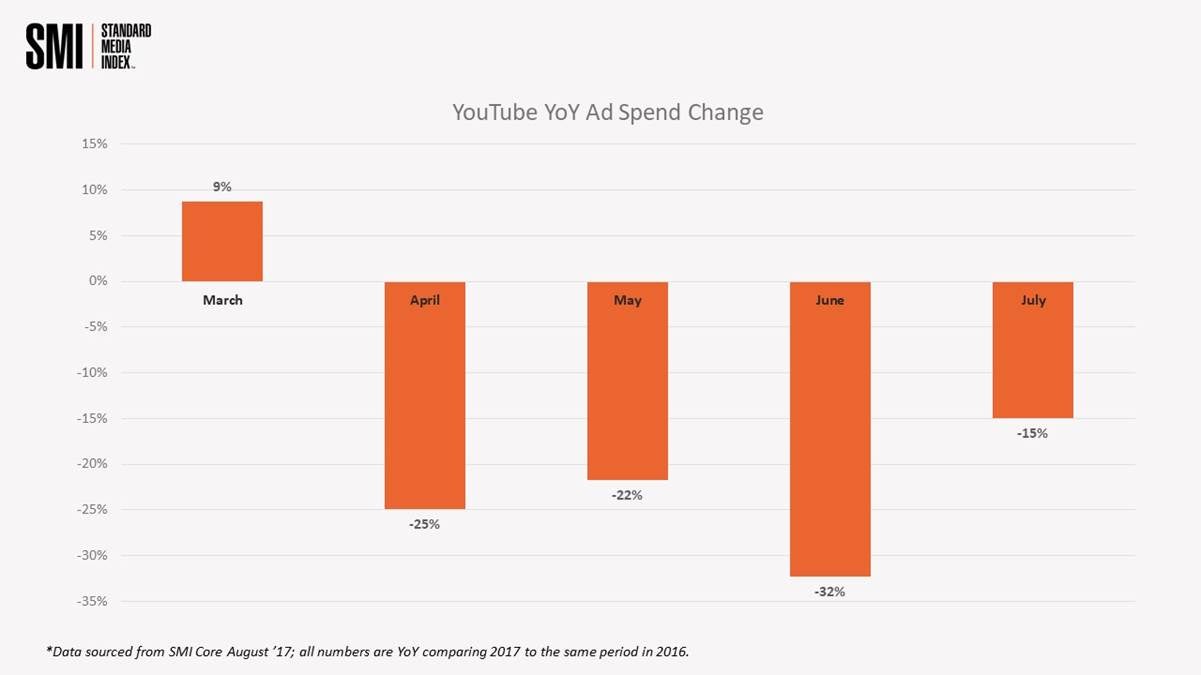

Here’s the timeline:

Direct YouTube ad spend increased 9% in March, according to SMI data.

But late March and early April is when large advertisers like AT&T and Verizon (which has since reinvested in Google) started to pull spend in light of YouTube’s brand safety snafu.

YouTube direct ad spend decreased 25% YoY in April, followed by a 22% decline YoY in May and 32% YoY decrease in June, according to SMI.

Then, YouTube saw a 15% decrease in direct ad spend in July, according to SMI.

These declines show that despite Google’s efforts to improve brand safety controls, the road to regaining the confidence of larger brands could be slow.

Although it’s unclear whether brand advertisers shifted their YouTube dollars to new channels or if they just hit pause, in recent weeks big spenders like P&G and Unilever reinvested digital ad spend into national TV.

Others may have moved money into pure-play video properties like Hulu, which clocked a 29% increase in ad spend in Q2, according to SMI.

Some of these shifts in ad spend may be due to seasonality, given the fact that the TV upfronts fall during the time measured.

But SMI CEO James Fennessy notes that concerns over inventory quality in the digital space are a big contributing factor.

“As [TV] networks strengthen their digital offerings and brands continue to question viewability,” he said, it could come “at the expense of non-premium digital video.”

But despite big brands shifting dollars into linear TV of late, it’s by no means a doomsday scenario for digital, which is still growing at a faster rate than television.

In July, digital ad spend grew 19% YoY, while radio increased 22%. National TV spend was up 2.5%, while out-of-home grew 2.5% YoY.

SMI declined to release dollar figures for its digital findings because its data is aggregated directly from media buying invoices and covers only 70% of the market.

While a lot of inventory is transacted programmatically or through self-serve, SMI claims its data is a good barometer for how larger brands are spending their ad dollars via their ad agency. Google does not break out YouTube revenue.

Correction: SMI’s reporting covers about 70% of US agency ad spend. An earlier version of the story cited 80%.