“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Kevin Geraghty, senior vice president of advanced analytics and decision sciences at 360i.

There’s an old space race story that NASA spent $2 million to develop an anti-gravity pen, while the Soviets just used pencils. The story serves as a reminder that sometimes you just need to look at a complex problem differently to find a better solution.

Marketers face a similar problem with attribution. They are consumed by too narrow a problem – attribution – when they need to rethink the whole equation. The difficulties with attribution extend beyond the commonly recognized issue of a last click getting all the credit. Companies turn away profitable business because they base their media investment strategy on upside-down math.

There is a structural mismatch between how we buy media – partner by partner – and the customer journey toward a purchase, which includes multiple partners and touch points. Determining ROI for each partner or touch point to make better budget allocation decisions is difficult, but it can be achieved through marginal contribution analysis.

Attribution Analysis Vs. Marginal Contribution

Attribution analysis spreads credit for a conversion across the media on a customer’s journey. It should be used as a macro decision-making approach that provides direction for budget allocation efforts.

Marginal contribution bases media-buying decisions on profit by subtracting media costs from the value created by advertising across the entire consumer journey. It works best for micro-level decision making, such as optimizing direct response campaigns.

Fortunately, the difference is easy to see with a simple math example. Suppose a marketer is selling pairs of shoes for $100 using joint paid search and display campaign management.

Marketers often give equal weighting to different exposures, but this can lead to bad advertising decisions. The examples below illustrate attribution analysis:

First Exposure Credit

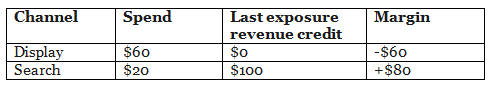

Last Exposure Credit

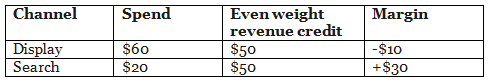

Even Weight Credit

In too many instances, attribution starves marketers of profitable returns because they look at it the wrong way. No matter what attribution strategy is applied, business is left on the table for competitors to scoop up, especially the ones that are optimizing to marginal contribution rather than a complex attribution strategy.As you can see, for each attribution strategy – first, last or even – the revenue credited always comes out so that one channel loses. This means the channel manager would not invest in that channel, despite the positive contribution it makes to a sale. However, when you look at total spending, most marketers would still be willing to spend $80 for the combined power of display and search to get the $100 shoe purchase, for a $20 profit.

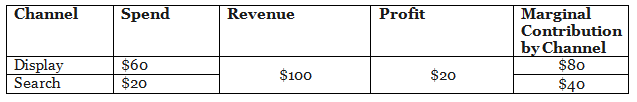

Marginal contribution works by applying the math across touch points:

For instance, if I spend $60 on display, I will get a $100 shoe purchase, but I will have to spend $20 in down-line search costs. Therefore the marginal contribution of the display partner is $100 minus $20, or $80, resulting in a profit of $20 more than the original $60 display spend. This justifies the display partner as a worthwhile investment. With marginal contribution, the math works better and it’s smarter for marketers.

Better Math

Applying the right math can transform how we buy and sell media. Through machine learning algorithms, it’s now possible to incrementally refine an ROI estimate for each partner, including for display, search and retargeting, to determine what partners are bringing the most value across different campaigns and categories.

What’s surprising is that contrary to what a marketer might think, just because a partner shows up on a lot of paths doesn’t mean they are a net contributor across the board. They may be simply hijacking credit by wallpapering the Internet or targeting prospects that would buy anyway. The goal now is to use attribution and marginal contribution correctly over time to discover what investments and partnerships provide benefit, and the value of each contribution.

Why put so much effort and investment into making a pen work when we can use a pencil? The industry needs to get the math right side-up by learning when to use attribution and when to use marginal contribution. It’s time to make more profit by getting smarter about how we measure media investment.

Follow 360i (@360i) and AdExchanger (@adexchanger) on Twitter.