“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Ken Allen, Managing Director at Blackstone.

Robb Stark, in Season II of HBO’s Game of Thrones, is presented with an interesting dilemma during his quest to avenge his father’s death. At the behest of his step-brother Theon, he considers an opportunity to join forces with House Greyjoy. To be sure, harnessing the power of the combined armies and artillery, inclusive of 100 ships, is an enticing prospect. But it is not an entirely straightforward one: the Greyjoys were once at war with the Starks and, as Lady Catelyn, Robb’s mother, warns, “The Greyjoys cannot be trusted.” So why does Robb give the issue such consideration, and, ultimately, try to broker a deal, despite the well-known risks?

In the Digital Marketing sector, we are witnessing a similar game play out that can give us clues to solving this riddle. On the Digital Marketing battlefield, as in the Game of Thrones, the dynamic landscape is being driven by four key themes: scale, capabilities, urgency, and fit.

Theme 1: Scale

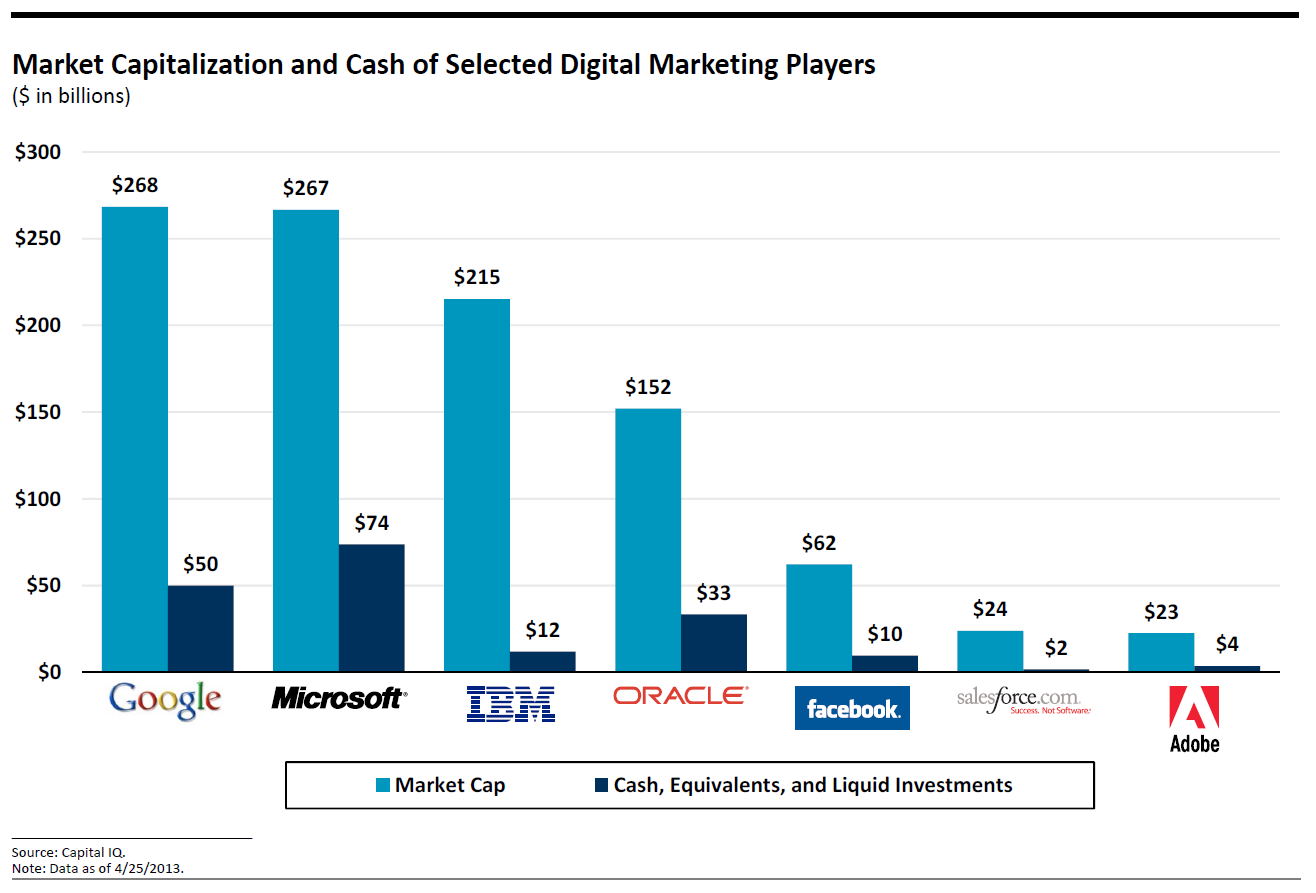

Scale has long been a key determinant of success in Digital Marketing, but has become even more critical in today’s marketplace. Talent, capital, mindshare, and the ability to invest (heavily and rapidly), have all become distinct competitive weapons. In the Digital Marketing arms race currently underway, capital is used as ammunition to invest in products, people, M&A, and an expanded footprint. The market capitalization and cash balances of various ecosystem players, shown below, illustrate this point.

For those keeping score, the market capitalization and cash among these seven companies totals a staggering $1 trillion and $185 billion, respectively. These assets are being used to protect and grow the market positions of these companies by enabling them to spend massive amounts on R&D, capital expenditures, sales personnel, and marketing initiatives. Consider this: Google, last year, spent $9.9 billion on R&D and capital expenditures. This amount was larger than the entire market value of the following companies: Akamai, AOL, Expedia, Groupon, Netflix, ValueClick, and Yelp, among many others. Said another way, assuming Google realizes a positive return above its cost of capital on each dollar of this spend, it is effectively creating a “company” with Netflix’s market value every year.

Scale in capital and investment has, by no means, been exclusive to the public markets. The amount of private capital raised in the sector has been growing as well, with many companies raising upwards of $100 million or more in extraordinarily short periods of time, as illustrated by the chart below.

Scale in both the public and private markets has been a key driver of M&A. Companies such as Google, Facebook, and many others have leveraged their balance sheets and share price “currencies” to acquire companies that give them new capabilities. This is particularly important when capitalizing on new market opportunities. For example, as social platforms emerged over the past few years, companies such as Oracle and Salesforce.com were able to pay aggressive multiples for the emerging, high-growth companies Vitrue and Buddy Media, respectively, giving them rapid access to critical capabilities in these new markets. Despite the relatively high price tags for these companies, the significant cash each acquiror had accumulated meant that each deal was well within reach.

Theme 2: Capabilities

Second, differentiated capabilities have become increasingly important as the adtech market has evolved. Simply being the biggest is not enough. Time and again, we have seen disruption of the largest technology companies at the hands of startups with new, ground-breaking products or services. Innovation at big companies is hard, and many large companies intuitively know they are not particularly good at it. As such, M&A is often used as a strategic capability to acquire innovation.

This quest for innovation and capabilities has led to consolidation in the sector. Vendors such as Adobe, Google, Salesforce, and others are assembling the critical pieces of the adtech stack, including data management, optimization, and multi-channel technologies, in an effort to create fully-integrated “one-stop-shop” platforms for buying and selling media in real-time.

The acquisition of capabilities extends well beyond products and technologies, to people. In the technology industry talent wars, many of the best and brightest seek the challenge, thrill, and potential monetary reward of a start-up rather than opting for the stability and slower pace of an incumbent company. Again, many large companies know this, and have therefore leveraged M&A to acquire the talent they need in order to be successful. In the Oracle / Vitrue and Salesforce.com / Buddy Media transactions referenced above, each deal not only gave the acquirors new technology and IP, but also the marketing DNA critical to driving their strategies forward.

Theme 3: Urgency

Successful companies in the Digital Marketing space understand how quickly innovation is disrupting the status quo. One can point to a long list of trends over the past several years that companies ignored at their peril: the shift to mobile and social, RTB, programmatic buying, predictive analytics, big data, cloud computing, etc. The leaders in the sector have been able to identify such trends well in advance and move quickly to either develop or acquire the key capabilities, products, and services they needed to capitalize on new opportunities.

One of the reasons M&A has proven to be such an important capability in Digital Marketing is that it enables a buyer to gain the assets it needs extremely rapidly. The inherent risk with any organic growth strategy is that market innovation moves faster than you do; by the time a company launches the new product it has been working on for the past 12 months, it may already be obsolete. M&A can be used by companies as a tool to catch up on a trend they may have missed or a product they failed to develop rapidly enough on their own. The speed M&A facilitates is important for other, defensive purposes as well: it can serve to take a competitive threat out of the market, or prevent a strategic technology or capability from falling into your competitor’s hands.

Facebook, for example, recognizing the threat posed by Instagram, was able to acquire the company extremely rapidly due to its considerable cash resources and the value of its share price. Facebook’s market capitalization further enabled it to pay the price required to get a deal done (~$1 billion), which was widely criticized at the time as being too rich. To put the price tag in perspective, however, we need to recognize that Facebook was valued at over $100 billion in the private markets when the deal was announced. Even in the worst case scenario, in which Instagram ultimately added zero value to Facebook, the transaction nonetheless acted as a 1% insurance policy that kept the asset out of its competitors’ hands and preserved the “option value” that the deal could be a home run.

Given the increased strategic importance of M&A, there are many companies in the Digital Marketing sector that have become acquisition machines. Google, for example, acquired 31 companies in the Digital Marketing / and Commerce sectors from 2008-2012, roughly 6 per year. On the agency side, the pace has been even faster: over this same timeframe WPP acquired 76 companies, or roughly 15 per year. In the case of both Google and WPP, rapid deal-making has led to broader capabilities, significant scale advantages, and an enhanced competitive position. Adobe, Oracle, Salesforce.com, IBM, Publicis, Amazon, Facebook, and others have realized these themes as well and have similarly bolstered their M&A capabilities.

Robb Stark wishes to explore a deal with the Greyjoys because he too recognizes the themes discussed above. First, he knows scale is important to winning the Game. With an army 1/3 the size of the Lannisters, he knows he risks defeat simply by being outnumbered, despite having superior soldiers. He believes he can maximize his chances of success by merging with another part of the kingdom, even if that other part is a former rival. Second, Robb covets the Greyjoy’s fleet of 100 ships, a wartime capability without which he risks failure, regardless of how many well-trained warriors he has. Finally, Robb knows that the time to broker a deal is now. With every passing day, he realizes, his existing enemies grow stronger and more organized, and new enemies surface: witness the nascent army of Daenerys Stormborn, who not only has a new battalion some 8,000 strong, but 3 dragons — scale, and best of breed capabilities (oh yes I did).

Theme 4: Strategic and Cultural Fit

Interestingly, Robb Stark’s proposed merger with the Greyjoys illustrates one last (cautionary) facet of strategic M&A: the importance of both strategic and cultural fit. Despite the importance of scale, capabilities, and urgency, without a strong fit between the parties, a deal will be doomed from the outset. This is in fact why Stark’s deal ultimately fails. In the end, he picked the wrong partner, and the alliance fell apart. Even a perfectly drawn up M&A strategy will not succeed if the people and culture involved between target and acquiror do not mesh.

In the $500+ billion Game of AdTech, we find a rapidly-evolving battlefield, with both established incumbents and emerging, well-armed entrants. As the Game has evolved, it has been increasingly critical for players to understand and harness the themes highlighted above: gaining critical mass, acquiring or developing the key capabilities you need, moving quickly, and picking the right partners. The most successful players have demonstrated their skill across all four battle lines. Those that haven’t should be wary of the overarching concern woven through George R.R. Martin’s epic tale: that Winter, in fact, may be coming.

Follow Ken Allen (@kw_allen) and AdExchanger (@adexchanger) on Twitter.