It takes a village to raise the profile of a global media agency.

To better service clients – and help with their own bottom line – some media agencies, including Havas Media Network (HMN), are placing more weight on providing services that are more specific to particular client needs.

Three years ago, HMN pushed more heavily into diversified services, according to Global Chief Operating Officer Jorge Irizar, including data and technology, ecommerce and Havas Play, which aims to “connect brands with communities, based on their passions, through content” and spans areas like influencer marketing, events, social media, sports and branded entertainment.

HMN is also looking to scale its B2B-specific service, which launched in 2022.

“It’s all about top-line growth,” Irizar said, both for the specialty services themselves and for Havas as a whole, which has an “ambitious” two-digit financial growth target this year.

To support those growth goals, HMN rejiggered its leadership earlier this month.

Irizar kept his title, but his role expanded and shifted focus. While he’s still in charge of HMN’s tech stack, called Converged, and of Mx (which stands for “media experience”), its media planning system, he’s now also tasked with growing specialty units and overseeing HMN’s Centers of Excellence. The latter provide specialized expertise to clients around the world, including in India, Spain, Colombia and Peru, with an emphasis on cost efficiency and consistency.

These changes were necessary because HMN’s core media strategy, planning, trading, optimization and reporting business is getting tougher and more complicated, said Irizar, who’s worked at Havas for nearly 25 years.

“The media landscape has changed drastically,” he said, and Havas has had to do the same.

Irizar spoke with AdExchanger.

AdExchanger: How important is media for HMN’s specialized offerings?

JORGE IRIZAR: Media is important – we measure the impact of media and have media to optimize campaigns – but it’s a fraction of the proposition.

Media is 20% to 25% of the total revenue we generate with Havas Market, our ecommerce offering.

Do you handle logistics or shipping?

We don’t have proprietary warehouses, but we have a set of partners. We can deliver logistics to our clients through third parties, Amazon or different marketplaces or directly with Bolloré [the main shareholder of Havas parent Vivendi].

We are agnostic when we work on data and technology, Market and Play. We don’t want to own data and we tend to rent technology. We’re not committed to a single partner or technology. We think it’s the best way to optimize in a network of 60-plus countries. There’s not one technology that will fit all, and we need to try to work with the best in your region.

What do you think of social commerce?

We were early adopters of TikTok Shop and Pinterest. We’re strong in the US and China on live shopping. Most of our ad dollars are focused on lower funnel. Havas Market is connected with our social media teams to move from engagement and performance to social commerce and sales.

How about shoppable ads?

We haven’t seen meaningful growth for upper-funnel and mid-funnel branded ad campaigns. Television [spend] is down because clients are more focused on sales in ecommerce.

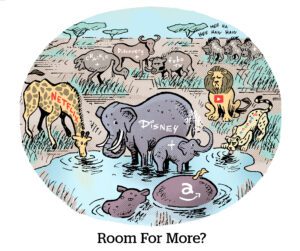

As people move from linear television to CTV, the challenge is that more players in the CTV arena are fighting for dollars, but the dollars aren’t growing.

It’s hard to steal a dollar from ecommerce because, for social commerce, you’re paying between a $4 and max $8 CPM. When you go on Netflix, you’re paying $35, $40 CPMs. It’s too expensive.

Amazon has a DSP, special product capabilities and a strong salesforce. If someone can succeed on this connection between CTV and lower funnel and ecommerce, it will be Amazon. But it’s not an easy win.

What do you think about Vivendi potentially spinning off Havas?

It’s a realistic possibility.

Would Havas be OK as a standalone company?

It’s a way for Havas to attract more investment and have a stronger position in the marketplace. It’s positive for acquisitions, for growth.

What do you have your eye on acquiring?

We’re super focused on four kinds of companies: One is pure ecommerce companies, and second is digital performance companies, which is a combination of performance and ecommerce.

Another bucket is all about content activation in social media, live shopping and influence marketing. And then there’s data. In an emerging market like India, for example, we might look for experts in a specific technology, like an Adobe company or Google company or measurement companies.

How disruptive will the end of third-party cookies be?

It’s going to be a disruption for sure because third-party cookies were a single currency for the marketplace and there is not a single currency moving forward. The market needs to find consistency.

But we are ready for this transition. We’ve run hundreds of campaigns with no third-party cookies already. We’ve been doing it for more than two years, and the campaigns are working fine. The challenge is going to be for the whole market to do it.

This interview has been edited and condensed.