“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Tom Manvydas, vice president of advertising strategy and solutions at Experian Marketing Services.

To improve the performance of their digital advertising campaigns, marketers can use yield-optimization practices, which are common in media supply sources.

Yield optimization employs a variable pricing strategy, based on understanding, anticipating and influencing consumer behavior in order to maximize revenue or profits from a fixed, perishable resource.

While this method has several benefits, there’s a big problem. The publishers – the outlets that provide the advertising space – and the marketers – who place the ads – both use yield optimization without considering the other party. I believe that in order to fully maximize this technology, marketers and publishers need to find middle ground.

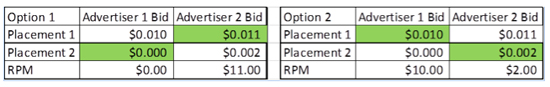

With the relentless downward pressure on cost per mille rates, publishers have grown increasingly sophisticated in yield-optimizing impressions. Supply-side yield optimization can be as simple as matching lower-value media to lower-value bids or using sophisticated predictive allocation models to maximize revenue yield. This table illustrates how powerful supply-side yield optimization can be for increasing revenue and margins:

In option 1, unsophisticated supply owners might allocate the impression from placement 1 to advertiser 2 based on the fact that it has highest bid. The impression for placement 2 would serve a house ad since advertiser 1 will not purchase it. It would be better for the supply owner to allocate placement 2 to advertiser 2 (option 2), which would net $12 in total revenue compared to $11. Now imagine this happening billions of times per day in a programmatic world and you can see why supply-side yield optimization receives much more attention from publishers.

Marketers can apply the learnings from supply-side yield-management practices to improve their data-driven digital campaigns. Instead of having a yes/no decision for an impression based on a simple targeted bid, marketers can apply relative value yield-optimization processes across media impressions (or audiences) and determine how much they are actually worth.

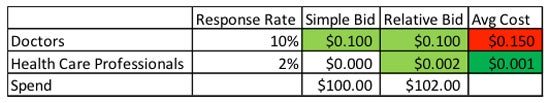

In the streamlined example below, doctors made 60% of purchasing decisions and responded at five times the rate of other general health professionals, who made up the remaining 40% of purchasing decisions.

For many marketers, this is a no-brainer. They will just target the doctors and be done with it using a simple bid model. But for just a 2% increase in the unit cost of the campaign, you can target 100% of the eligible prospect pool vs. a segment that limits you to 60% potential orders. If we expand this example and show how the actual cost can be very different from the calculated value, we can see that market limitation is further constrained by media availability. With fierce competition from multiple marketers, the available supply to reach doctors is pretty limited. You end up with a campaign where you either overpay or get no reach. It’s the exact opposite for health-care professionals, where we have 20 times the supply of doctors but with much lower competition from marketers.

So doctors may have the best response rates but when you apply some basic yield-optimization concepts, they don’t look so hot anymore. Going after a less responsive segment that has more scale at lower cost provides positive returns and the reach that marketers are looking for.

The superior data technologies that have been developed on the demand side could be leveraged by publishers to improve their yield-management programs. While publishers have made great strides in yield management they will need to do more, especially with digital media supply continuing to grow. They first need to distance themselves from their obsession to apply financial market models to their supply chain and develop new ones, specific to a consumer-centric digital marketplace. Contrary to popular belief, media exchanges do not work like the Nasdaq and media impressions are clearly not fungible assets across marketers.

When both marketers and publishers develop more effective and balanced yield-optimization techniques, the end result could be an increase in value for both sides of the media transaction. Despite the wide gap today, I am confident that data-driven practices will one day lead to the elusive market equilibrium where supply will match demand and value is created for marketers, publishers and consumers simultaneously.

Follow Experian Marketing Services (@ExperianMkt) and AdExchanger (@adexchanger) on Twitter.