Despite their dependence on Nielsen, programmers love complaining about the TV ratings titan.

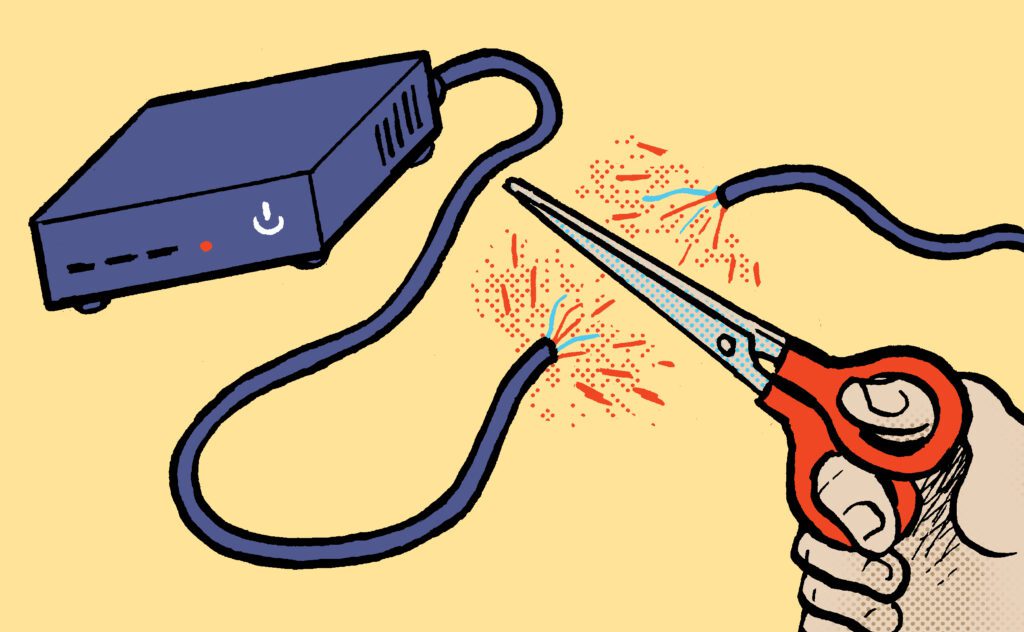

But Paramount Global recently went beyond griping when it announced its contract with Nielsen had lapsed. Now, the broadcaster is relying on VideoAmp for its viewership numbers, which is once again sparking

Paramount’s move represents a serious shake-up because TV publishers that use Nielsen alternatives (like VideoAmp, iSpot and Comscore) typically do so in tandem with Nielsen, which has been the foundation of TV ad measurement for decades. In this case, however, Paramount and Nielsen failed to come to an agreement in time for their contract renewal.

And Paramount has a few bones to pick with Nielsen about how their unsuccessful negotiations went down.

“Nielsen has severed our long-standing measurement partnership with its unacceptable demands, including substantial price increases,” a Paramount spokesperson told AdExchanger in a statement.

Specifically, “Nielsen’s costs as a percentage of Paramount ad revenue have quintupled over significant parts of our business over the last years,” John Halley wrote in a memo to clients. That cost structure “is not workable and needs reengineering.”

A new way to handle TV measurement … or not

Despite the strong sentiment, a break from Nielsen’s services isn’t ideal for Paramount. Advertisers and media buyers have leaned on Nielsen ratings since the 1950s.

“Disengaging from Nielsen is not our first choice, and we remain hopeful for a resolution,” Halley noted in the memo.

Nielsen also expects the two companies to resume doing business together soon. “We look forward to working with Paramount on a new agreement,” Nielsen said in a (far more anodyne) statement.

I mean, how long can a programmer really last without Nielsen?

That question has been spurring a lot of conversations on LinkedIn lately.

On the one hand, Paramount could be a trendsetter.

“If Paramount is able to do business using VideoAmp without [a financial] downside, then other programmers will naturally start considering making the same move,” media measurement vet – and VideoAmp’s former chief measurability officer – Josh Chasin observed on LinkedIn. “This is a critical moment.”

Chasin was commenting on a post written by Marshall Cohen, an industry vet and media and marketing consultant.

Cohen notes that Nielsen keeps its service fees high not simply out of stubbornness, but because its business model doesn’t leave much room for negotiation. If Nielsen lowers its prices for one client, according to Cohen, they have to lower prices for everyone. “This,” he argues, is very difficult with private equity owners, who don’t understand the business [and just] want better returns.”

Still, Cohen writes, it’s likely a renewed contract will – eventually – put an end to the contentious standoff between Paramount and Nielsen.

“Rarely, if ever, does a media company go without Nielsen ratings for very long,” Cohen says.

What I want to know is this: Will the contract dispute inspire other programmers to rely on measurement providers other than Nielsen?

“As we say in the video business,” Cohen writes, “stay tuned.”