Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Don’t Label Me

Canada is coming for digital platforms like YouTube, TikTok, Spotify and Netflix with legislation that requires the services to feature Canadian content in country.

The new law extends regulations already in place for domestic TV and radio stations to abide by Canadian content quotas. But, counterintuitively, the law faces resistance from many Canadian creators and producers, The Wall Street Journal reports.

“I prefer not to be certified as Canadian,” says TikToker Oorbee Roy of Toronto. She and other Canadian creators worry people won’t engage as much with their content if it comes with a Canadian label, especially if algorithms serve it up to people solely because it’s Canadian and not because it interests them.

Also, what qualifies content as “Canadian enough” under the current point system can be baffling. For instance, “Turning Red,” though it takes place in Toronto and was directed and produced in Canada by Canadians, doesn’t count as Canadian because Disney owns the rights to the animated film.

Canada’s not the only nation imposing domestic programming minimums. Australia is also introducing local content quotas in mid-2024.

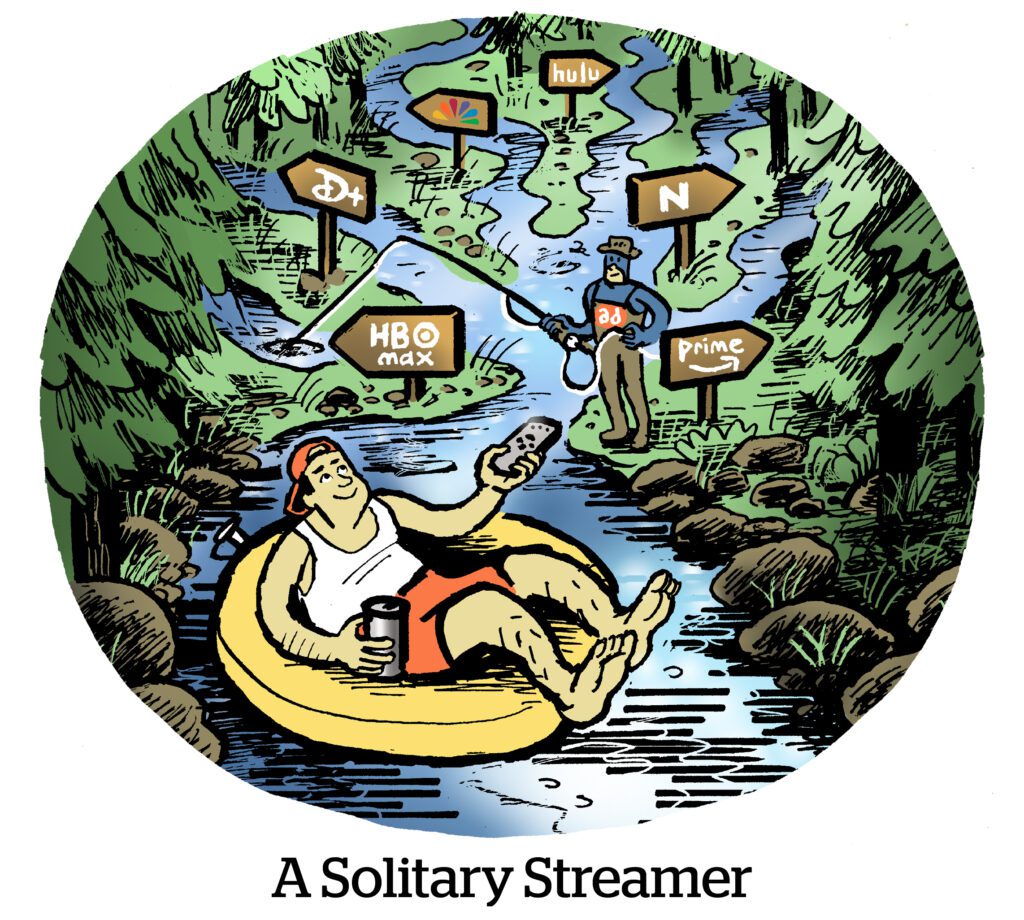

Stream Work Makes The Dream Work

Traditional entertainment studios reacted to the pandemic and the simultaneous surge of streaming viewership by taking on a walled garden approach. They secured as much of their own IP as they could and made movies and shows exclusive to their services rather than licensing to Netflix, Amazon Prime, HBO, et al.

But the pendulum is swinging back, Bloomberg reports.

Disney, NBCUniversal, Paramount and that whole crowd remain unprofitable with their streaming ventures now that the initial burst of sign-ups has slowed. Not to mention that we’re in a down economy and Hollywood is bracing for another potential writer’s strike.

And so studios are rediscovering theaters. Even with a little historical perspective, it’s clear that cinemas don’t cannibalize streaming viewership. Ticket sales can actually catalyze streaming with word of mouth. The Pixar film “Encanto,” the No. 1 streaming hit of 2022, was initially considered a major bust after its theatrical run.

And studios are also embracing syndication deals. Rather than hoard content behind one subscription, why not syndicate content to Netflix or Amazon as a way to gain wider distribution?

Netflix says it won’t syndicate but may release a free, ad-supported channel akin to Pluto, Tubi or Amazon’s Freevee. To each their own.

Ridesharing The Cloud

Uber has decided to shift to cloud-based app development rather than use its own data center servers, The Wall Street Journal reports.

The two winners are Google Cloud Platform and Oracle, which will split the account load.

The news may not seem relevant to AdExchanger readers, but, on reflection, neatly encapsulates how ad tech and data services are moving to the cloud and how big ad platforms (primarily Google, but also Amazon) use the ubiquity of their ad businesses to cross-pollinate services.

Uber, for instance, isn’t just committing to a Google Cloud account. The deal bundles in Google’s mapping services and Google’s ad tech, which is an effective add-on in this case since Uber is investing heavily in a new advertising business of its own.

The deal should also free up engineering resources. Uber could default to some Google ad products instead of building its own stuff.

Engineers also won’t have to tend to their own data centers. Instead, those developers can focus on the app and “areas that make differentiation for our product,” says Kamran Zargahi, Uber’s senior director of technology strategy.

But Wait, There’s More!

For the first time, Amazon’s cut of the average vendor sale on Amazon is above 50%. [Bloomberg]

Meta Chief Business Officer Marne Levine is leaving the company after 13 years. [release]

“Fundamentally, the SSP business is not very attractive”: The fallout of ad tech’s latest closures. [Digiday]

Netflix is refunding Australian advertisers after failing to meet projected audience numbers for advertising subscriptions. [The Drum]

You’re Hired!

Ryan Calabrese joins Semcasting as VP of business development, health care, pharma and financial services. [post]

Creative agency Los York hires former Snapchat and Uber exec Nicole Taylor as VP of business development. [MediaPost]