Fresh, frozen or canned.

Those are your vegetable options – but also how a brand marketer might describe a first-party data vendor pitch or a TikTok influencer video.

For frozen vegetable brand Birds Eye, “fresh, frozen of canned?” is a question it wants customers to ask themselves while doing their grocery shopping.

Birds Eye has a unique vantage point on ecommerce and retail media. The Conagra-owned brand is a century-old grocery store staple, not a DTC or social-native brand. Which means it has resources (both people and ad dollars) but relatively little first-party data.

Not to mention, as a purveyor of frozen food, Birds Eye has category-specific challenges when it comes to navigating ecommerce warehouses and home delivery. Once its products thaw, they’re ruined.

AdExchanger caught up with Birds Eye marketers Alex Birchmeier, Conagra’s senior director of marketing activation, and Lanie Friedman, senior director of content and communications, to talk about the brand’s latest campaign, which spans streaming TV and social video, and its mar tech data strategy.

AdExchanger: Why is your most recent campaign running on streaming and online video, but not TV?

ALEX BIRCHMEIER: We made the pivot a couple years ago from linear television to more streaming and digital video.

We see the decline of viewership on traditional linear, and the prices are still quite high. We also see quite a bit of frequency waste on linear. By controlling the frequency on digital streaming and online video platforms, we’re able to have more efficient reach.

What’s the difference in the timeline and process for CTV and video campaign production compared to a traditional TV ad campaign?

LANIE FRIEDMAN: Agility is the No. 1 difference in the process now. We used to live in a world where it could take four months to create a spot. Now you see creators in the social space who make things in a matter of hours or days.

I don’t think the process has changed much for coming up with the video concept and having alignment on a creative and strategy brief, but the timeline certainly has. [For our current campaigns], once we were aligned [on the concept], social creators had about six weeks to create the spots – which is less than half the time you would have had in the past.

How do you decide which accounts to work with?

FRIEDMAN: We don’t have a stable of people. We choose the right creators based on what we’re trying to accomplish and the messages we’re trying to deliver.

For this campaign, for instance, we have a couple of registered dieticians, there are what you might call “busy parent” accounts, there are college-age influencers, as well as [creators] from the cooking and culinary space. Those are people who can speak credibly and from a scientific perspective about the benefits of flash freezing, say, and motivate their audiences.

Our category is “vegetables,” remember. Not necessarily just “frozen.” So we want to reach as many people as possible to clarify the point of difference and superiority between flash-frozen vegetables that can be better than fresh.

Are the ads shoppable?

BIRCHMEIER: The barriers have come down with the convergence of social commerce and click-to-buy.

Anything social or on YouTube is driving people to shoppable landing pages. We want to make sure whatever way they want to purchase – if it’s possible in their zip code, we can make that happen.

We’re noticing QR codes becoming more of a thing and considered that for our connected TV campaign. We decided against it at this point. But I am curious to see if and when it does make sense to use QR codes to drive to a shoppable page.

How is your ecommerce or home delivery approach impacted by selling a frozen product?

BIRCHMEIER: When we look at ecommerce, we consider three different modalities. There’s warehousing and fulfillment delivery – so your Amazon.com, say – which is limited to our grocery and snacks. You can’t really ship frozen from there. [Editor’s note: Amazon does ship frozen food, but its algorithms downrank frozen items because they tend to melt or thaw in warehouses and delivery trucks, which also leads to bad reviews.]

The other two modalities we look at are quick home delivery – your Instacarts or DoorDashes of the world. And the biggest modality for us is click-and-collect, when someone buys online and picks up at a store.

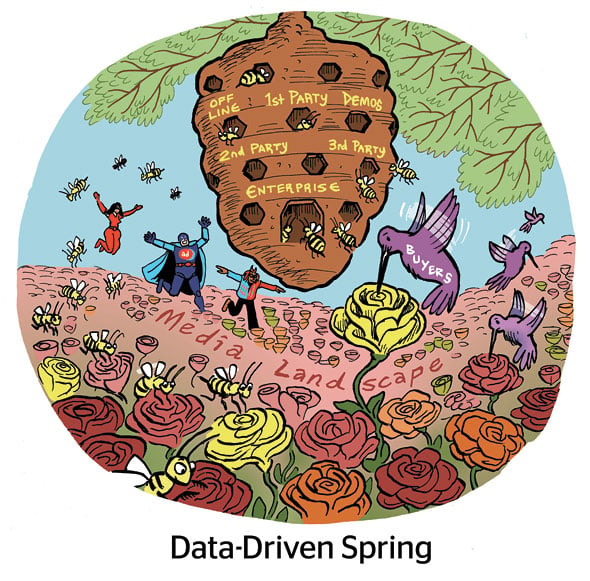

Digital-native and DTC grocery brands have struggled lately, and I wonder whether owning first-party data and the direct customer relationship is as important as people make it out to be, or if there’s been any pushback against the glorification of first-party data?

BIRCHMEIER: We’ve been talking about that a lot, actually, over the last year or so.

The promises of martech personalization, one-to-one marketing and first-party data all sound amazing on the surface. But then you quickly realize that we’re going into a cookieless future where there’s less data available. Cookieless solutions require people on staff to do the work, and the tools cost a lot of money to maintain.

Then, when you actually start deploying the personalized messaging, you see tons of data degradation when you try to target people. You run into ad blockers. You run into privacy concerns by customers.

We’ve actually taken a bit of a step back because the promise of first-party data hasn’t been realized, from our perspective.

What are you prioritizing instead?

BIRCHMEIER: We’re focused on efficiently reaching a lot of people with our message. These are fast-moving purchases, and it’s more important for us to continually build that mental availability for the brand.

There are opportunities for first-party data, but the promise doesn’t necessarily mean you’re going to succeed.

This interview has been edited and condensed.