“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Ameet Shah, senior director of global technology, publisher and data strategy at Prohaska Consulting.

How much do we really know about the data we use?

A company’s advertiser, agency or publisher first-party data is a well-understood data point. Second-party data, although not directly known, comes from a trusted partner and is easily identifiable.

The most common data source used is third-party – and how much is known about that?

With well more than 100 data providers in the marketplace, how do we know which are better, when types should be used and whether the data comes from a trusted source?

Many people do not take important steps to choose the best sources, which hampers results. It’s time for decision-makers to make this an ongoing practice.

Don’t take the easy way on provider selection

Often, data provider selection will be based on recognizing a household name, such as Oracle or Experian vs. Bombora or Leap, but does that mean it is better? How often do we just search within our data management platform (DMP) or demand-side platform (DSP) to search for the desired trait – gender, income, in-market new car buyer or fitness enthusiast, for example – to view the list of presented options?

From there, we may look at the list of segment names, provider names and costs before making a selection. We implement the campaign, satisfied that the desired targeting has been applied and move on to the next task.

Do we regularly stop to consider if we have made the right choice, given the importance of our actions? This targeting will directly impact the audience reached. The accuracy of this data will directly impact the campaign’s performance and ultimately ROI and ROAS. Yet, while the decision made might be fine for a given campaign, too often the longer-term effects on winning future business are not considered amid the urgency of getting campaigns planned, scheduled and launched.

Much more thought needs to go into the decision on which third-party data providers should be used.

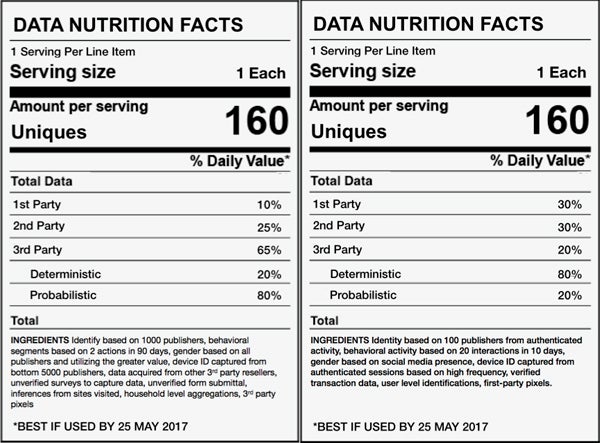

To make a food analogy, if I am buying a can of soup, I would look at the nutritional label and would probably consider the one with recognizable items and a shorter ingredient list to be healthier. In the long term, eating the healthier option would be better for me.

That’s why much more thought needs to go into data vendor selection.

An “unhealthy” nutritional data label (left) and a “healthy” nutritional data label. Source: Prohaska Consulting.

Spend time researching third-party providers

Consider how third-party segments are developed. Ingredients matter. They are a collection of data points from multiple, numerous or hundreds of sources.

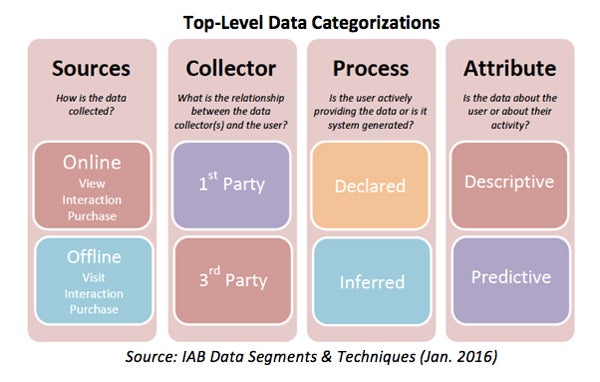

Are the segments based on deterministic or probabilistic models? At a high level, data sources are classified into four categories. The type of categorizations used will impact the quality and accuracy. However, in the crunch of executing a campaign, we may not – though we should – routinely assess the basis of data segment definitions using recommended criteria, such as those defined by the IAB.

Consistently match the provider to the audience targeted

Often, a user will select the providers and segments available natively via their platform DSP or DMP. That may or may not meet the campaign need. How do we know? There needs to be a greater understanding of the segments used to meet the specific needs of the marketer.

It’s my belief that the targeting needs of each campaign need to be understood to answer these types of questions, yet resolving these questions may get shortchanged in the daily rush:

- Is the desired audience B2B or B2C?

- Does the targeting need interest-based or purchase intent information?

- Are desktop, mobile, video or cross-platform user behaviors required?

- Are offline insights needed as criteria?

- What are the provider’s thresholds for identifying a behavior? For example, is it three visits within 90 days or 30 visits in 30 days?

- What do the marketing-friendly data segment names actually mean?

- What data gap is needed to augment what exists from a first-party perspective?

Do your existing providers excel at each of these, or do they have an established specialty? Too often, decision-makers take the easy route and go with familiar sources versus exploring a range of options. I would expect multiple data partnerships, and each should be used in the application that best meets the marketer’s needs.

These assessments need to be done at regular intervals – quarterly would be ideal. As with all things related to ad tech and mar tech, capabilities and solutions change often. This happens due to policy changes (such as the upcoming GDPR that goes into effect May 25 for EU audiences), platform considerations (such as a lack of tracking on iPhone Safari browser), new company solutions, the release of new technologies, including sensors, and the application of AI to understand correlations not easily determined via our people-based observations.

Take the right steps to get the right results

Finding the right data partners is a critical task and one that should not be taken lightly. These decisions translate directly to campaign performance, effectiveness and, ultimately, conversions. The implications are massive, but often the time spent on the considerations are minimal.

I encourage decision-makers to ask the hard questions, identify each provider’s strength and align with business goals to achieve meaningful results. Much as we spend time getting ourselves healthy to enjoy a better life, we need to do the same with data partners to have better business outcomes.

Follow Prohaska Consulting (@TeamProhaska) and AdExchanger (@adexchanger) on Twitter.