“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Brian Bowman, CEO and founder of Consumer Acquisition.

Apple killed the IDFA and Armageddon was upon us – or so we thought. IOS 14.5 was a landmark update that included Apple’s AppTrackingTransparency (ATT) framework, which was supposed to have an asteroid-like impact on the mobile app industry.

And yet the rollout of iOS 14.5 has been super slow and Facebook CPMs are up.

On Monday, May 24 of this year, iOS 14.6 was released. As Eric Seufert asks in a post at MobileDevMemo, “Why did Apple slow-roll the adoption of variants of iOS 14.5, which unveiled (arguably) the feature that most impacts the mobile app economy since the launch of the App Store?”

So, what’s really going on here?

iOS 14.5 adoption speed

As this MobileDevMemo graph indicates, Apple may have been showing concern for advertisers and publishers.

CPMs for opted-out iOS 14.5 users are much lower than CPMs for opted-in users, as predicted. Most advertisers and publishers weren’t prepared for iOS 14.5 because many of them hadn’t completed their SKAdNetwork integrations, which meant they would have been negatively impacted by the release of iOS 14.5. Instead, these publishers and mobile app developers can acclimate to the new mobile app advertising world order, while Apple temporarily mutes the impact on the developer ecosystem.

AdExchanger Daily

Get our editors’ roundup delivered to your inbox every weekday.

Daily Roundup

Attribution After iOS 14.5: What Does the Data Tell Us About Why the Apocalypse is So Quiet?

Still, Apple claims that it made the IDFA permission based in order to provide privacy as a human right – and that prompts a few important questions.

Why does Apple disable the “Allow App to Request to Track” setting by default, essentially not giving users a choice? And why is Apple simultaneously claiming that user privacy concerns are paramount, while not immediately releasing all the features?

The answer is because this was never about privacy. A deliberately slowly paced IDFA “Armageddon” obfuscates Apple’s true motives.

What’s really going on

IOS14.5 and ATT are Apple’s attempts to wrench back merchandising control over app distribution. It’s an elegant PR spin to give Apple the moral high ground.

The de facto removal of the IDFA is a tectonic shift that rolls back advertising efficiency by 15 years. Apple didn’t seek industry input or encourage discussion during the planning and development of SKAdNetwork or ATT. To me, ATT was created to prolong users’ dependency on Apple and the App Store. It’s Apple’s desire that users must find and download apps only through its App Store, and that mobile app developers must use Apple’s payment mechanisms if a consumer would like to perform an in-app purchase.

Apple is attempting to define privacy, and its version is that Apple and first parties should get all the data – but third parties can’t.

Consumers cannot opt out of Apple tracking their downloads via a third-party app store, nor can consumers pay for a purchase using a neutral third party, such as PayPal or Venmo. Why did Apple set up its app ecosystem like this? The answer is simple, and that is to mandate Apple’s involvement in the process.

The fact is that the App Store has poor merchandising and recommendations, so it’s actually an unnecessary step between the app advertiser and the user installing the app.

But what’s up with rising CPMs?

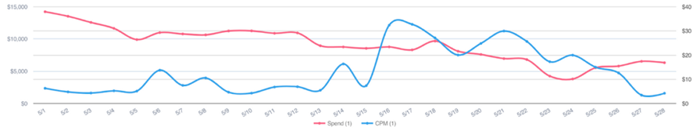

Across multiple platforms, CPMs have oscillated since the rollout of ATT. We’re not sure exactly why, but it appears that the platforms may be adjusting their algorithms for this post-IDFA world. Below are CPM graphs across several mobile app gaming advertisers in unrelated genres across platforms.

A Facebook romance game app developer’s CPMs returned to the high levels it saw in April.

One Facebook hidden object developer saw CPMs increase using both Facebook’s automated app ads (AAA) and Facebook’s standard algorithm.

This Facebook simulation games developer has experiences some real volatility, with CPMs going above $10 but then coming back down close to the start of May.

Another Facebook simulation app developer has seen CPMs increase 4x the amount they started at in May.

For comparison, this Facebook desk client saw a minimal impact possibly due to running desktop-only campaigns.

This client didn’t appear impacted perhaps due to not running Facebook value or App Event Optimization (AEO) purchase events.

While this wellness app developer’s Facebook website AEO purchases spiked – then reverted within four days.

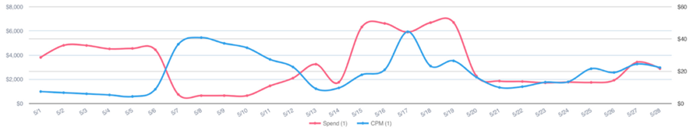

TikTok CPMs spiked, too

For TikTok, there was a spike as well. One app developer saw a higher spend around May 14, which was normal, and then an increase over Memorial Day weekend.

Similarly, another TikTok developer experienced a CPM bump mid-month, and then another just before Memorial Day weekend.

Finally, this TikTok sports app developer also experienced the CPM bump mid-month, although its CPMs started trending up towards the end of May.

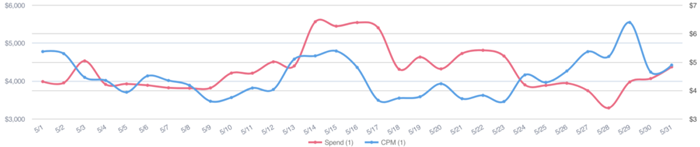

Google CPMs are also up

Google CPMs rose from the start of the month, peaked and stabilized for about 10 days, then slightly decreased over the course of the following week.

Interestingly, this app developer sees a spike every seven days in the United States – but, overall CPMs are stable.

And another Google client saw its CPMs steadily rising throughout last month despite pulling back on spend for the last two weeks of May.

Surviving and thriving post IDFA

What does it all mean?

The way to maintain profitable mobile app advertising and to survive and thrive in a post-IDFA world is through creative optimization. With IDFA effectively dead – and both Facebook and Google moving to automated media buying – the last meaningful lever mobile app developers have is creative.

Those who don’t adapt to the creative-is-king philosophy will simply fade away.

Follow Consumer Acquisition (@conacq) and AdExchanger (@adexchanger) on Twitter.