“How do I deal with uncertainty?”

That was one of the main questions that Nikhil Lai, a senior analyst at Forrester, heard from clients in 2022.

“The world right now is volatile,” Lai said. “It’s uncertain. It’s complex.”

All signs point to an equally dizzying whirligig in 2023.

“Turbulence is going to be the new norm,” said Jeff Matisoff, a partner at Brandtech Media, the media arm of martech holdco The Brandtech Group.

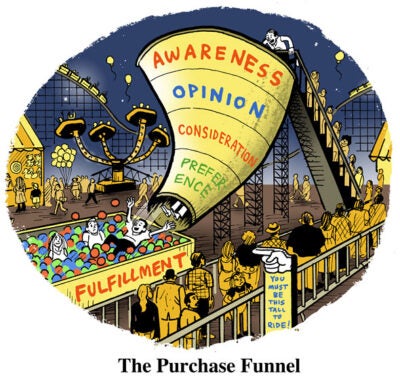

Marketers are simultaneously hustling to satisfy quickly changing consumer appetites and striving to squeeze the value out of every last marketing dollar. Not to mention needing to adopt full-funnel marketing approaches and allocate spend to channels as flexibly as possible.

Work hard for the money

Brands increasingly want to prove the worth of each dollar.

“What we see with our clients across brand and performance is that every dollar really needs to be held more accountable,” said Sammy Rubin, head of media strategy at digital marketing agency Wpromote. “The name of the game going into 2023 [will] be profitability.”

Profitability and performance.

“We try to talk to our clients about having all budgets be performance budgets,” said Larry Fisher, CEO of performance agency Rise Interactive.

And brands have been receptive to the message.

The dark cloud of economic unpredictability has inspired marketers to pull back on branding opportunities and other upper-funnel undertakings that don’t directly drive revenue or leads.

“We’ve seen clients be more excited about spending in the mid and upper funnel when there’s data supporting the downstream impacts of those dollars,” said Natalie Scherer, SVP of marketing at Rise Interactive.

Amazon Marketing Cloud, for instance, allows clients to gauge whether customers who see top-of-funnel display placements on Amazon have a “higher propensity to buy later on,” Scherer said.

Integration is the name of the game

But branding vs. performance is a “false choice,” said Lai.

“There’s no longer a distinction between brand and performance channels or brand and performance tactics,” he said. “It’s all marketing.”

Although distinct strategies still exist across brand and performance, “marketing executives are shifting their organizations to focus more on that integrated full funnel,” Rubin said.

And nowhere is the collapse of the funnel more apparent than in social. “The line between first brand exposure and conversion, depending on the industry or the product category, can be pretty instantaneous,” she said.

But while platforms like Meta allow marketers to run full-funnel campaigns “virtually all in one place,” Rubin said, “there’s a need for diversification, and we started to see that in 2022.”

As the world turns, budgets have to budge

Diversification is always a good strategy in the face of economic uncertainty.

A Forrester report from November found that 85% of global B2C marketers are shifting their marketing strategies to ready themselves for the effects of inflation in 2023.

Seventy-one percent said they’re focused on reducing unnecessary marketing spend, 68% on consolidating marketing efforts to their most impactful channels and 67% on bringing outsourced technologies or services in-house.

But modifying marketing plans doesn’t always mean cutting costs. Despite the macroeconomic climate, Lai said marketing executives are planning to increase their paid media budgets across the board in 2023. Paid search, retail media and online video are seeing the biggest budgetary bumps, while social is growing more slowly.

An economic downturn, paradoxically, can be a good time to invest in upper-funnel marketing, including TV, out-of-home and direct mail, Lai said.

“Awareness-generating media helps you gain share of voice and maintain your voice when other folks might be pulling back,” he said. “It’s less expensive to gain share of voice [and] build pent-up demand during a downturn that you can then harvest once demand bounces back.”

Brands that maintain high visibility during a recession engender greater goodwill and brand loyalty among consumers, according to Forrester’s research.

“Eighty-six percent of consumers said that when they see a company during a recession, it keeps that company top of mind when making purchasing decisions and makes them feel positive about the company’s commitment to its products and employees,” Lai said.

Changing channels

But there’s no one method for staying top of mind.

From a channel perspective, although social is expected to grow more slowly overall, brands will continue to increase their investment,” said Wpromote’s Rubin, who also predicts an “influencer boom and acceleration.”

And you can’t talk about social without talking about TikTok, which will remain “a strong channel in 2023, so long as CPMs remain efficient,” said Paul Kasamias, managing partner of performance at Starcom.

“TikTok continues to grow in the double digits,” Kasamias said. “This will improve, especially as measurement of business outcomes improves.”

Search is also in a good position for growth, Lai said, because it’s “most invulnerable to data replication and to macroeconomic uncertainties.”

Retail media, however, is “due for a reckoning,” he said, and CTV, although a “bona fide growth channel,” is “becoming as fragmented as cable,” with unduplicated, incremental audiences that are increasingly difficult to reach.

Yet CTV will continue attracting marketing investment in 2023, as will programmatic out of home, according to Rob Davis, president and chief marketing officer at media planning and buying agency Novus Media.

But Rubin is also betting on podcast advertising, because podcast listeners are attentive and actively interested in the content they’re consuming. Podcast advertising saw tremendous growth in 2022, per the IAB and PwC’s US Podcast Advertising Revenue Study and eMarketer’s US Podcast Advertising 2022 report. And growth is only expected to accelerate further in 2023 as measurability increases.

Overall, though, most agencies are moving away from a channel-based approach.

“We’re really focused on an audience-first strategy of understanding where the audience goes and then providing the media against any channel that fits that mold, whether it’s online or offline,” Rise Interactive’s Fisher said.

And clients have more choices than ever in terms of where to advertise, so they need an “intentional strategy” across platforms like TikTok, CTV and Instagram Reels, according to Rise’s Scherer.

Leaning into just one or two social platforms will lead to diminishing returns, Rubin said, which is why diversifying budgets will be key for brands in 2023.

“There might be really unique ways for your brand to come to life that you wouldn’t necessarily know about unless you’re spending time in those environments,” she said.