Yahoo’s ad stack had been under a microscope, as CEO Marissa Mayer sought ways to appease shareholders and prove she had reached “parity” at last with competing ad tech stacks.

Yahoo’s ad stack had been under a microscope, as CEO Marissa Mayer sought ways to appease shareholders and prove she had reached “parity” at last with competing ad tech stacks.

On Tuesday, Yahoo’s announcement that it would acquire video demand-side platform (DSP) BrightRoll for $640 million enhanced this portfolio.

“We now have scale with Flurry and their mobile assets, BrightRoll’s video assets and Yahoo Gemini’s technology and native marketplace,” Yahoo’s SVP of advertising technology Scott Burke told AdExchanger.

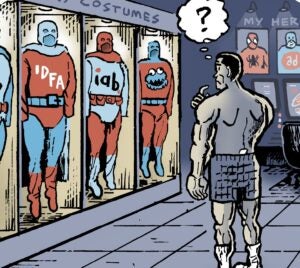

Burke stopped short of calling the tech stack a platform, though he said one imperative for Yahoo’s ads division and new ad chief Lisa Utzschneider is helping marketers determine the efficacy of cross-channel spend and to unlock more value with less tools.

“Advertisers and agencies can buy things like [search, display, video, mobile social] from other players, but nobody else can determine when you run a campaign on Tumblr, what is the impact on search behavior?” he said.

With BrightRoll, Yahoo gets a video network that has a DSP, an SSP and an exchange. BrightRoll’s $1o0 million in net revenue this year, will be accretive to Yahoo once the deal closes.

More than one-third of BrightRoll’s supply is mobile inventory, and the company has inked a number of third-party integrations with eXelate, Verizon’s Precision Market Insights and Oracle’s BlueKai. BrightRoll also had a preexisting integration to Google’s AdX, for automated bidding on YouTube inventory.

“Depending on which part of our business you look at, we tried to independently create differentiation in our sets and sources of data and features and functionality,” said BrightRoll CEO Tod Sacerdoti, who will work at Yahoo to increase its share of video content and ad revenue.

“[BrightRoll] fills a video-size hole in [Yahoo’s] stack,” said Martin Kihn, digital marketing analyst at Gartner. “However, strategically it isn’t too exciting. The…strategy seems to be, ‘What did AOL do last year? That’s what I’ll do! It’d be interesting if they moved the other way in the value chain – acquiring a content company like A+E.”

At the very least, the deal helps Yahoo “keep its ad technology relevant,” said Forrester principal analyst Jim Nail. “[Digital video] will be the dominant ad format by 2016, and larger than rich media and static banners combined by 2018.”

Yahoo and BrightRoll’s relationship dates back to 2006, when Yahoo used BrightRoll’s DSP to buy video inventory. Following the acquisition, Burke said Yahoo’s demand sources will connect with BrightRoll’s supply and vice versa.

“This will augment our owned and operated monetization because [BrightRoll] has a great DSP and advertiser relationships,” Burke said. “We want to be a better partner for Kellogg’s and P&G and all the premium advertisers and agencies. …They’re looking for fewer, larger, more strategic partnerships today and this evolves us in that position there.”

Although Burke said it was premature to discuss integration and how specifically BrightRoll will operate within the Yahoo tech ecosystem (remember – Yahoo “sunset” or, more applicably, rolled the assets of Right Media exchange and data management play Genome into the Yahoo Advertising fold last January), he said interoperability between Yahoo’s mobile, desktop, smart TV, and video assets helped spur the acquisition. Yahoo wants to drive performance in native contexts across mobile and video at “huge scale,” Burke said.

Yahoo has also piloted ways to measure the “downstream effects” of TV and video-streaming content consumption on Yahoo Screen for advertisers. Yahoo’s purchase of mobile ad marketplace Flurry brings to the table app usage data, which coupled with digital video and smart TV app data, could generate more finely tuned targets for marketers who are trying to reach certain subsets and categories of people, Burke said.

Another driver in the acquisition was the intent to build its off-network reach. While Burke cited such owned-and-operated strengths as Live Nation and Yahoo Originals as Yahoo’s historic “sweet spot,” he acknowledged Yahoo hadn’t developed a mature network and programmatic business to complement its video and music assets. “We decided the strategic fit was to plug in BrightRoll,” he added.