Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Shake-Up At Nielsen

Nielsen just can’t catch a break.

First, Nielsen lost its MRC accreditation. Now the company is undergoing a massive reorg – and some industry folks are worried Nielsen might miss a very important deadline. Nielsen’s revamped measurement platform, Nielsen ONE, is set to go live this month.

Five of nine senior group managers are leaving the company, including Maniak Mazumdar, Nielsen’s chief data and research officer and … head of Nielsen ONE. Well, former.

The departures come at a difficult time for Nielsen, which is struggling to regain its footing as the de facto TV measurement service.

Still, CEO David Kenny tells Ad Age he’s confident that splitting Nielsen into separate data and research teams – audience measurement, analytics and Gracenote/ACR – will make the company’s measurement quality more precise and put Nielsen in a better position to reclaim its MRC accreditation.

Nielsen is working to replace the executives who left. Pete Doe, formerly head of research at Xandr, will become chief research officer of Nielsen Audience Measurement.

Here’s hoping broadcasters and advertisers awaiting Nielsen ONE’s general release don’t have to wait any longer than expected.

Duopoly Down?

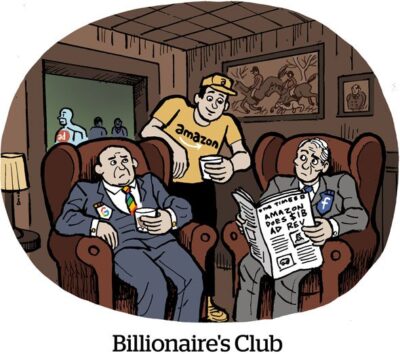

For the first time since 2014, Google and Meta’s share of total digital ad spend has dropped below 50%, Axios reports, citing research by Insider Intelligence.

This year, the duopoly will account for a measly (ha) 48.4% of US digital ad revenue, a roughly six-point drop from their combined peak in 2017, and renewed antitrust scrutiny makes it difficult for either company to claw back market share through acquisitions.

Although Google and Meta are both facing more competition for ad dollars on multiple fronts, Amazon, which now has a $30 billion ad business, is their biggest rival. By 2024, Amazon is projected to pull 12.7% of US ad spend, compared with Meta’s projected 17.9% share. (The triopoly is nigh.)

The CTV category is also gobbling up ad dollars as marketers shift spend away from linear TV, not to mention the rise of TikTok, which is a more distant challenger but the duopoly’s fastest-growing threat.

TikTok is expected to draw $8.6 billion in ad revenue by 2024, which would make it the fifth largest ad platform in the US, after Google, Meta, Amazon and Microsoft-owned LinkedIn. Guess it’s good to be popular with the youngs. TikTok also threatens Google’s search dominance and Meta’s social dominance because it’s become the go-to youth choice for search and social.

Before PMax, There Was AC

Performance Max may be the blackest black box in Google’s advertising portfolio – and the fastest growing – but it wasn’t Google’s first time putting machine learning in charge of ad budgets with no controls or oversight. That would be App Campaigns (AC), which takes the same approach but focuses on app install campaigns and AdMob inventory (aka long-tail apps).

“Everyone in the mobile apps space saw the PMax stuff coming from a mile away,” Adam Lovallo, founder of the digital agency Thesis, tells Adweek.

AC frustrates advertisers primarily because Google taps into Play store search queries to convert on cheap in-app inventory that most brands wouldn’t want to associate with. But also annoying is the fact that developers don’t have control over keywords, which means Google might be taking credit for organic installs, like when users search for an app by name.

Like PMax, App Campaigns isn’t a privacy product and it’s not an ATT fix. Google is putting machine learning in charge because it’s good for business.

And it’s also good for Google.

Google keeps the data about where ads have run to itself, because if advertisers got to see placement breakouts, products like AC and PMax would no longer function. No, not because they’d break – because advertisers would pull budgets or insist on better controls.

But Wait, There’s More!

TikTok’s new feature will tell you why a particular video appeared in your For You feed. [TechCrunch]

The internet is Kmart now. [The Atlantic]

Doing Things Media plans to acquire social media content brand Overheard. [Axios]

Kim Masters on Hollywood’s year of wishful thinking. [THR]

Paramount scraps its long-running traditional TV upfronts presentation. [Variety]

You’re Hired!

SafeGuard privacy names Rachel Walkden as COO and Jared Combs as VP of sales. [release]

Nate Rackiewicz joins Reset Digital as chief data officer. [release]