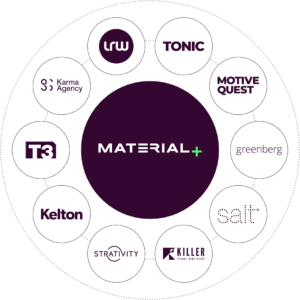

After acquiring 10 agencies in the last four years (and seven in the last two), marketing services firm LRW Group is rebranding to Material.

After acquiring 10 agencies in the last four years (and seven in the last two), marketing services firm LRW Group is rebranding to Material.

Material’s acquisition spree began in 2015, with funding from private equity firm Tailwind Capital. Its purchases include full-service agency T3, customer service agency Strativity and market research firm Kelton.

CEO Dave Sackman, a former marketing exec, wanted to build a full-service marketing consultancy that wasn’t bogged down by silos – in other words, to fix the holding company model.

“So much is lost when moving between silos,” Sackman said. “There’s are so many handoffs, even within clients from department to department, and certainly to agencies.”

To enhance collaboration, Material is organized under a single P&L. The group goes-to-market by practice areas in analytics, media and customer strategy. And it has a full-time team dedicated to pulling together capabilities across the organization to meet specific client needs.

“They frame client problems and pull together the cross-company, cross-capability teams that will endure the length of our relationship,” Sackman said.

Material will sunset its legacy agency brands within the next year and a half and go to market in its specialty areas. That’s unlike traditional holding companies, where different cultures and competing incentives prevent uniting agency teams under a single strategy, Sackman argued.

Material’s work includes mining insights for a holiday season campaign for UPS that evolved into an ongoing annual social content program. The agency also helped convenience store 7-Eleven build the technical capability for its first delivery offering through a partnership with Postmates. And it helped Disney, a client for 30 years, develop its strategy as its moves into the streaming era with Hulu and Disney Plus.

“We did everything from analytics, to consulting, to developing content and a digital loyalty program,” Sackman said. “So many clients have known us predominantly for one or a few capabilities, so now we have the opportunity to give them the full range of what they’re building.”

Material is pinning its growth both on new client acquisition as well as on expanding its responsibilities with existing clients. The agency generally pitches against the big six holding companies and consulting firms for new business, Sackman said.

But Material isn’t the first agency group looking to repair the much-maligned holding company model by providing cross-functional services. The agency will have to create a culture that’s stronger than the sum of its parts so that its employees and clients buy into the model – a challenge holding companies continue to face.

Sackman argues that because Material started acquiring businesses while it was small ($100 million in revenue), it’s in a better position to grow into a collaborative agency model than its holding company peers.

“Holding companies were financially constructed,” Sackman said, “and when they got large, they wanted to create an integrated experience. But there was too much culture clash.”