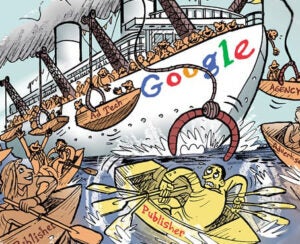

In its antitrust suit against Google, the US Department of Justice is portraying the company as a monopolistic giant, but the reality of Google’s ad tech business – and its future – is far more complex and evolutionary.

The courtroom drama is drawing attention away from the real changes already reshaping the industry. These shifts are driven not by legal proceedings but rather by evolving market dynamics, changing advertiser demands and Google’s own strategic priorities.

In fact, regardless of the trial’s outcome, Google is poised for a win. The very scrutiny that threatens its current business model is likely to accelerate a transformation that will benefit the tech giant in the long run.

The catalyst for Google’s future success – regardless of any legal ruling – is its YouTube strategy.

Google’s priority is YouTube, its crown jewel

As a platform, YouTube’s value extends far beyond its role in Google’s ad tech stack. It’s a cultural phenomenon, a search engine in its own right and a key player in the streaming wars.

Opening YouTube’s ad inventory to outside demand will increase its value. More competition for ad spots will drive up prices while reducing Google’s operational burden. It will position YouTube as a more neutral platform, attracting a wider range of advertisers and content creators.

This scenario shouldn’t feel strange considering YouTube wasn’t always a walled garden within Google’s ad tech ecosystem. When Google acquired YouTube in 2006 for $1.65 billion, it maintained a relatively open approach to YouTube’s ad inventory, allowing various ad tech players to participate.

It changed course in 2015 by restricting YouTube ad inventory to be bought only through Google Ads and DV360. This move consolidated Google’s ad tech stack and maximized the value of its YouTube acquisition. The impact was profound.

Rival demand-side platforms (DSPs) were shut out. Companies like AppNexus and TubeMogul cited the lack of access to YouTube as a significant blow to their ability to compete with Google in video advertising.

Growing industry speculation today suggests Google might reverse this decision and open YouTube back up to third-parties.

While the ad tech business generates substantial revenue, it operates on much thinner margins compared to Google’s owned and operated properties like Search and YouTube. These platforms are the real profit centers.

The ad tech operations, while significant, bring challenges – regulatory scrutiny, industry pushback and the need for constant innovation in a competitive field. As Google grows, the cost-benefit analysis of maintaining tight control over every aspect of the ad tech stack is shifting.

Opening up is inevitable

Market pressures and industry trends are pushing toward more open, interoperable systems. Advertisers demand greater transparency and flexibility, while regulators worldwide scrutinize walled gardens. By opening up its ad tech stack, particularly YouTube’s ad inventory, Google will address these concerns while maintaining its competitive edge.

This evolution will allow Google to focus on its core strengths – owned and operated properties, AI and machine learning capabilities and vast data troves. By reducing involvement in commoditized aspects of ad tech, Google will increase profitability while reducing regulatory heat.

When Google opens up its ad tech stack, either voluntarily or due to the trial, we’ll see a more diverse ecosystem of ad tech providers, each specializing in different aspects of the advertising process. This will drive innovation and lead to better outcomes for advertisers and publishers. Smaller ad tech companies will find new opportunities to compete, bringing fresh ideas to the market.

By focusing on core strengths and reducing exposure to regulatory scrutiny, Google will emerge stronger and more profitable. The company’s vast resources, technological prowess and market position will still provide significant advantages, even in a more open playing field.

Opening YouTube’s ad inventory marks a significant shift from the 2015 policy. It signals a return to a more open ecosystem in a changed and matured digital advertising landscape. This evolution isn’t a retreat from Google’s previous strategy, but a confident step forward by a company that no longer needs tight control to ensure quality and effectiveness in YouTube advertising.

Losing the battle, winning the war

Even if Google loses this antitrust case, the long-term outcome will be in its favor.

The goodwill generated by a more open ad ecosystem will improve Google’s image among advertisers, publishers and regulators. This will lead to more collaborative relationships and new business opportunities. By losing control of some ad tech components, Google gains in areas that truly drive its growth and profitability.

The future of digital advertising will be shaped by the evolving needs of advertisers, publishers and consumers, not court rulings. In this landscape, Google’s ability to adapt and focus on its core strengths will determine its continued success, regardless of the trial’s outcome.

As the ad tech world continues to watch the legal spectacle unfold, the real action is happening behind the scenes, where the next chapter of digital advertising is already being written.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Follow Zefr and AdExchanger on LinkedIn.

For more articles featuring Rich Raddon, click here.