Hey, readers!

In case you were too busy to keep up on CTV trends this week because you’re watching the Olympics or reading up on Google losing the search antitrust case, don’t worry. This week’s CTV roundup has your CTV rundown.

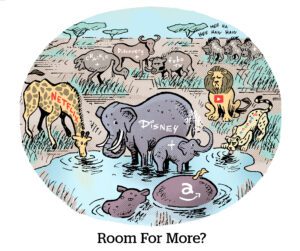

Streaming services are at very different points in their pursuit of profitability.

This week, Disney announced that its combined streaming business (Disney+, Hulu and ESPN+) generated $47 million last quarter and is now profitable one quarter earlier than expected. Disney mostly has ESPN+ to thank – without which Disney reported a $19 million loss for just Disney+ and Hulu. (Disney+ and Hulu are reported as direct-to-consumer, whereas ESPN+ is sports.)

Meanwhile, Netflix’s operating margins grew 5% year-over-year, thanks to ads and ad-supported account growth.

Warner Bros. Discovery (WBD), however, continues to suffer streaming losses, reporting a 5% YOY drop in revenue in Q2. It’s trying to monetize Max amid unprecedented streaming competition while still paying off the remaining debt from Warner Media’s acquisition of Discovery in 2022.

What Disney and WBD have in common, however, is a desire to copy Netflix.

Taking a page from Netflix

Netflix and Disney both say that ad-supported streaming has become a profitable part of their business after launching their respective services at roughly the same time: the end of 2022.

To some degree, this is evidence of maturation running its natural course. Now that both programmers have had ad-supported offerings for around the same amount of time at similar price points, they each have enough scale to start making a profit on subscriptions and ad revenue.

But in order to maintain its growth, Disney is taking a page from Netflix’s book.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

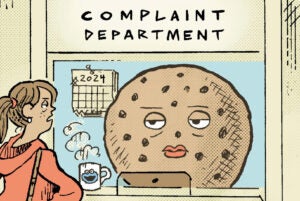

Netflix has been touting the success of its anti-password sharing tactics for over a year, pointing to higher-than-expected subscriber growth numbers as proof. Now, Disney is putting anti-password-sharing enforcement in place, too. The Mouse House started disabling account sharing in June, with plans to ramp up its efforts in September.

Still, enforcing anti-password sharing isn’t easy to get right.

From a business perspective, streamers should focus on scaling subscriber growth for a new service before risking churn in an effort to achieve profitability. (To say that anti-account sharing is unpopular among viewers is an understatement.) So it makes sense that Disney wanted Disney+ to reach a certain level of scale before pursuing anti-password sharing in full force.

WBD, which is losing revenue, is also planning to erect barriers against password sharing. It’s launching in new international markets as quickly as it can, and timing anti-password sharing with global expansion could encourage more sign-ups in new markets.

WBD also just finished rolling out a new content personalization feature for Max’s homepage, which resembles Netflix’s content recommendation system. WBD is also testing a feature to allow viewers to rank titles they “like” or “love,” which may sound like an obvious move – but it’s predicated on tactics that Netflix has been monetizing for years.

My question is: Will Netflix’s competitors yield similar results by using Netflix’s playbook?

Let me know what you think. Hit me up at [email protected].