“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Jed Nahum, Senior Director of Programmatic Sales at Microsoft Advertising.

At the recent IAB Annual Leadership Conference, I attended a cocktail-fueled discussion of programmatic. The discussion started with a noted publisher asserting “Programmatic is not RTB, it is automation.” It was an assertion I’ve heard before –at Microsoft, also a publisher. Other publishers went on to assert that there is a conflation of RTB with programmatic that they don’t like. Tom Shields also discussed this topic on AdExchanger.com a couple weeks back.

I agree: there is conflation between the terms, but I believe it’s slightly different than the participants identified.

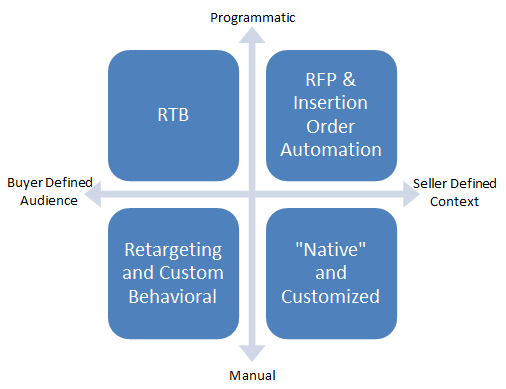

I believe there are two dimensions that tend to get confused when talking about programmatic offerings. One is: Programmatic versus Manual (or “Hand Sold”). The other is one of the big issues facing our industry right now, and it asks the question “who gets to define audience: Buyers or Sellers?” Consider the following diagram, which crosses the two dimensions:

While I’ve put examples of offerings into each quadrant, I mostly want to concentrate on the axes themselves, and hopefully “de-conflate” them. In particular, I want to acknowledge and explore the tensions in the audience axis above.

RTB was display’s first automated, programmatically connected offering. When it arrived, the industry was captivated by its ability as a protocol to virtualize much of the intelligence of an ad network. Over time, we’ve realized that RTB lives at the intersection of automation and buyer defined audience. But, because RTB was the first programmatic offering, there is a natural tendency to conflate those two great attributes. But I see the automation and audience dimensions as independent.

If you think about it, the vertical axis of Programmatic vs. Manual is pretty much motherhood and apple pie. Everybody stands to benefit from automation, which solves problems of efficiency across demand and supply. Eric Picard argued recently that programmatic isn’t all about automation and in fact represents an opportunity for better demand and supply matching. I think he’s right. But when we limit our analysis to programmatic vs. manual the conversation naturally turns to efficiency and normally polarized constituents relax and embrace each other a bit more.

Much more divisive and complicated is the audience axis above. As advertisers and buyers tag up sites and build up their stores of consumer data, RTB has gained momentum. And it has triggered a looming battle over audience. The DMP segment in our industry is built on the premise that buyers must accumulate information on the users that they want to converse with. Publishers, on the other hand, react to buyer defined audience as commoditization of supply. The language they use to describe buyer defined audiences leans towards game theory (e.g., “cherry picking,” “cream skimming,” “asymmetrical information,” and “adverse selection.”

Developments in the programmatic axis are easy to forecast because programmatic should not divide the key constituents of our industry: buyers and sellers are united in seeking efficiency. Things are going to get more automated. On the other hand, getting a fix on the buyer defined audience vs. seller defined context axis is much more difficult. For execs to predict along this axis they need to consider and forecast issues such as:

- The relative value of buyer data versus publisher context in driving results for advertisers

- The impact of potential regulation on collection of consumer data

- The impact of browser providers’ attempts to cater to consumer privacy needs on collection of consumer data (e.g., DNT defaults, Firefox and Safari 3rd party cookie policies, etc.)

- Response from publishers to items 2 and 3 above (e.g., potentially ignoring DNT from certain browsers, blocking browsing from browsers that disallow use of third party cookies by default)

- Other stuff we haven’t yet identified

It’s reasonably easy to have an opinion on item #1. It’s much more difficult to voice a forecast for items #2-#5 because of their inherent variability and because they interact with each other. Were it not for the complications of #2-#5 above I would argue that buyers defining audience is an inevitability. Outside of registration data, buyer defined audiences tend to be an accumulation of context and so present a greater signal to buyers. As time passes I think we’ll see consumers grow more accepting of online tracking and the value it generates in terms of greater access to content and better relevance in advertising.

For all the reasons above the trend of buyers defining audience will continue. And we’ll even see new ways in which forward markets address the buyer defined audience business. In the meantime, as offerings appear which illuminate the difference between programmatic and audience, programmatic will become a less controversial term.

Follow Jed Nahum (@jednahum), Microsoft Advertising (@MSAdvertising) and AdExchanger (@adexchanger) on Twitter.