Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Prime Time

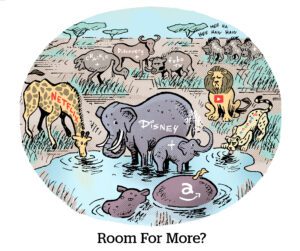

Ads have arrived on Prime Video.

But audiences have just about had it with streaming services that nickel-and-dime them, The Wall Street Journal reports.

Instead of forking over an additional $3 per month to avoid ads, many have canceled their Amazon Prime subscriptions entirely, forgoing free deliveries and other perks that attracted them to the service in the first place.

To be fair, there’s nearly always some churn when subscriber conditions change, which the company accounts for.

Netflix is a good example: Subscribers bashed Netflix’s anti-account-sharing tactics, but in a matter of months, new sign-ups outweighed cancellations.

And for Amazon, investment bank MoffettNathanson projects Prime Video to earn $1.3 billion in ad revenue this year, while Bank of America analyst Justin Post says ad revenue could grow as high as $3.2 billion, plus another $1.6 billion from price hikes for the ad-free tier.

That’s a strong justification for dealing with a bit of churn.

However, media buyers did have a lukewarm response to Amazon’s pitch deck for its new ad tier, according to Insider Intelligence. Prime Video will have to impress its viewers and advertisers to achieve those goals.

Is This Related?

The Chrome Privacy Sandbox isn’t entirely about advertising.

But it kinda is, right?

Take the Related Websites Sets proposal, a Chrome Privacy Sandbox solution that allows companies with many domains to coordinate actions across those sites. Publishers apply to have use cases approved.

Google maintains that RWS is explicitly not for advertising purposes, Adweek reports. Most use cases aren’t ad-related. But sometimes, at least, RWS applications are blatantly for advertising, including frequency capping across co-owned sites, content or ad personalization, and managing ad-serving times. Zach Edwards, a web privacy researcher, lists a few public RWS examples in a follow-up to Adweek’s story.

The RWS brouhaha underscores the challenge for the Privacy Sandbox, when its testing is someone else’s livelihood. RWS seems like a permanent change coming to Chrome. But companies using it for ad purposes sense it’s a workaround or a form of fingerprinting that may not last.

RWS is a useful post-cookie data signal for online businesses that serve ads to and monetize many domains. Although Google says it’s not for that at all.

Confusing.

Also, Google caps the RWS solution at five domains. Which Edwards and other publishers say is arbitrary and favors the largest owned networks (ahem … Google).

Airing Of Grievances

Speaking of the Privacy Sandbox … The IAB Tech Lab says Google should clarify how it actually works.

In conversation with Digiday, Tech Lab CEO Anthony Katsur says the Sandbox specs need more transparency to spur wider adoption.

The Tech Lab is working on getting Google to publish clearer, more complete help documents that are hosted in one place, since the documents currently are “kind of all over the place,” Katsur says.

Plus, Google’s existing help docs lack detail on “transmission guarantees, data-size limitations, latency” and performance, he added.

In addition, the rollout of the Privacy Sandbox will require rethinking the programmatic supply chain. Advertisers take the current DSP-to-SSP-to-publisher chain for granted, but the Sandbox changes how contractual relationships between these partners will work.

For example, it’s unclear how long-held norms concerning sequential liability and data rights are affected under the Privacy Sandbox. And these concerns must be ironed out so the various players know their liabilities, Katsur says.

The Tech Lab will publish its analysis of the Privacy Sandbox and its plans to address existing points of contention next month.

But Wait, There’s More!

TikTok tests a feature that could make all videos shoppable. [Bloomberg]

Amazon abandons its iRobot acquisition after European antitrust opposition. [The Verge]

Agency acquisitions are heating up. [Ad Age]

Netflix is different now – and there’s no going back. [The Verge]

The results are in: Here’s what Americans streamed in 2023 (according to Nielsen). [The New York Times]

You’re Hired!

Paramount hires Emily Huo as SVP of SMB advertising, and Luke Peng as VP of product for SMB advertising. [Ad Age]

Basis promotes Grace Briscoe to EVP, client development. [post]

Jason White joins The Arena Group as chief product and technology officer. [post]