“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

“Data-Driven Thinking” is written by members of the media community and contains fresh ideas on the digital revolution in media.

Today’s column is written by Cassie Lancellotti-Young, executive vice president of customer success at Sailthru.

I’ve said it before and I’ll say it again: Smart marketers use retention data to optimize their acquisition mixes. And to ensure ongoing success and revenue, the best marketers are always thinking about the so-called “long game.

Sure, a discount drives sales today, but at what cost? Do we train customers to buy only on promotion and erode our margins? What is the impact of short-term optimization tactics on longer-term customer lifetime value?

While discussing this a few weeks ago with a retail analyst, she said, “If only we could get all retailers to listen!” Coincidentally, the next day I read an interesting piece from Alyson Shontell at Business Insider about the rise and fall of a former New York tech darling, which included a very relevant assertion: “[U]sers who had been acquired through aggressive Facebook-marketing campaigns weren’t showing strong repeat buying patterns.”

One And Done

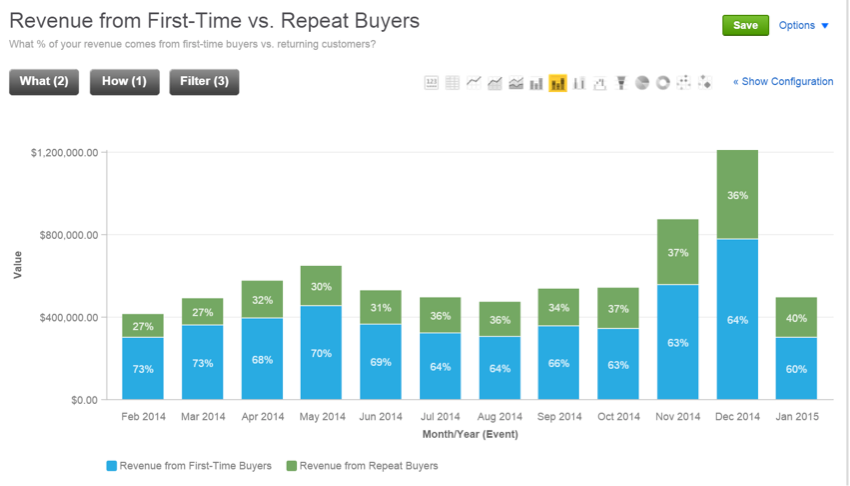

The “one and done” challenge has plagued ecommerce marketers for some time. The proliferation of online retailers and hefty incentives has not made the struggle any easier. It is all too common to see trends wherein any given month, first-time buyers account for 60% to 70% of revenue. It is inevitably valuable to convert more browsers into buyers, but that conversion in no way guarantees long-term solvency. To protect the business’s long-term health, marketers must seek ways to drive customer retention, not simply revenue.

This revenue vs. retention trade-off is a tough pill to swallow, as marketers are often pushing hard to hit their weekly or monthly numbers. That said, it is crucially important that marketers frequently revisit downstream buying patterns to ensure the optimization tactics they are deploying today are not at the detriment of building strong long-term customer value.

Leverage The Data

The acquisition program is the first place to look for this type of analysis. A source of traffic that looks inexpensive today may be costly in the longer run. For example, users acquired through a cheap source such as contests may turn out to be the least likely to become buyers and most likely to opt out of emails, an important push force for revenue. The converse is also true. When I did acquisition for a job search site, we at first balked at the media costs of running ads across LinkedIn, only to realize that freemium conversion and lifetime value for that channel were more than strong enough to offset the upfront costs.

As marketers develop data sets, they must leverage them to forecast the future. If you can estimate the revenue intake of a cohort or group over time, you can closely model how much money you anticipate to make from each cohort with each passing day, week or month. In other words, revenue estimates for a direct marketing shop will be a function of intake cohorts and their expected behaviors.

There is almost always marked revenue attrition after the customer’s first interaction with the brand, but understanding the depth of this attrition is critical to managing your business. Marketers can use tools like personalization to mitigate the risk of attrition. The ability to reduce this attrition not only extends customer lifetime value, but also allows marketers a higher threshold for what they can spend on paid acquisition.

Marketers struggle to balance lightweight testing aimed at quick optimization wins with longer-term longitudinal data, but short-term wins and long-term testing can indeed exist in harmony. The key here is to get intimate with your data: Run tests today, but revisit the results in both the near and longer terms to ensure customer behavior played out as expected.

If a cohort of users looks ugly compared to other channels today, shut it down. You can always pick it back up at a later date if the downstream data bucks the trend. Revenue comes with an inherent expense, and that expense is the risk of focusing on the here and now vs. the longer-term game of retention. The best marketers will operate in a manner that allows them to drive lift in both areas.

Follow Cassie Lancellotti-Young (@dukecass), Sailthru (@sailthru) and AdExchanger (@adexchanger) on Twitter.