“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Chris O’Hara, vice president of strategic accounts at Krux.

Marketers have always craved access to quality audience at scale. That was once as easy as scheduling buys on the top three broadcast networks and buying full-page ads in national newspapers. Today, the world is more complicated, with attention shifting into a splintered digital universe of thousands of channels across multiple media types.

Ad tech companies have tried to corral a massively expanding world of inventory in ad exchanges, along with the means to bid inside them. This “programmatic” world of inventory procurement is deeply flawed, yet still the best thing we have at the moment.

It’s flawed because it mostly offers access to commoditized “display” ad units of dubious value and struggles to deliver real audiences, rather than robots. But it’s also good because we have taken the first steps past a ridiculous paradigm of buying media through relationships and fax machines, while starting to bring an analytical discipline to media investment that is based on measurement.

So, as we sled the downward slope of the programmatic buying Hype Cycle, we are starting to see some new trends in inventory procurement – namely, a strategy that involves replacing some or all of the licensed programmatic architecture, as well a growing reliance on one’s own data.

But first, before we get into the nuts and bolts of how that works, some history:

The Monster We Created

After convincing ourselves of the lack of scalability in the direct model, where we would call an ad rep, we have set up a lot of distance between a marketer and their desired audience.

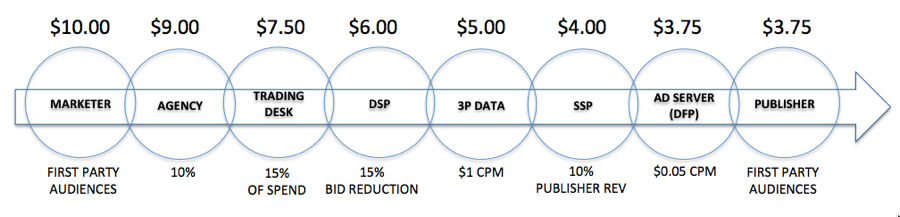

Imagine I am a cereal manufacturer and have discovered through media mix modeling that digital moms on Meredith sites drive a lot of offline purchases. They are the “household CEOs” that drive grocery store purchasing, try new things and are influential among their peer group, in terms of recommending new products. In today’s new media procurement paradigm, there are many “friends” standing between my target and me:

- Media agency: This is a must-have, unless marketers want to add another 100 people to their headcount with an expertise in media, but this adds 5% to 10% in costs to media buys.

- Trading desk: Although many marketers are starting to take this functionality in-house, whether you trade internally or leverage an agency trading desk, you can expect 10% to 15% of media costs to go to the personnel needed to run this type of operation.

- Demand-side platform (DSP): Don’t forget about the technology. A 15% bid reduction fee is usually required to leverage the smart tools necessary to find your inventory at scale across exchanges.

- Private marketplace: But wait! We use private marketplaces to make exclusive deals among a small pool of preferred vendors. Yes, but they operate inside DSPs and carry transactional fees that can add between 5% and 10% extra.

- Third-party data: You can’t target effectively without adding a nice layer of audience data on your buy, but expect to pay at least $1 CPM for the most basic demographic targeting – a significant percentage of cost even on premium buys.

- Exchanges: Maybe you pay for this via your DSP, but someone is paying for a seat on an ad exchange and that cost is passed through a provider, which can add another several percentage points.

- Supply-side platform (SSP): It’s not just the demand side that needs to leverage expensive technology to navigate the new world of digital media. Publishers pay up to 15% in fees to deploy SSPs, a smart inventory management technology to help them manage their “daisy chain” of networks and channel sales providers to get the best yield. This is baked into the media cost and passed along to the advertiser.

- Ad server: Finally, the publisher pays a fee to get the ad delivered to the site. It is a somewhat small price, but one that is passed along to the advertiser, usually baked in to the media cost.

This is essentially the middle of a crowded LUMAscape, a bunch of different disintermediating technologies that stand between an advertiser and the publisher. Marketers pay for everything I just described. They may not license the publisher’s SSP for them, but they are subsidizing it. After running this gauntlet, marketers with $10 to spend on “cereal moms” end up with much less than half in media value – the amount the publisher ends up with after the disintermediation takes place. This can be anywhere from 10% to 40% of the working media spend.

That’s probably the biggest problem in ad tech right now.

We’ve essentially created a layer of technology so gigantic in between marketers and audiences, that 60% to 70% of media investment dollars land up in venture-funded technology companies’ hands, rather than the media owner creating the perceived value. How do we change that paradigm?

Leapfrogging the Middleware

Data management technology is increasingly replacing some of the middleware in this procurement equation, effectively writing the third chapter in the saga we know as programmatic direct.

Here is a bit of background.

What I call “Programmatic Direct 1.0” was the short-lived period in which companies leveraging the DoubleClick for Publishers (DFP) ad-serving API built static marketplaces of premium inventory.

For example, a premium publisher like Forbes might decide to place a chunk of 500,000 home page impressions in a marketplace at a $15 CPM. Buyers could go into an interface, transact directly with the publisher and secure the inventory. The problem that inventory owners had a hard time valuing their future inventory and buyers weren’t keen to log into yet another platform to buy media. This phase effectively ended with the Rubicon Project buying several leaders in the space, ShinyAds and iSocket, and AdSlot taking over workflow automation software provider Facilitate Media. Suddenly, “programmatic direct” platforms started to live inside systems where media planners actually bought things.

Programmatic direct’s second act (2.0) is prevalent today. Companies use deal IDs or build PMPs within real-time systems and exchanges to have more control over procurement than what is available in an auction environment. Sellers can set prices and buyers can secure rights to inventory at a set, transparent cost. This works pretty well, but comes with the same gigantic stack of providers as before and includes additional transaction fees. This is akin to making a deal to buy a house directly from the owner, but agreeing to pay the real estate broker fee anyway. The thing about programmatic direct transactions is that they are fundamentally different than RTB because they don’t have to take place in “real time,” nor do they involve bidding. A brand-new set of pipes is required.

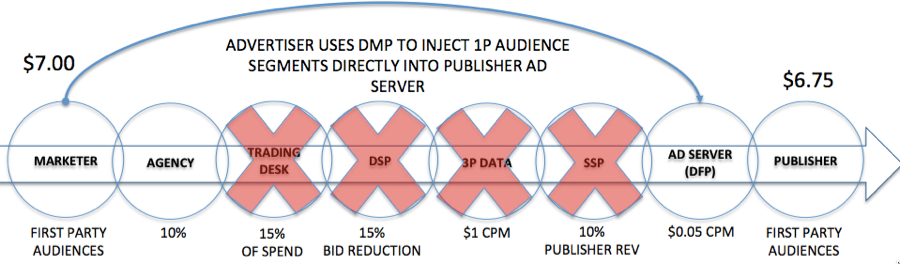

“Programmatic direct 3.0” – or whatever we decide to call it – looks a bit different. Let’s say the big cereal company uses a data-management platform (DMP) to collect its first-party data and creates segments of users from both offline user attributes and page-level attributes from site visitation behavior. The marketers have created a universal ID (UID) for every user. Let’s imagine they discovered 200,000 were females, 24 to 40 years old, living in two-child households with income greater than $150,000 and interested in health and fitness. Great.

Now imagine that a huge women’s interest site deployed its own first-party DMP and collected similar attributes about their users, who were assigned UIDs. If the marketer and publisher have the same enterprise data architecture, they could match their users, make a deal and discover that there’s an overlap of 125,000 of users on the site. Maybe the marketer agrees to spend $7 CPM to target those users, along with users who are statistically similar, every time they are seen on the site for November.

The DMP can push that segment directly into the publisher’s DFP. No trading desk fees, DSP fees, third-party data costs or SSPs involved. The same is true for a variety of companies that have built header bidding solutions, although they see less data than first-party DMPs.

With this 3.0 approach, most of the marketer’s $7 is spent on media, rather than a basket of technologies, and the publisher gets to keep quite a bit of that revenue.

Sounds like a good deal.

Follow Chris O’Hara (@chrisohara) and AdExchanger (@adexchanger) on Twitter.