What do fitness centers and grocery stores have in common?

You can now put more ads there, that’s what.

On Thursday, Yahoo DSP announced new partnerships with Rippl – a co-op of regional grocery and convenience store chains like Wegmans and Giant Eagle – and PF Media, launched by gym franchisor Planet Fitness earlier this year.

Yahoo said these retail media networks will add roughly 70 million grocery shoppers and 20 million gym-goers to its pool of addressable audiences.

More importantly, both retail audiences are made up of verified, first-party data sets, which have more inherent value to marketers as third-party options become scarce and privacy regulations stricter.

Out-of-home advertising

The Planet Fitness media network originally developed out of an existing affiliate marketing perks program for members, which still has anywhere from 50 to 60 brands running at any given time.

Upon its official launch in January, the network already included digital channels through a partnership with LiveRamp and an “out-of-home” component via TVs and other screens throughout its gyms, locker rooms and other physical locations.

“The hard work was already done in terms of the infrastructure and the scale of the member base,” said Justin Unger, senior director of partnerships at Planet Fitness. “So it was on us to enable and operationalize the technology that was already in place.”

Although PF Media is still very much in its early stages, the network has gotten traction across each of its three major channels, he said. In-club offerings in particular have seen noticeable lift in engagement, especially compared to offers that only run across digital channels.

Health, wellness, nutrition and fitness brands are an obvious fit, of course. But Planet Fitness is going broad with the types of advertisers it allows and has already found success with outside verticals like travel, electronics, apparel, meal kits and even food delivery.

The new partnership with Yahoo will widen PF Media’s reach to a larger, more diverse advertiser portfolio, Unger said, and allow it to “figure out how and where the Yahoo kind of advertisers can optimize and enhance their campaigns.”

Retail vs. Commerce

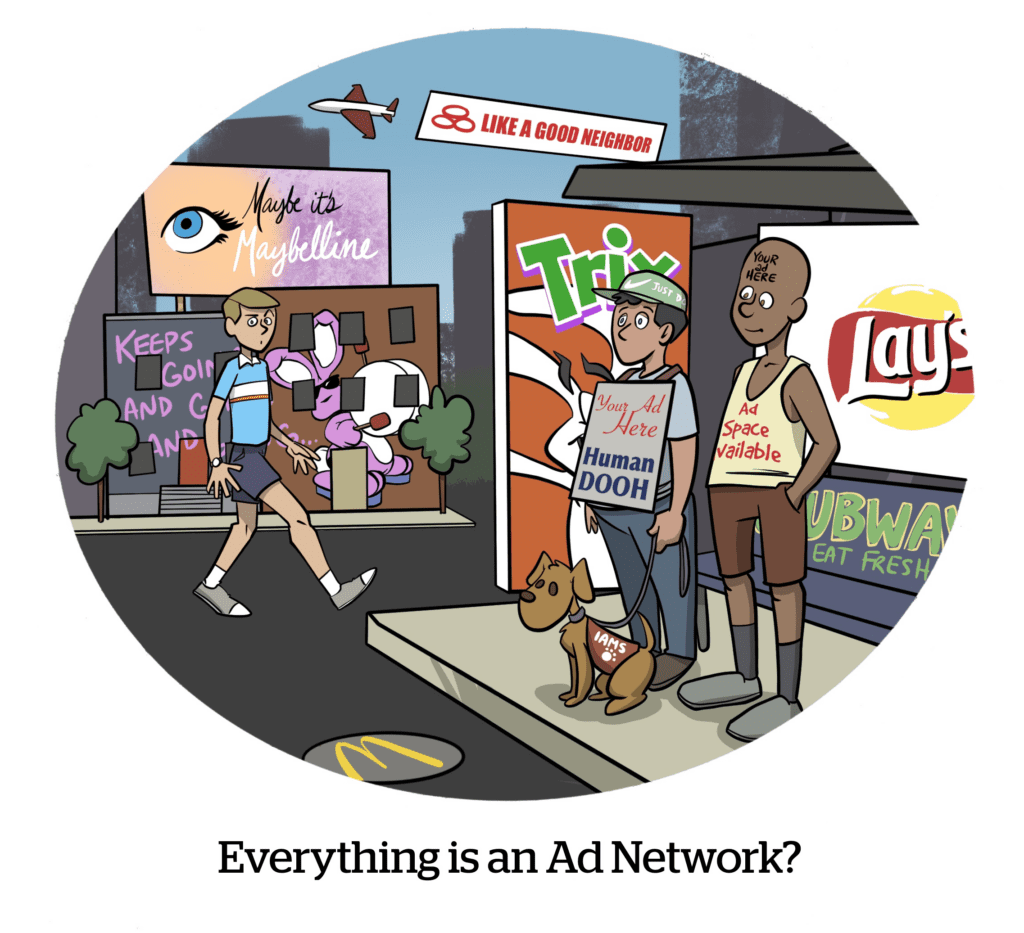

Over the past couple of years, the proliferation of retail media networks – especially among companies that aren’t actually in retail – has become a bit of a running joke in the ad tech world (or at least here at AdExchanger).

But there’s good reason for the trend, said Yahoo Head of Commerce Media Mike Brunick.

In addition to diversifying revenue, these media networks (which Yahoo places squarely in its own “commerce media” category) also offer advertisers something they actually want: addressability.

“These companies are realizing that they can take advantage, particularly with the way privacy and regulation are going, of their own first-party data relationship they have with their customer,” said Brunick.

Stores like the ones in Rippl’s network have additional incentive for advertising partnerships because they actually sell the products being advertised. But brands with unique first-party audiences and access to in-store inventory, like Planet Fitness, can also provide value.

Ultimately, Brunick theorizes that, as first-party data becomes a more essential resource to advertisers, smaller players in RMN categories will begin to consolidate along shared interests and verticals, much in the way regional grocers are continuing to buy into Rippl’s network.

In the meantime, those with data already in hand have a distinct advantage in the marketplace.

“Bringing that data linkage to an advertiser, and being able to demonstrate the ability to bring that again all the way through to the actual ad itself, is a very powerful proposition,” Brunick said. “And I think the more addressable channels will continue to see growth because of that.”