“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Chris O’Hara, Chief Revenue Officer at NextMark.

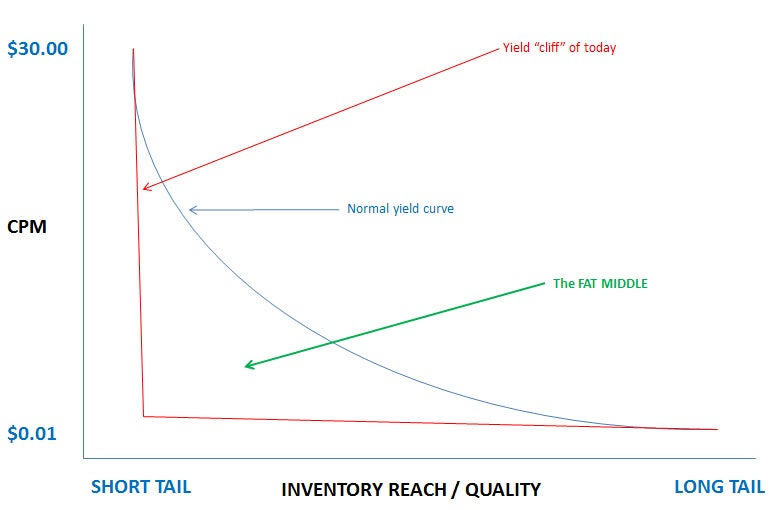

The ideal advertising yield curve for digital display is basically a classic marketplace-yield curve. It starts at the top left, with premium inventory capturing the highest CPMs, and slopes gently downward on the X axis to the lowest-value inventory on the lower right corner. In this concept, ESPN could charge $20 CPMs for its baseball section, while sites in the mid tail, like Deadspin, could charge $7, and the networks and exchanges aggregating hundreds of sports blogs in the long tail could charge $1. The concept is nice, fair and rational, envisioning the bulk of the opportunities in the “fat middle.”

This is not what is happening, though.

As John Ramey of iSocket pointed out in a presentation at the recent Tech for Direct event in New York, what we have today is a yield cliff instead of a curve. In the real world, we essentially have only two types of inventory: the super-premium, which is hand-sold directly for double-digit CPMs; and the remnant, which is sold via RTB on exchanges or surviving ad networks, often for pennies. In this world of the Haves and the Have Nots, there is no middle class of inventory — even though one could argue that $7 inventory on Deadspin has the potential to actually outperform its upscale cousin, ESPN. The “fat middle” remains a dream.

This inventory disparity that the digital advertising industry has created has nothing to do with supply and demand; it has everything to do with the transaction process. And that’s something we need to fix, because premium mid-tail buying is a great idea. It’s also not a new one. Back in 2009, marketplace platforms like TRAFFIQ were already bringing this innovation to the space and enabling marketers to cherry pick and aggregate premium quality sites that could offer friendly CPMs and URL-level transparency. In fact, I think of premium mid-tail buying as a success indicator for programmatic direct. When today’s technology can make it easy to put together a large array of guaranteed buys — and enable fast and easy optimization — then we will have succeeded.

This inventory disparity that the digital advertising industry has created has nothing to do with supply and demand; it has everything to do with the transaction process. And that’s something we need to fix, because premium mid-tail buying is a great idea. It’s also not a new one. Back in 2009, marketplace platforms like TRAFFIQ were already bringing this innovation to the space and enabling marketers to cherry pick and aggregate premium quality sites that could offer friendly CPMs and URL-level transparency. In fact, I think of premium mid-tail buying as a success indicator for programmatic direct. When today’s technology can make it easy to put together a large array of guaranteed buys — and enable fast and easy optimization — then we will have succeeded.

Here what was missing in 2009, and what we need to succeed today:

- A centralized directory: You can’t effectively buy ad space without knowing what’s available and how much it costs. Other media channels, such as direct mail, have published prices for mailing lists, right down to audience targeting. You want to reach people who have bought something from the Cabela’s catalog in the last six months and restrict the mailing to men only? No problem. You can find out what it costs, and who sells it. The digital display market needs to be organized in a similar directory, down to the placement level. You shouldn’t have to wait for an email back from an RFP to find out what known inventory costs. The work to pull this information into one place is being done now, but there’s a long way to go before a directory is comprehensive.

- An extensible platform: Today’s API-driven technology makes it easy to buy directly into publishers’ inventory. A link into DFP means buyers can discover availability and start serving ads with a few button clicks. The problem is that agencies want a Single System to Rule Them All. So far, agencies have been stuck with installed legacy systems that have more to do with billing and reconciliation than media planning and buying. Agencies want new, Web-based ways to discover and buy great inventory, but they also want a system that plugs into their existing tools. They’re not going to log into another buying system if they don’t have to. A system that can enable premium mid-tail buying at scale either has to integrate directly into existing media management systems or replace them. Right now, a lot of tech companies are working to retrofit old technology or create new technology that promises to make this a 2014 reality. It’s a horse race, and agencies are starting to place their bets. The winners will be the ones with the most extensible platforms that are good at integration, and they will be richly rewarded. The rest will fail, or will become a point solution in someone else’s platform.

- The right model: This may be the most important factor in determining programmatic direct success. If you are charging anywhere north of 10% (and some would argue you should be charging a LOT less than that) to help media buyers aggregate inventory, then you are not a “programmatic direct” technology company. You are an ad network or media rep firm. The situation, former Operative CEO Mike Leo tells me, is reminiscent of another one from 1968, when ad agencies rebelled against specialized media buyers – with opaque pricing methodologies — in the middle of the transaction. Agencies teamed up and decided that a standard rate of 15% was all they were willing to pay for television-buying services (and then they eventually bought all of the media-buying companies, but that’s another story). The lesson is that markets always rationalize themselves, and right now even 15% feels like a big vigorish for agencies with ever-shrinking margins on their media practices.

- Standards: It’s 2013, and we are still faxing IOs. This is largely because there are no accepted standards — and no protocol — for electronic orders. This is actually not a hard problem to solve, but it can be difficult for any solution to gain adoption from buyers and sellers. Right now, a few companies are working with groups like the IAB to get real traction with standards, and we need that to succeed to make programmatic direct buying a scalable reality. Electronic orders suck a lot of the viscosity out of the deal pipeline, and start to let the machines — instead of $50,000 junior media planners — do the grunt work of order processing.

The good news is that there has been a tremendous amount of progress in 2013 on all of these initiatives. The promise of true programmatic direct buying is closer than ever, and there is enough real development behind the hype to make these dreams of efficient media buying a reality in the near future. In that future, it just may be possible for a buyer to use demand-side technology to aggregate the “fat middle” of premium mid-tail publishers, and start to reward the middle class of inventory owners who are currently getting paid beer prices for Champagne content.

Follow Chris O’Hara (@chrisohara) and AdExchanger (@adexchanger) on Twitter.