IAS’s Two Cents

Integral Ad Science is raising rates on various products by one to three cents per CPM, Adweek reports. The new prices go into effect on November 1.

IAS is juggling a difficult set of pins right now.

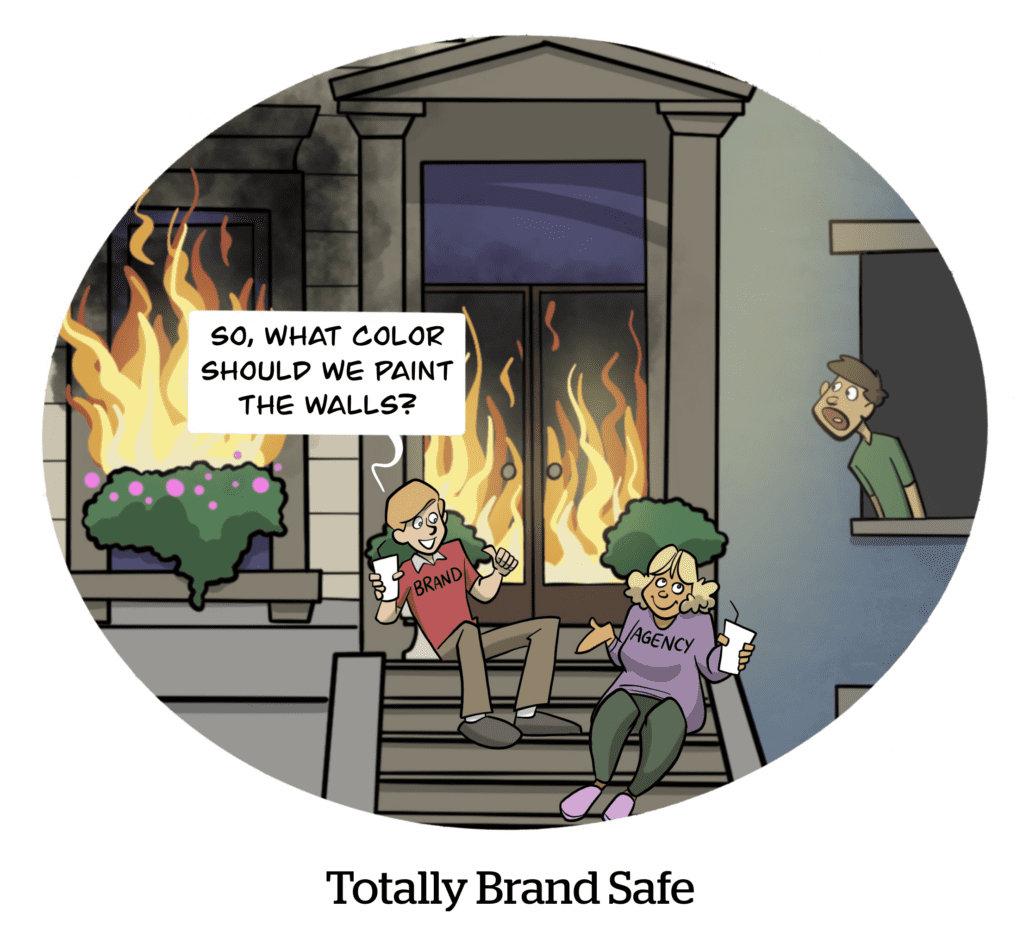

For one, it’s up for sale, according to a Bloomberg report last week. Then there’s the fact publishers are ticked that verification providers have waded into ad serving, targeting and contextual analytics, which they scrape from websites. And advertisers are more than a little irritated by recent Adalytics reports documenting apparent brand safety tech failures.

But IAS and DV have tailwinds, too, though. Moat, which was shut down by Oracle last month, had some major brand clients, which are now up for grabs. And IAS and DV could also have great strategic appeal for major media platforms, like big retailers or TV manufacturers.

IAS’s shares are up 11.8% since the news broke that it’s weighing a sale.

The Unverifiers

For all the focus on the best-known brand safety and verification companies – IAS, DV, Moat (RIP) and White Ops (now HUMAN) – there is a multitudinous set of contenders.

Zefr is one such brand safety challenger, which has long focused on walled garden integrations. IAS and DV are now both also headed down that road. But Zefr is still clinching partnerships, including with YouTube and, just this week, with Snap.

And then there’s GeoEdge, a cyber security and ad verification company that just snagged a partnership with Yahoo DSP to monitor its campaigns, akin to The Trade Desk’s longstanding partnership with HUMAN. Also this week, MikMak, a commerce ad tech and analytics company, inked a deal with TrackStreet, which monitors product placements and brand safety for ecommerce advertisers.

But there’s more. Moving over to podcast and streaming audio advertising, Barometer, an ad analytics and brand safety startup primarily for audio campaigns, announced on Thursday that it’s going to help audio ad seller Acast build brand-safe podcast marketplaces.

Gannett Bets On Betting

Gannett is inching back to overall growth.

In Q3, Gannett’s total publisher portfolio surpassed 200 million monthly average unique users for the first time. That helped push digital ad revenue to $84.7 million, a 4.9% YOY increase. Digital subscriptions accounted for $50.1 million, up 25% YOY.

Gannett is focused on growing engagement and saw double-digit pageview growth compared to Q3 2023, CEO Mike Reed told investors. Digital-only average revenue per user was $8.16, up 19.6%.

But while Gannett’s digital business was solid, its overall business slumped. Total revenue was $612.4 million, down 6.2% YOY.

This downturn was the result of Gannett selling off or closing businesses “that were not at all core to our strategy,” says Chris Cho, president of digital marketing solutions.

Cho pointed to Gannett shutting down its commercial printing business, as well as another unnamed entity that “was very dependent upon the Google algorithms.” It’s possible he’s talking about Reviewed, which Gannett closed in August after it attracted controversy for allegedly publishing AI-generated reviews.

Looking ahead, Gannett is banking on its partnership with BetMGM to enhance its monetization opportunities. If news publishers can’t count on generative AI to keep the lights on, they can always turn to sports betting.

But Wait! There’s More!

Roblox reported $919 million in revenue and $1.13 billion in bookings for Q3, with YOY increases of 29% and 34%, respectively [Yahoo]. However, this growth was driven by Roblox’s core microtransactions business, and “brands and ads will be incremental down the road,” CFO Mike Guthrie told investors.

Russia fines Google a deliberately unrealistic $2.5 decillion – more than the world’s current GDP – over YouTube blocking Russian broadcaster accounts. [NBC News]

Comcast is considering spinning NBCUniversal’s cable networks out into a publicly raded company. [Variety]

Yes, there were more Halloween ads this year. [Ad Age]

The Star-Ledger, New Jersey’s biggest newspaper, will end its print edition in 2025. [NY Post]

Exploiting Meta’s weaknesses, deceptive political ads thrived on Facebook and Instagram in the run-up to the US presidential election. [ProPublica]