“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Jay Seideman, US director of the targeting and exchange team at Microsoft.

At the end of every year, publishers enjoy many wild debates about budgeting, forecasting and sales compensation. As they plan for the next 12 months, one oft-discussed topic is whether sales organizations should compensate direct sellers for programmatic revenue.

In most instances, paying direct sellers for all programmatic revenue is the right decision. But I have talked to some publishers who disagree and, in select cases, I am beginning to understand their reasons.

Where Sales And Programmatic Intersect

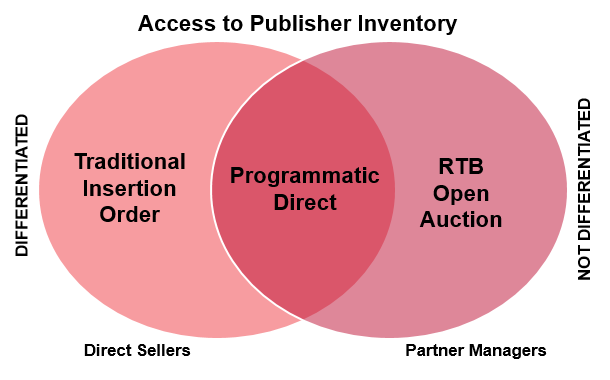

Direct sellers, such as an account executive at a publisher, own the primary relationships between agencies and advertisers, and they sell solutions and carry quota for their respective territories. Specialists, program managers and service counterparts often support them internally. Historically, direct selling was executed with signed insertion orders.

Programmatic is the machine-to-machine purchasing of inventory. The bulk of programmatic spending today is auction-based through real-time bidding. For publishers, programmatic RTB is used to maximize yield on the unsold impressions that fluctuate monthly. In contrast to direct sales, partner managers, also known as “indirect” sellers, typically lead programmatic conversations and oversee relationships with programmatic players like demand-side platforms, trading desks and ad networks.

Somewhere in between these worlds is a nascent and more complicated offering that I’m labeling as programmatic direct. It includes private marketplaces and programmatic forward markets (for a better definition, see Jed Nahum’s recent article), and is facilitated with either Deal ID or via direct access into a publisher’s ad server. Unlike RTB, this type of programmatic is implicitly linked to the direct-sales channel, since it requires negotiating deal terms, preferred access to inventory and, sometimes, guaranteed impressions.

Paying Direct Sellers For RTB

There may only be the one instance where not paying direct sellers for RTB is justified – under certain conditions.

The principle arguments for compensating or not compensating direct sellers for RTB revenue haven’t changed much. First, direct sellers have little or no leverage against RTB revenues because it is an open auction and the highest bidder wins. Second, publishers worry about “double paying” their sales teams because their partner managers look after programmatic relationships. These themes come up consistently, but they don’t help rationalize a publisher’s decision whether to pay their direct sellers for RTB.

For RTB, there are only two considerations that matter: the property’s sell-through rate and the percent of the publisher’s revenue represented by RTB. Thus, there are two main reasons not to compensate direct sellers for RTB revenue:

1. The sell-through rate varies widely or is entirely unpredictable

2. RTB makes up a high percentage of overall revenue in some or all months

If both conditions are present, the publisher may not want to compensate direct sellers for RTB because RTB revenue could be a distraction to reps. It could also be difficult to set goals properly because RTB revenue may make up such a high percentage of a seller’s quota. Be warned: If sellers are not compensated for programmatic revenue, they may be tempted to sell against the RTB channel. Worse, the misalignment could cause obvious friction among buyers and partners.

In every other case and for the majority of publishers, I recommend paying direct sellers for RTB. It creates harmony for the organization between direct and indirect sold inventory, which the seller’s clients recognize. In addition, it increases the direct seller’s appetite to learn about programmatic, which has become an important underpinning to our industry. And finally, if the data is mined properly, RTB can become a great “signal” to empower direct sellers to have informed and consultative conversations with clients.

For midsized and large publishers, seasonal sell-through rate is predictable and RTB is not an overwhelming percentage of revenue in any given month. If CFOs can’t stomach the fact that direct sellers have such little influence over this channel, they should be reassured that RTB revenue can be easily baked into sales quota. Furthermore, it’s simple enough to formulate sales incentives and packages for non-RTB revenue that will ensure sellers are prioritizing the right products.

Paying Direct Sellers For Programmatic Direct

As defined above, programmatic direct is in its initial stages, but in our quest for operational efficiency, it should immediately become a bigger chunk of programmatic revenue than RTB. At its core, programmatic direct involves some level of negotiation for preferred access to publisher inventory, just like direct buying.

While the programmatic “plumbing” confounds traditional sellers today, that is changing quickly. And the fundamental skills needed to negotiate PD deals are in the direct seller’s wheelhouse. As a result, I see no use cases where a publisher would not pay direct sellers for programmatic direct.

Because of the complexity of players and technologies today, some publishers have built separate sales forces to broker programmatic-direct deals. This is a short-term fix that could cause problems because two different teams negotiating custom access to a property will create unneeded friction in an organization. That conflict will be apparent externally.

The Bottom Line

When considering programmatic RTB revenue, most publishers should be paying their direct-sales force. The rare exception is if the publisher’s sell-through rate is too unpredictable or if RTB revenue is too high a percentage of overall sales. For programmatic direct, or whatever we’re calling it next year, I see little or no justification for not paying direct sellers. As the tools and processes to execute PD evolve and simplify, direct sellers will take the lead more and more when negotiating these deals.

Follow Jay Seideman (@JaySeideman) and AdExchanger (@adexchanger) on Twitter.